After you decided what kinds of business entity in Korea, If you decided to choose local corporation, the second decision you need to make is choosing the type of company.

There are five types of companies in Korea: 1)Partnership Company, 2)Limited Partnership Company, 3)Limited Liability Company, 4)Stock Company, and 5)Limited Company. However, Stock Companies and Limited Companies are the most commonly chosen.

Today, we will delve into the differences between these two types of companies and determine which might be more advantageous for your business.

While these two types of companies share some similarities, they also have significant differences that could impact your decision.

1.External audit obligation

Both Stock Companies and Limited Companies in Korea are required to undergo external audits, but the criteria for triggering these audits differ slightly between the two.

For Stock Companies, an external audit is mandatory if the company meets two out of four specified criteria. On the other hand, a Limited Company must meet three out of five criteria to be subject to an external audit.

This means that Limited Companies have a bit more flexibility regarding the external audit obligation. For example, if a company's total assets exceed 12 billion KRW and sales exceed 10 billion KRW, a Stock Company would be required to undergo an audit. However, a Limited Company would need to meet at least one additional criterion before being subject to the same audit requirement.

2.Term of office of directors

According to Korean Commercial Law, the term of office for directors in a Stock Company is a maximum of 3 years. This means that every 3 years, a Stock Company must register with the court to renew the director's term, or register their retirement or replacement. Failure to do so can result in penalty taxes of up to 5,000,000 KRW.

However, there are no such rules regarding the director's term of office in a Limited Company. Therefore, if your company is a Limited Company, you don’t need to worry about registering the director’s term with the court.

3.Issue of corporate bond

A corporate bond is a method for companies to raise funds for their business by issuing bonds to the public. For Stock Companies, it is possible to issue corporate bonds. However, Limited Companies cannot issue corporate bonds.

4.Appointment of an auditor

Stock company should appoint an auditor(this auditor is different with external auditor for audit) for the establishement process. when stock company's capital amounts are below 1billion KRW, stock company don't need to appoint an auditor. so, typically when first establish stock company they appoint auditor for the establishement process and after that if the company's capatal amoutns are below 1billion, do the process of resigh of auditor.

However, Limited compnay don't need to do the process, because limited company don't need auditor. of coure limited company may have auditors but it's an option.

5.Prohibation of share transfer

A Limited Company can include provisions in its articles of incorporation to prevent members from transferring their shares, making it easier to restrict share transfers and maintain closed management. While a Stock Company can also implement rules to limit share transfers, it is generally more complex to enforce such restrictions compared to a Limited Company. This difference allows Limited Companies to have tighter control over share ownership and company management. y.

In summary, for those who want to operate a company with a closed management structure, a limited company would be a good choice. However, for those looking to operate a company with external investors through investment, a stock company would be more appropriate.

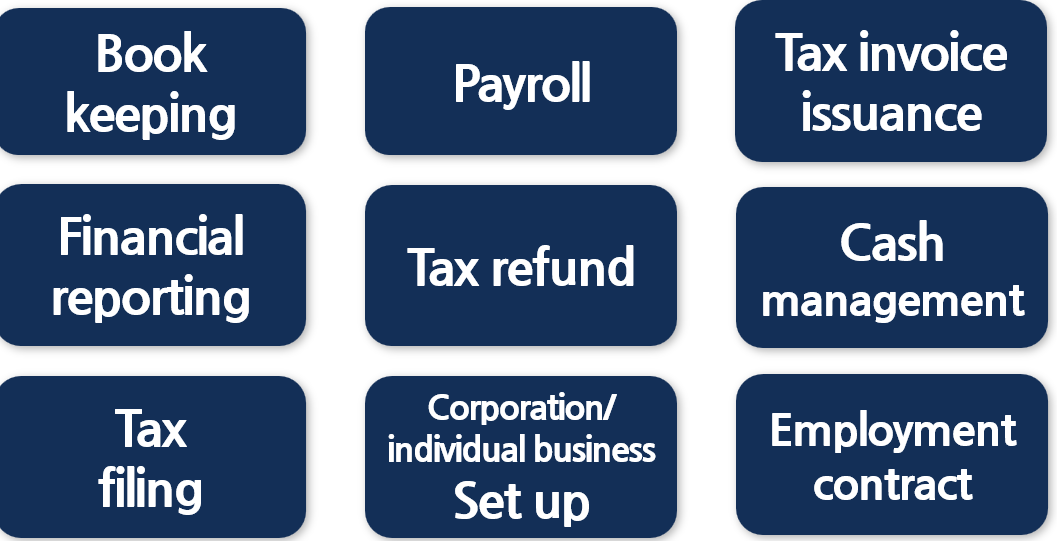

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| November Tax schedule in Korea (1) | 2024.11.01 |

|---|---|

| October Tax schedule in Korea 2024 (2) | 2024.09.25 |

| September Tax schedule (0) | 2024.08.27 |

| What is this taxes?(Local tax pro rata business portion) (0) | 2024.08.05 |

| August Tax schedule you should not miss! (0) | 2024.08.02 |