January is the month for Value added tax filing for business owner. Let's check the baisc due dates of this tax and extended due dates for this filing.

1. VAT Filing Differences for Individual vs. Corporate Businesses

The VAT filing periods differ for individual and corporate businesses in Korea. Corporate businesses are generally required to file VAT returns quarterly, while individual businesses typically file twice a year.

- Corporate Businesses: If your business is classified as a corporation, you must prepare VAT records for the full 4th quarter (October 1st – December 31st), including revenue and purchases.

- Individual Businesses: If your business is classified as an individual business, you only need to prepare VAT records for the 3rd and 4th quarters (July 1st – December 31st), including revenue and purchases.

In special cases, corporate businesses with revenue below 150,000,000 KRW from previous VAT periods may be allowed to skip preliminary VAT filing and pay the interim VAT, just like individual businesses.

2. VAT Due Date Extended for this VAT Filing

The VAT filing due date for this period has been extended to the end of the month.

Normally, VAT filing deadlines are the 25th of the following month after each quarter. For this filing, the due date would have been 25th January. However, since the 25th falls on a Saturday, the deadline would typically shift to Monday, 27th January.

This year, the due date has been further extended to 31st January due to the Lunar New Year holiday, one of Korea's most significant national holidays, occurring at the end of the month this year.

3.Accelerated VAT Refund Period

The tax office has announced that this period’s VAT refund amounts will be paid earlier than the usual refund schedule.

- Early VAT Refund Date: 7th February 2025 (Statutory deadline: 15th February)

- Regular VAT Refund Date: 18th February 2025 (Statutory deadline: 2nd March)

Please note that this accelerated refund schedule only applies to businesses that meet specific criteria outlined below.

| | Tax Support Eligible Businesses | |

| ① Small and medium-sized enterprises (SMEs) with annual sales of 150 billion KRW or less in the previous year and in business for over 3 years. ② Microbusiness owners with annual sales of 1 billion KRW or less. ③ Recipients of government awards or commendations on Taxpayer's Day (in accordance with Article 3 of the Exemplary Taxpayer Management Regulations). ④ SMEs in innovative growth industries or new industries (e.g., semiconductors, biotechnology, environment, etc.). ⑤ Export companies eligible for tax support:

|

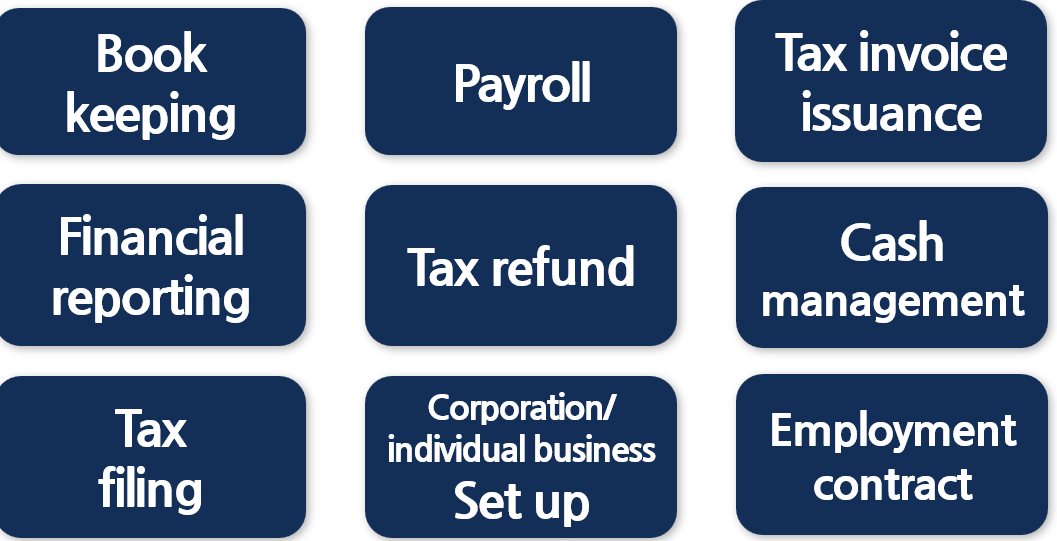

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Corporate income tax filing' 카테고리의 다른 글

| How Companies Share Their Earnings with Shareholders in Korea: The Dividend Process (0) | 2024.12.30 |

|---|---|

| What’s the Difference? Tax Invoice vs. Regular Invoice (0) | 2024.12.16 |

| Foreign Corporations Should Be Careful When Borrowing Money from HQ (Thin Capital Taxation) (0) | 2024.11.28 |

| Donations can cut your company tax. (2) | 2024.10.23 |

| [VAT]How to Prepare for Value Added Tax (VAT) filing (0) | 2024.07.03 |