A donation, in tax terms, refers to giving money or goods to entities that are unrelated to a company's business. Companies often make donations as a way to share their profits with society, helping to create a more livable community.

Naturally, there are tax benefits for these donations, as governments encourage companies to contribute to the public good.

However, to prevent misuse of the tax benefits associated with donations, there are specific rules that companies must follow to qualify for these incentives.

So, if your company is considering making a donation, please ensure you review the following things.

1.Qualified donation organization

A company can only receive tax benefits when donating to a qualified donation organization. Without this rule, companies could potentially exploit the system. For example, one could create a corporation they own, donate money to it, and then claim the tax benefit for the donation, while also controlling the receiving company.

Qualified donation organizations are approved by the tax office, and the qualification process is strict. These organizations are also required to undergo audits for the money they receive.

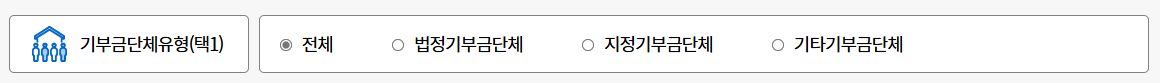

You can check if the organization you are planning to donate to is qualified through the websites below.

1365 기부포털 - 기부단체 - 국

30112 세종특별자치시 도움6로 42(어진동) | 고객센터 1522-3658(유료) 본 홈페이지에 게시된 이메일주소가 자동 수집되는 것을 거부하며, 이를 위반시 정보통신망법에 의해 처벌됨을 유념하시기 바

www.nanumkorea.go.kr

For example,

I've searched '굿네이버스(Good Neighbors)' and searched.

And found out that the 굿네이버스 is qualified donation organization(지정기부금단체)

These qualified donation organizations can only issue "qualified documents," which are essential to receive tax benefits.

In the website screenshot above, you may notice three types of donation organizations:

1)법정기부금단체(->now change the term to '특례기부금'(Special donation organization) *Qualified for tax benefits

2)지정기부금단체(->now change the term to '일반기부금'(General donation organization) *Qualified for tax benefits

3)기타기부금단체(every donation organization besied 1) and 2). *Not qualified for tax benefits

2.Tax benefit of donation (And limit)

Tax benefits can vary slightly depending on your current situation. Let’s look at two different scenarios.

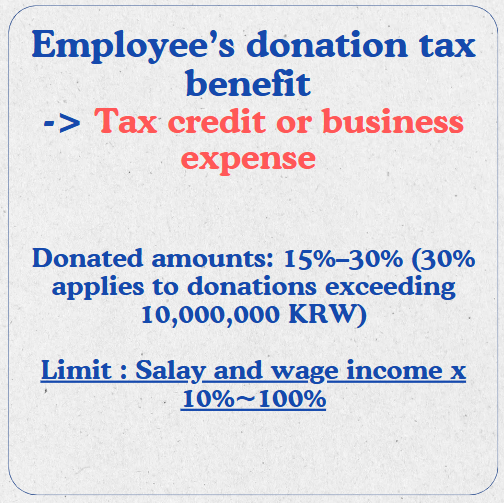

If you are an employee

You will complete your year-end tax settlement every February for your salary and wage income. During this process, you can apply for a tax credit for any donated amounts.

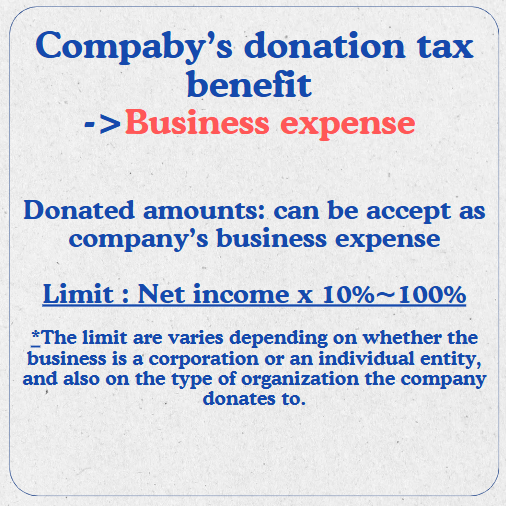

If you are compnay

The donated amounts will be recorded as non-operating expenses in the company’s profit and loss statement, which will reduce the company’s net income.

3.Reamining donation amounts

If your company doesn’t have net income (which means there’s no limit to applying the donation amount as an expense), the donation amounts can be carried forward to future years. Specifically, they can be carried forward for up to 10 years.

This way, the company can still reduce its taxes in future years when it generates net income.

For example,

Year 2024:

- Company net income: -50,000,000 KRW (Net Loss)

- Donated amount: 5,000,000 KRW

→ Limit for donation expense in 2024: 0 (since -50,000,000 x 10% = -5,000,000)

As a result, the 5,000,000 KRW cannot be treated as a company expense in 2024.

Year 2025:

- Company net income: 200,000,000 KRW

- Donated amount: 2,000,000 KRW

→ Limit for donation expense in 2025: 20,000,000 KRW (10% of net income)

A total of 7,000,000 KRW can be recognized as a company expense in 2025 (5,000,000 KRW carried forward from 2024 + 2,000,000 KRW donated in 2025).

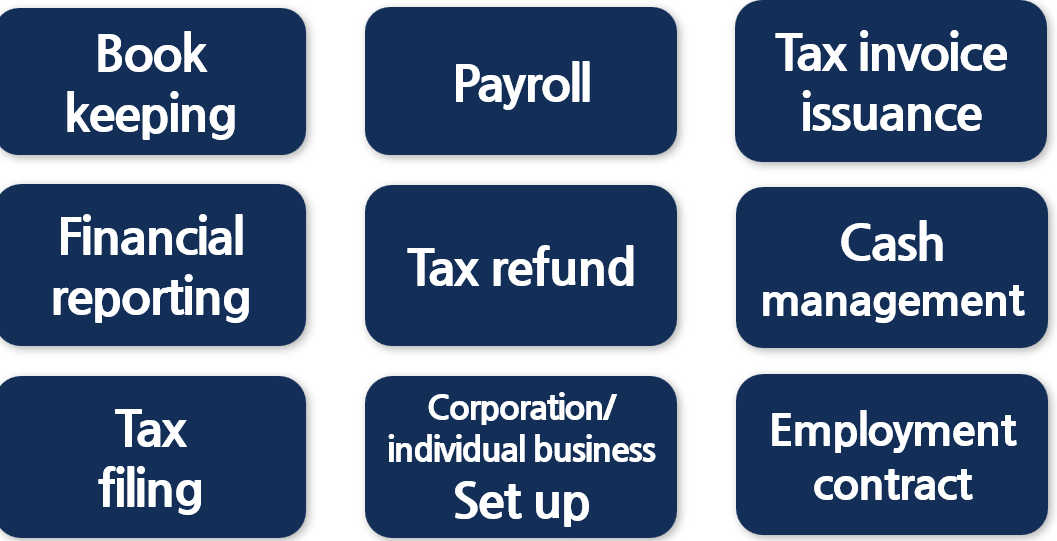

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr