An invoice is a crucial document for businesses. It is a formal record issued by a seller to a buyer, detailing the goods or services provided and the corresponding payment amount. Companies send invoices to inform clients about the services rendered and their associated fees.

An invoice typically includes: Buyer's and seller's information, Dates ,Description of goods or services provided,Amounts charged,Payment method and due dates, Other relevant details.

Invoices serve as the basis for recording sales and purchase transactions in a company’s financial statements. In some countries, invoices must meet specific legal standards to ensure compliance with tax and regulatory requirements.

In Korea, while companies issue and send invoices to their clients, there is an additional requirement. Businesses must also issue a tax invoice to their client companies.

1.Two Invoices, Understanding the Difference

In Korea, when a company issues a normal invoice to clients to request payment for their fees, it is also required to issue a tax invoice. A normal invoice serves as a document for understanding the transaction between the buyer and seller, but it is not considered an official invoice.

The tax invoice serves as the only official document for transactions in Korea. As a result, some companies opt to issue only tax invoices without providing normal invoices, which is entirely acceptable. However, it remains common practice to use both types of invoices.

*It’s important to note that tax invoices are only required for clients with a business license in Korea. If your clients are individuals without a business license, you do not need to issue a tax invoice. This is because the primary purpose of a tax invoice is related to VAT.

2. The Essential Steps for Issuing a Tax Invoice

Unlike normal invoices, which companies generate internally, tax invoices must be issued through the Korean National Tax Service (NTS) system.

The typical process involves accessing Hometax (www.hometax.go.kr) and issuing the tax invoice electronically. You simply enter the buyer's information,dates, the price of the goods or services, and then generate the invoice. It’s a straightforward process. The information on the tax invoice, including buyer and seller details, price, and VAT, is automatically recorded in the NTS system and sent to the buyer's email address that you provided (you don't need to send it directly to the buyer).

This system is a unique feature implemented by the Korean government to prevent companies from avoiding sales tax exemptions.

*Tax invoice is mandatory documents for company to claim VAT refund

*For small individual business owner, it's still possible to issue tax invoice in paper not electonical way.

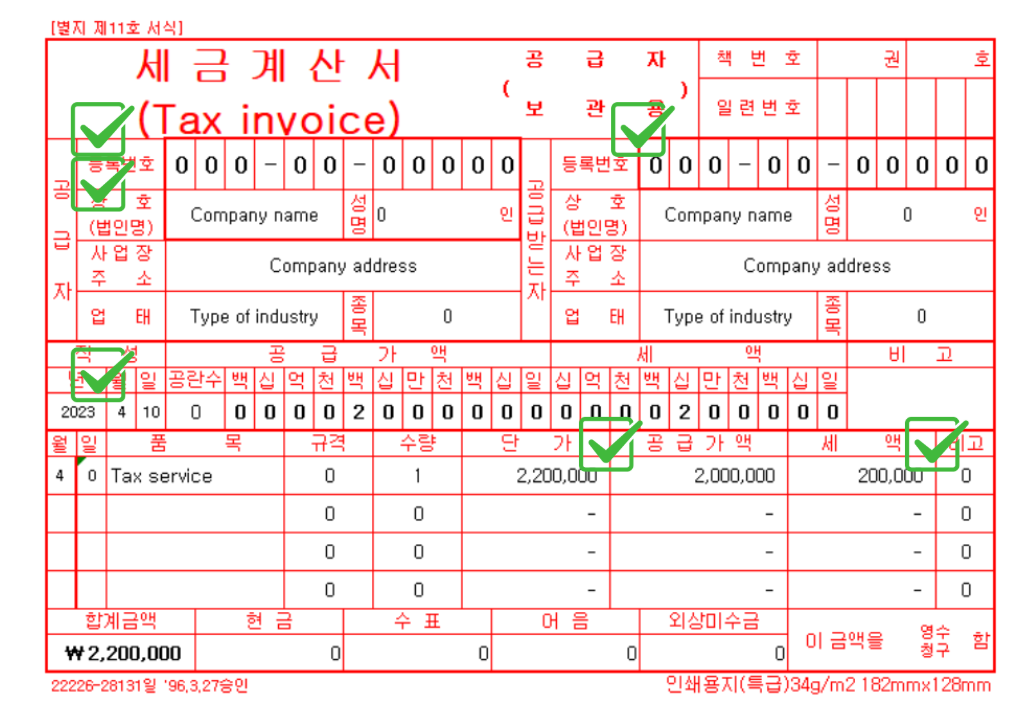

3. Key Information You Need to Include When Issuing a Tax Invoice

Since the tax invoice is managed by the government, failure to issue it on time (typically by the 10th of the month following the delivery of goods or provision of services) can result in penalty taxes. Additionally, if you fail to include the mandatory items in the tax invoice, it will be considered an invalid tax invoice. Therefore, you should check.

Here are the mandatory items you must include:

1.Business registration number and name of seller

2.Business registration number of buyer.

3.Dates of issuance

4.Price of goods or service and tax(10%)

Other things(type of industry, descrtption) are also important, but not affect to effect of tax invoice.

Normally, companies request their business license when they need to issue a tax invoice, as all the information required to fill out the tax invoice can be found on the company’s business license.

If there are any missing items on the tax invoice or if there are changes in the price or other details, the company should correct the tax invoice in the same way it was originally issued through the Hometax system. For example, a company can issue a "minus" tax invoice if the price has changed.

To issue a tax invoice electronically, a company must have a "digital certificate for tax invoice issuance" or a "tax invoice issuance card."

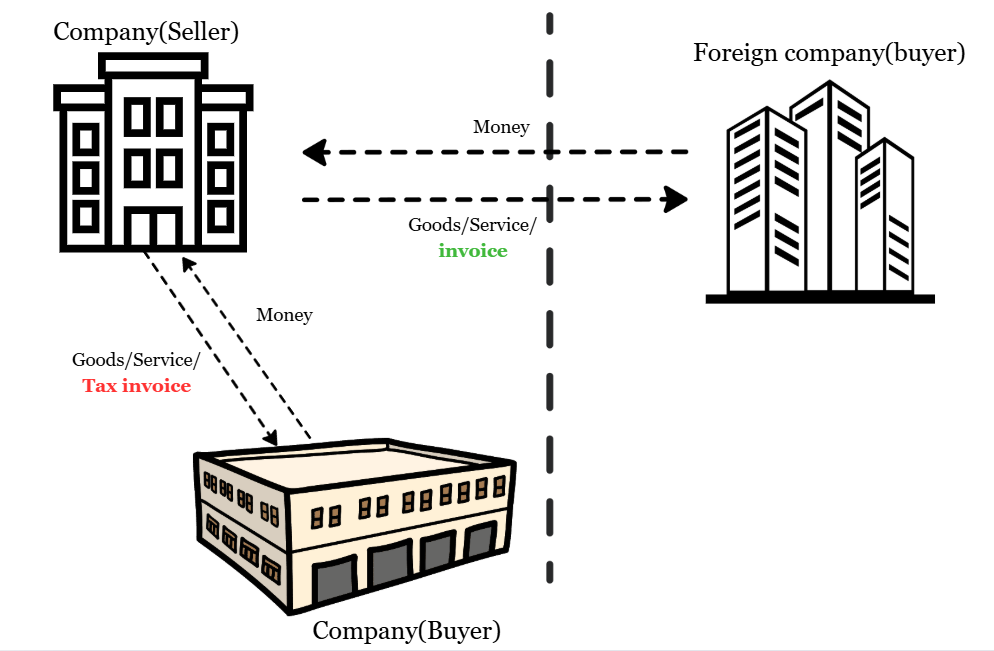

4.Why Companies Don't Need to Issue Tax Invoices for Foreign Transactions

A tax invoice is only issued between companies that hold a Korean business license. Therefore, if a company provides goods or services to a foreign company, it is not required to issue a tax invoice. In fact, it is impossible to issue a tax invoice in such cases, as the Korea business registration number is a mandatory item on the tax invoice, and foreign companies do not have a Korean business registration number.

However, not issuing a tax invoice does not mean the company is exempt from paying the 10% VAT. Regardless of whether a tax invoice is issued, the company is still required to pay 10% VAT on the provided goods or services. Depending on the details of the transaction, the company may be eligible to apply for a 0% VAT rate.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the email below

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Corporate income tax filing' 카테고리의 다른 글

| It's time to get ready for the 2nd VAT return filing. (0) | 2025.01.13 |

|---|---|

| How Companies Share Their Earnings with Shareholders in Korea: The Dividend Process (0) | 2024.12.30 |

| Foreign Corporations Should Be Careful When Borrowing Money from HQ (Thin Capital Taxation) (0) | 2024.11.28 |

| Donations can cut your company tax. (2) | 2024.10.23 |

| [VAT]How to Prepare for Value Added Tax (VAT) filing (0) | 2024.07.03 |