Sarah, a foreign national, started a business in Korea. She established a business entity in Korea, secured customers, and sold her goods. One day, she received a letter from the NTS (National Tax Service in Korea) stating that she should file a Value Added Tax (VAT) return and pay the tax. However, she has no idea what VAT is and how to file a VAT return

1.What is Value added tax?

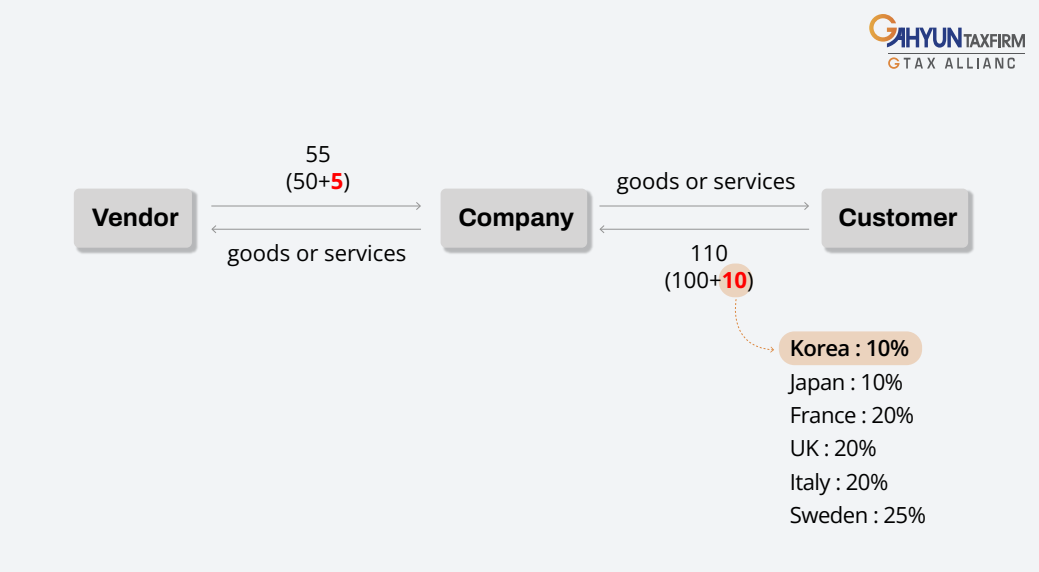

Value Added Tax (VAT) is a fundamental tax that companies pay and collect on every transaction conducted while operating a business in Korea. VAT is applied when a company sells goods or provides services to customers, as well as when the company purchases goods or services for its business operations. Therefore, when a company sells goods or services and receives payment, it is required to collect 10% of the transaction amount as VAT. Similarly, when a company buys products or services, it is obligated to pay 10% of the transaction amount as VAT.

So, we can seperated VAT in to two parts.

①VAT payable (VAT collected from customer) ②VAT receivable(VAT paid to vendor)

2.What is rate for VAT in Korea?

The VAT rate varies from country to country. For instance:

- Korea: 10%

- Japan: 10%

- France: 20%

- UK: 20%

- Sweden: 25%

Each country may have different VAT rates, and some countries apply different VAT rates to different items. In Korea, the standard VAT rate is 10%. and there are exceptions:

- Certain essential items for daily living, such as rice, grain, hospital expenses, and sanitary items for women, are subject to a zero VAT rate.

- When a company exports goods abroad or provides services to foreign companies, a 0% VAT rate can be applied.

3.How VAT payabale amoutns are calculated?

Companies pay the collected VAT amounts to the tax office through VAT filing. In the Value Added Tax return, you'll find VAT amounts for sales and purchases. The VAT payable amount is calculated by deducting VAT purchase amounts from VAT sales amounts.

For example: Sales amounts: 100,000,000 KRW Purchase amounts: 50,000,000 KRW

Calculation:

- Sales VAT (100,000,000 x 10%): 10,000,000 KRW

- Purchase VAT (50,000,000 x 10%): 5,000,000 KRW = VAT payable amount: 5,000,000 KRW

In this scenario, the company should pay 5,000,000 KRW as VAT.

Another example: Sales amounts: 10,000,000 KRW Purchase amounts: 50,000,000 KRW

Calculation:

- Sales VAT (10,000,000 x 10%): 1,000,000 KRW

- Purchase VAT (50,000,000 x 10%): 5,000,000 KRW = VAT refundable amount: 4,000,000 KRW

In this case, since the purchase amounts exceed the sales amounts, the company doesn't have to pay VAT but can get a VAT refund of 4,000,000 KRW.

4.When does a company pay VAT to the tax office?

In Korea, companies should file and pay VAT every quarter. More precisely, VAT filing and payment occur on the 25th of April, July, October, and January for each quarter. During these periods, companies pay or receive refunds for the VAT they collected in each quarter.

| Quarter | Period | Due dates (Filing and Payment) |

| 1Q | 1st Jan~ 31th Mar | 25th April |

| 2Q | 1st Apr~ 30th Jun | 25th July |

| 3Q | 1st Jul~ 30th Sep | 25th October |

| 4Q | 1st Oct~ 31th Dec | 25th January |

Exceptionally, small corporations or individual businesses can opt to skip the 1st or 3rd quarter VAT filing and instead file VAT half-yearly (for January to June, due on July 25th, and for July to December, due on January 25th). In this scenario, even if the company doesn't file VAT returns to the tax office, they still need to pay a portion of the VAT amounts (half of the prior quartes's VAT amounts).

Additionally, if a company has a significant amount of purchases (indicating a substantial amount of paid purchase VAT), they can apply for early VAT filing before the official due dates. This allows them to receive VAT refunds earlier, thereby assisting with the company's cash flow.

5.What should I care to prepare VAT well?

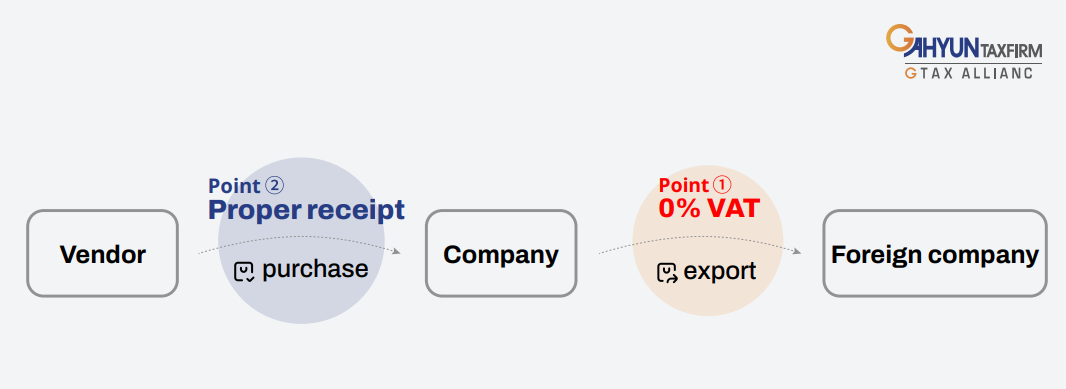

To prepare VAT well, aside from minor details, there are two key points to consider:

- International Sales: When a company engages in sales abroad, it's essential to ensure eligibility for applying a 0% VAT rate. Korea has policies allowing for the application of 0% VAT on foreign sales, but the specific requirements and procedures may vary. It's crucial to verify eligibility and understand the applicable regulations.

- Receipt Management: Proper receipt management is critical for reducing VAT payable amounts. Valid receipts include tax invoices, credit card receipts, and cash receipts. These documents serve as evidence that VAT was paid on purchases of goods or services. Without these receipts, VAT deductions cannot be claimed. Therefore, maintaining accurate and complete records of all relevant receipts is essential for VAT calculation and compliance.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr