1.Why VAT filing is important?

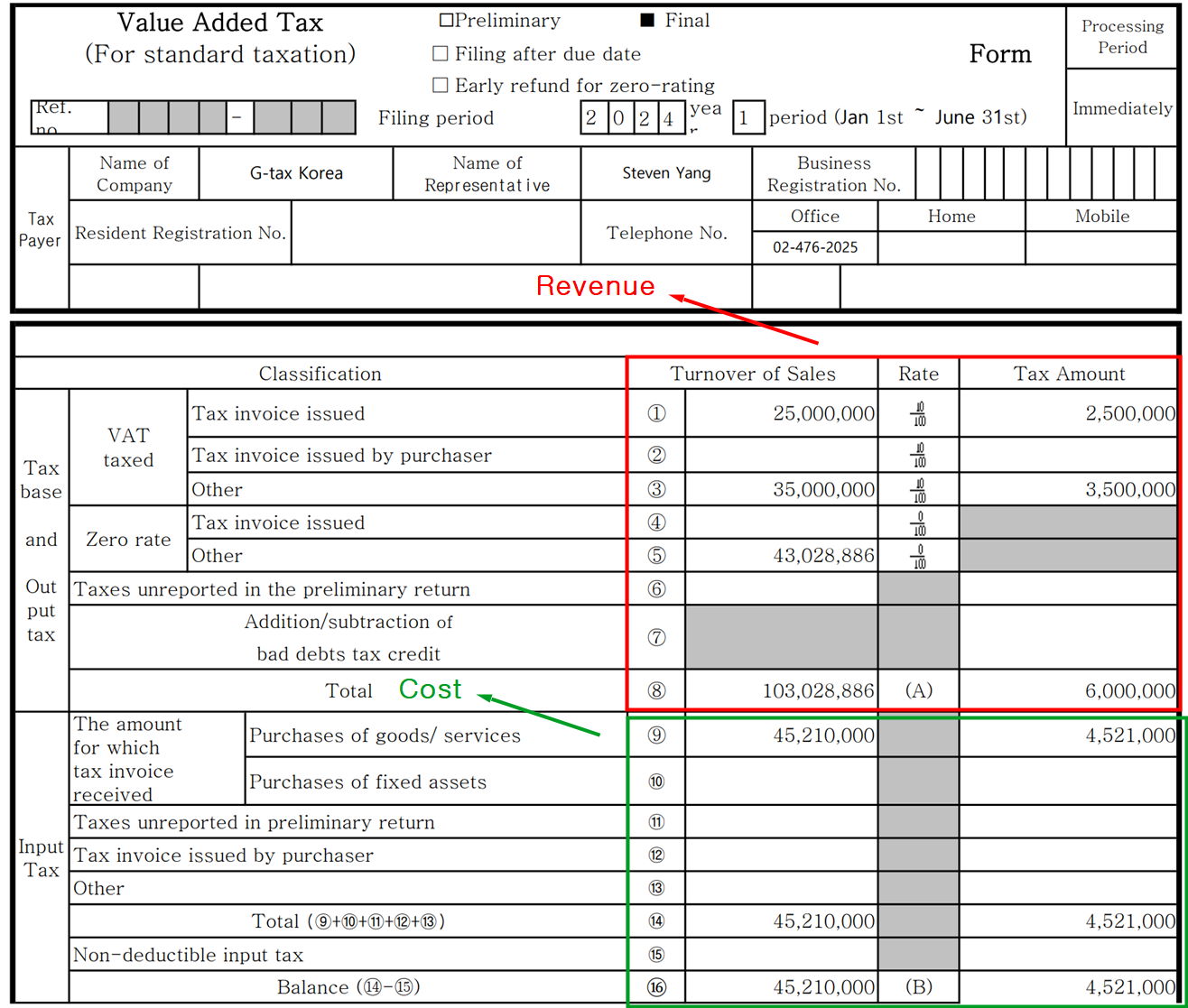

The VAT return includes company's revenue amounts and cost amounts. you can check in the below example of VAT return, revenu amounts in red and cost amounts in green.(Company's all revenue amounts are shows in the VAT return but for costs amounrs it shows only related to VAT)

Therefore, filing VAT means company confirm company's revnue and cost numbers in the VAT periods. If there are changes in revenue, the VAT return should be re-filed. Failure to file the VAT return could result in a penalty of 20% additional tax, and if the filing is incomplete, a penalty of 10% additional tax may apply.

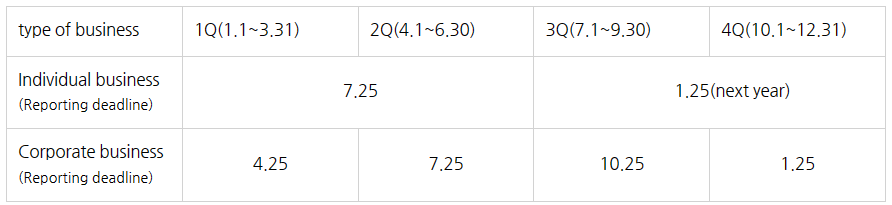

2.When VAT return should be filed?

If your company is a corporation, it should be file the VAT return quartely :

-1Q (Jan 1 to Mar 31) : Due on Apr 25th

-2Q (Apr 1 to Jun 30) : Due on Jul 25th

-3Q (Jul 1 to Sep 30) : Due on Oct 25th

-4Q (Oct 1 to Dec 31) : Due on Jan 25th

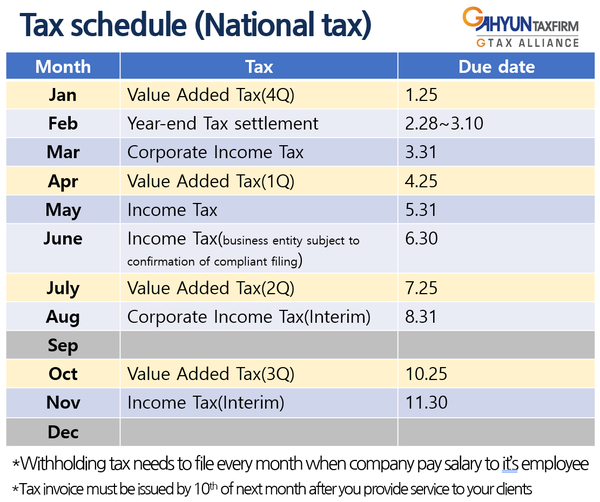

Please refer to below national Tax schedule and check the VAT filing periods in ivory color.

3.Which Documents I should prepare?

To prepare for VAT filing, you need to gather two types of datas. revenue data and purchase data. Nowdays, most data is issued electronically and can be checked through Hometax. However, there are some documents that you need to preapre manually, including :

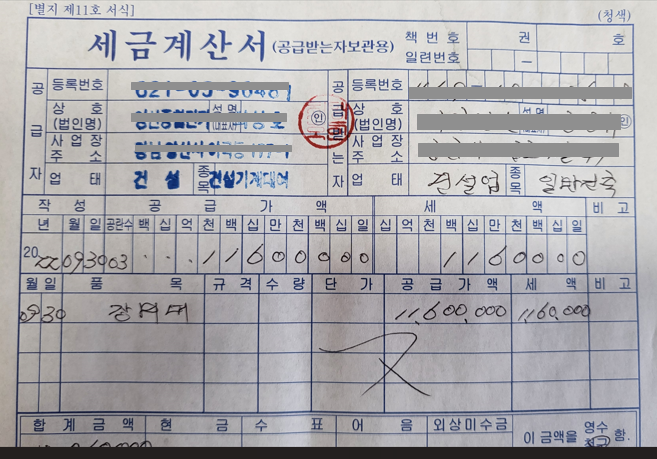

①Paper tax invoices

It it rare to receive a paper tax invoice. However if you receive a papaer tax invoice without the word "전자" (electronic) on it like this picture, you should definitely keep it and provide it for VAT filing. cause unlike electronic tax invoice which can be checked through Hometax, it's not possilbe to check if company don't provide it to tax firm.

Most companies use electronices tax invoicing, but some individual business may still issue them manually.(especailly when your office is owned by individual business)

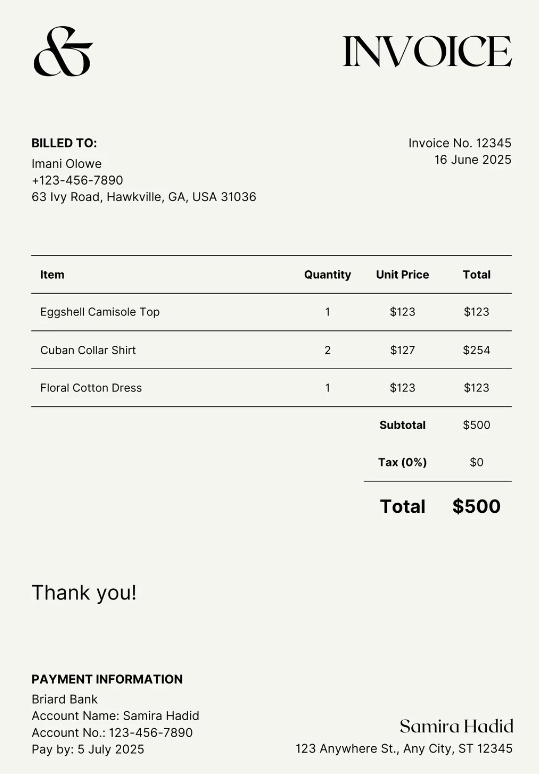

②Invoices from or to foreign companies

When comapny export their product to company in other country or provide service to other company in other country, there are high possibility to apply 0% VAT which means paying no VAT. so company don't need to pay VAT for that and it meano no need to issue tax invoice to foreign company in abroad.

So, it's not possible to check by tax firm without the invoice.So company should organize invoices that issued to foreign company or be issued from foreign company and provide tax firm for VAT filing.

③Revenues figures that company did not issue proper receipts to clients

Even if a company didn't issue proper receipts to clients like tax invoice, cash receipt, after company get funds from them it's still considered as company's revenue and should be included to VAT return to avoid penalty.

And if company have sales through PG(payment gateway) or Platform(Naver smart store) also should be check.

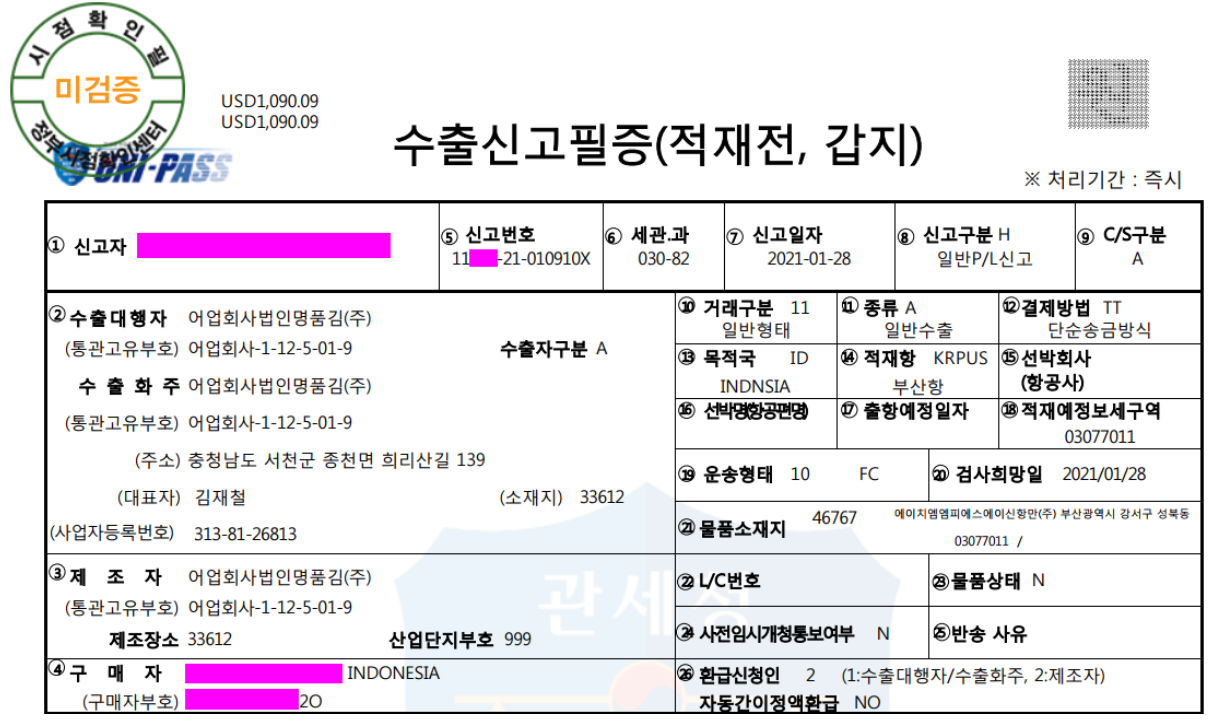

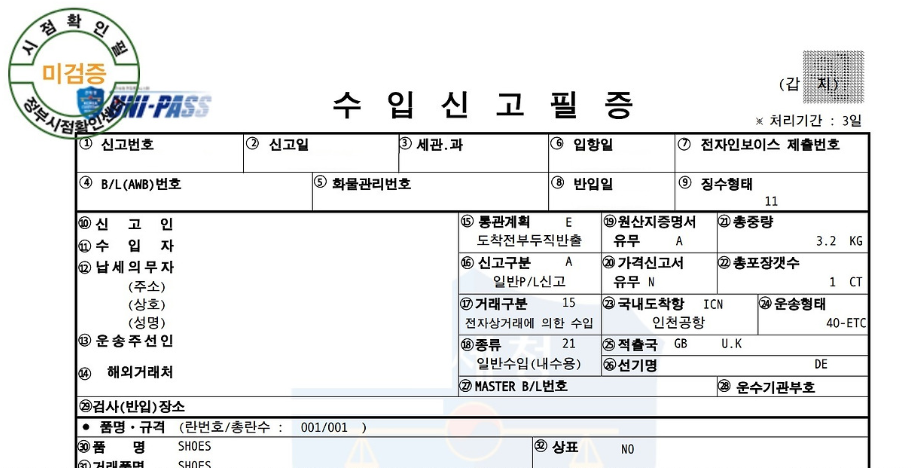

④Documents related to import or export

when importing or or exporting goods, you may receive documents such as

-Import/export declaration certificate.(수입신고필증, 수출신고필증) -Customs clearance statements (통관정산명세서)

When company export their goods through custom, will get the export declaration form like this and related documents. It essestial documens to check company export revenue and apply 0% VAT for export sales. and when company also can direcly send their goods to abroad. in that case company should prepare documents related to that.

When company import goods through custom, will get the import declaration form like this and customs clearance statements which shows vat and tariff, other services fee company paid are stated.

through the documens tax firm can check the imported goods and account it properly on financial statement

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr