1.Estalbishment of Korea subsidary

When a foreign company establishes a business in Korea, the HQ typically invests a minimum of 100,000,000 KRW as the capital for its Korean subsidiary.

This amount represents the minimum required investment to set up a business entity in Korea.

However, depending on the company’s goals and circumstances, the capital investment can exceed 100,000,000 KRW.

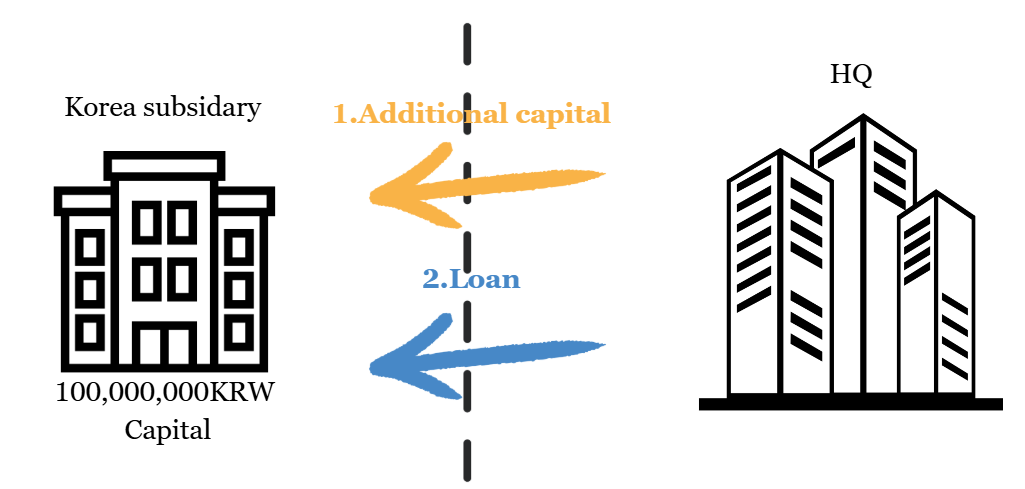

2.Two options for additional funds from HQ

The Korean subsidiary operates using its initial capital. Ideally, if the business performs well and generates revenue locally, that would be the best scenario. However, it may take time for the subsidiary to become profitable, and additional funds might be required to sustain operations.

In such cases, the HQ has two options:

- Increase Capital: Invest more funds into the Korean subsidiary, thereby raising its capital.

- Provide a Loan: Lend money to the Korean subsidiary to support its business operations.

3.Interest rate and withholding tax when paid to HQ

When a company invests additional capital, several administrative tasks are required, including updating the company’s court registry and filing a foreign investment report with the bank. Additionally, taxes must be paid on the increased capital, making the process quite complex.

On the other hand, providing a loan to the Korean subsidiary is relatively straightforward, as it involves borrowing money rather than increasing capital.

However, one crucial factor to consider when loaning funds is interest. When the Korean subsidiary borrows money from HQ, it is obligated to repay the loan amount along with interest.

Since the HQ is a related party (a shareholder of the Korean subsidiary), the interest rate must comply with Korean tax law, which stipulates a rate of 4.6% (or the rate the subsidiary is already paying).

Furthermore, when the subsidiary pays interest to HQ, taxes must be withheld from the interest payment. The withholding tax rate varies depending on the country, as it is determined by the tax treaty between Korea and the HQ’s country. (I’ll discuss this in more detail in my next post.)

4.Tax law regarding limitation of interest expense

The interest paid by the Korean subsidiary is treated as an expense for the subsidiary and income for HQ. What I want to highlight today is how this interest expense can sometimes face limitations.

If the interest payments are disproportionately large compared to the subsidiary’s capital, the tax authorities may disallow the excess portion as a deductible expense. Instead, this excess could be reclassified as a dividend to HQ, even though it was initially treated as interest.

This rule is designed to prevent companies from using excessive interest payments to artificially lower their taxable income in Korea. It is governed by the Adjustment of International Taxes Act

5.Example of thin capital taxation

Let’s consider the following example:

The Korean subsidiary borrows 300,000,000 KRW from HQ and pays 12,000,000 KRW in interest.

Under normal circumstances, the entire 12,000,000 KRW would be treated as an expense, reducing the subsidiary’s taxable income.

However, because the borrowed amount is significantly higher than the subsidiary’s capital, part of the interest may be disallowed as a deductible expense under Korean tax law. In this case, 4,000,000 KRW of the interest is denied as an expense and reclassified as a dividend to HQ.

This is a simplified example for illustration purposes. In reality, the calculation involves more complex factors and detailed financial analysis.

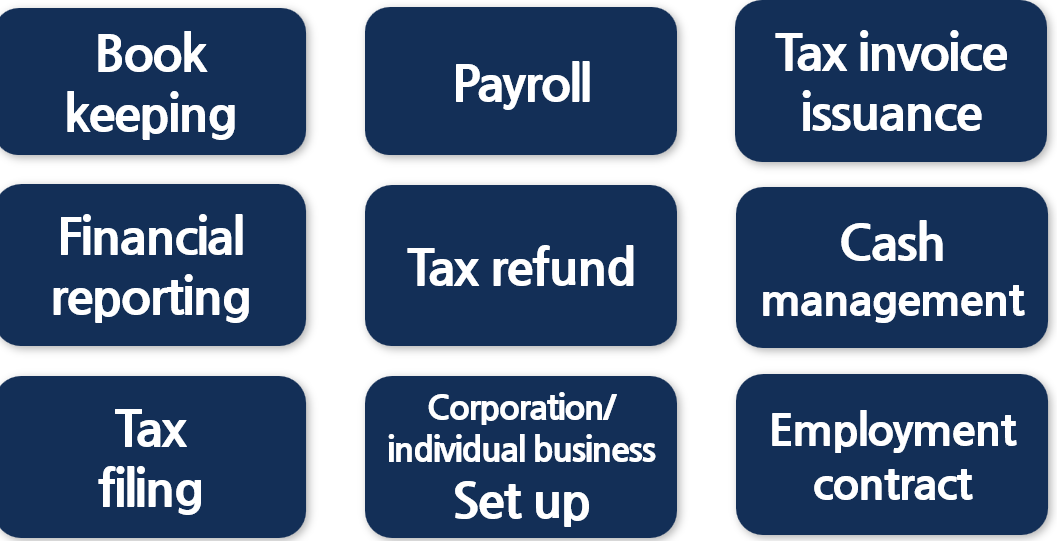

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the email below

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

1.