1.Withholding tax filing(~10/10)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,500,000 KRW, you must deduct 35,600 KRW for taxes, and pay your employee 2,464,400 KRW. The 35,600 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Sep, you must file the withholding tax return by Oct 10th.

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

2.VAT payment for individual business owners (~10/25)

If you own a small business as individual, you will receive a VAT payment bill from the tax authority. Even if you don't file VAT returns, you are required to pay half of the VAT amounts you paid during your last VAT filing. This is an advance tax payment that will be deducted from your next VAT filing (10/25)

3.VAT filing for corporations (~10/25)

Corporations have obligation to file their VAT returns every quarter. This is important because it shows the company's sales and VAT-related costs. Corporations should also submit a breakdown of tax invoices.

So Ensure that all invoices have been issued or received before VAT filing.

4.Submission of payment statement.(~10/31)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

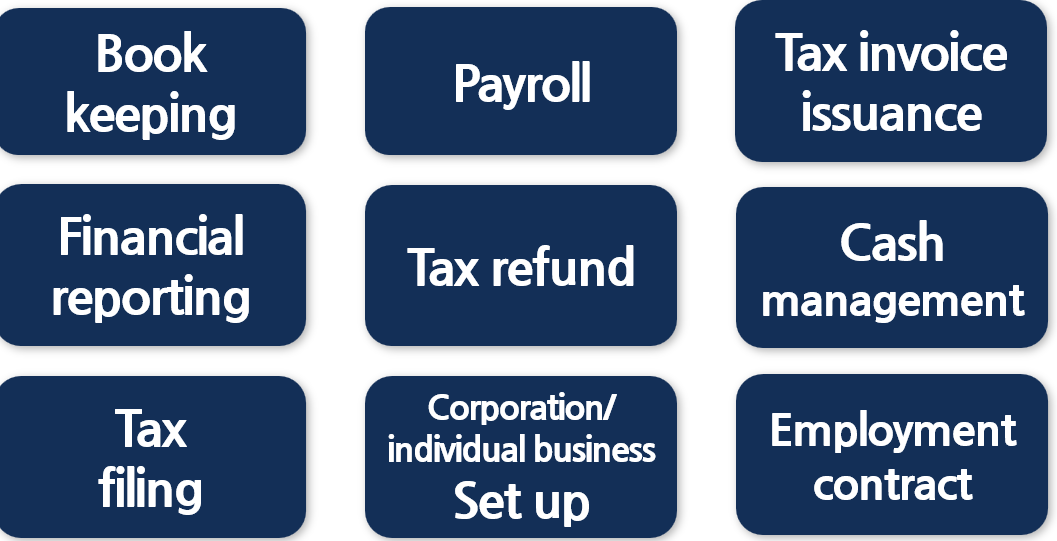

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| February Tax schedule in Korea (0) | 2025.02.04 |

|---|---|

| November Tax schedule in Korea (1) | 2024.11.01 |

| [Corporation set up] How foreigners enter the domestic business in Korea? - 2 (Difference between 'Stock company' and 'Limited company) (1) | 2024.09.03 |

| September Tax schedule (0) | 2024.08.27 |

| What is this taxes?(Local tax pro rata business portion) (0) | 2024.08.05 |