I know that the names of taxes can be quite complicated.

The tax called "Local Tax Pro Rata Business Place Portion" (as per Korean tax law terminology) is a local tax that companies pay every August.

1)Every business should pay this local tax

It's a relatively small amount (50,000 KRW to 200,000 KRW), and the taxes depend on the company's capital amount.

When the capital amount is below 3,000,000,000 KRW (approximately 2,200,000 USD or 2,010,000 EUR), the tax amount is 50,000 KRW. As most SMEs (small and medium-sized enterprises) which are not listed on KOSDAQ or KOSPI in Korea do not require such large capital amounts, your company will likely fall under this 50,000 KRW tax amount.

| Criteria | Tax amounts |

| A corporation whose amount of capital or investment does not exceed three billion won | 50,000KRW |

| A corporation whose amount of capital or investment is more than three billion won but not more than five billion won: | 100,000KRW |

| corporation whose amount of capital or investment exceeds five billion won | 200,000KRW |

| Other corporation | 50,000KRW |

2)There are additional taxes for the space of your office

1)Additional tax for your corporation's floor area

If your office space is more than 330㎡, you should pay 250 KRW per 1㎡.

For example, if your office space is 400㎡ (excluding non-taxable space), you would pay 400 x 250 = 100,000 KRW for your space. Therefore, the total local tax pro rata business portion would be 50,000 KRW + 100,000 KRW = 150,000 KRW.

*It used to seperate with lcoal tax pro rata business portion before, but from

*There are no taxes calculated for the space when the total floor area does not exceed 330 square meters.

2) Local Education tax

Local education tax is added to other taxes. Therefore, the tax base for this tax is usually other local taxes, and the Local Tax Pro Rata Business Portion is no exception.

As a result, 25% is added to the tax amount.

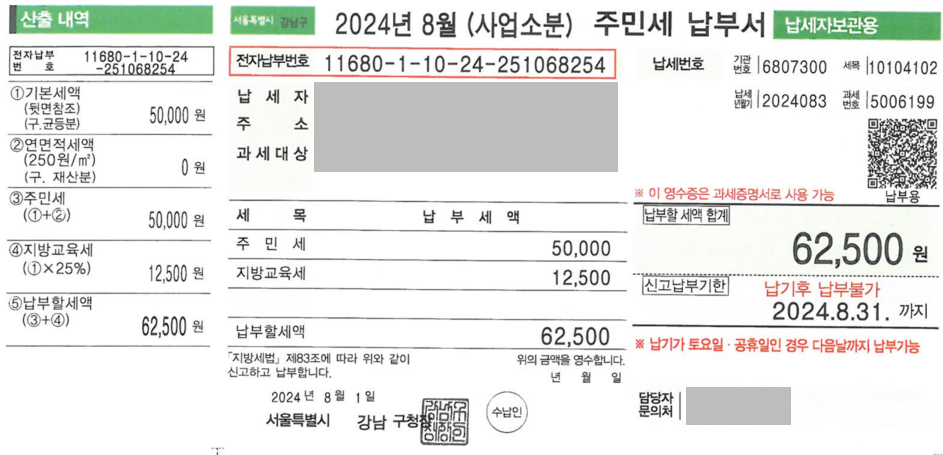

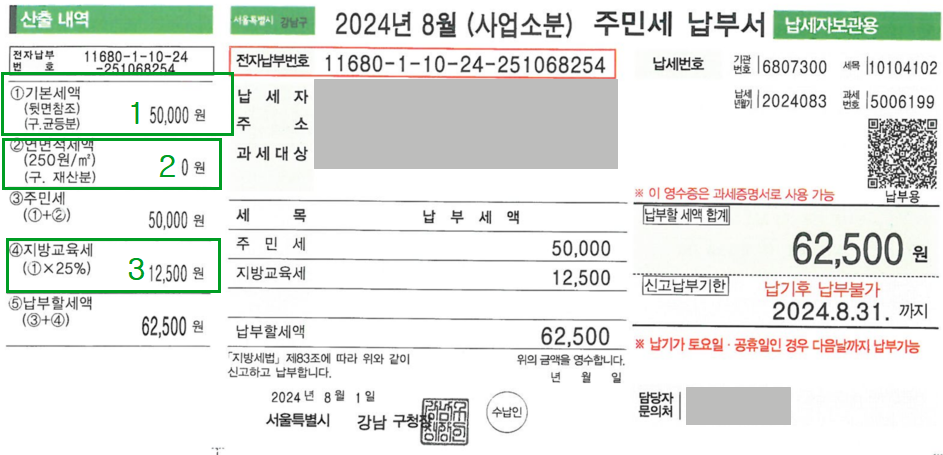

3)Let's get back to the tax bill and check each amounts

- The company's capital amount would be below 3,000,000,000 KRW, so the tax amount is 50,000 KRW.

- The company's floor area would not exceed 330 square meters, so there are no taxes for that.

- The education tax is 25% of the local tax, which amounts to 12,500 KRW (50,000 KRW x 25%).

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| [Corporation set up] How foreigners enter the domestic business in Korea? - 2 (Difference between 'Stock company' and 'Limited company) (1) | 2024.09.03 |

|---|---|

| September Tax schedule (0) | 2024.08.27 |

| August Tax schedule you should not miss! (0) | 2024.08.02 |

| Simplify Your Business Expense Management (2) : Way to get Cash receipt (0) | 2024.07.26 |

| Important July Tax schedule (0) | 2024.06.28 |