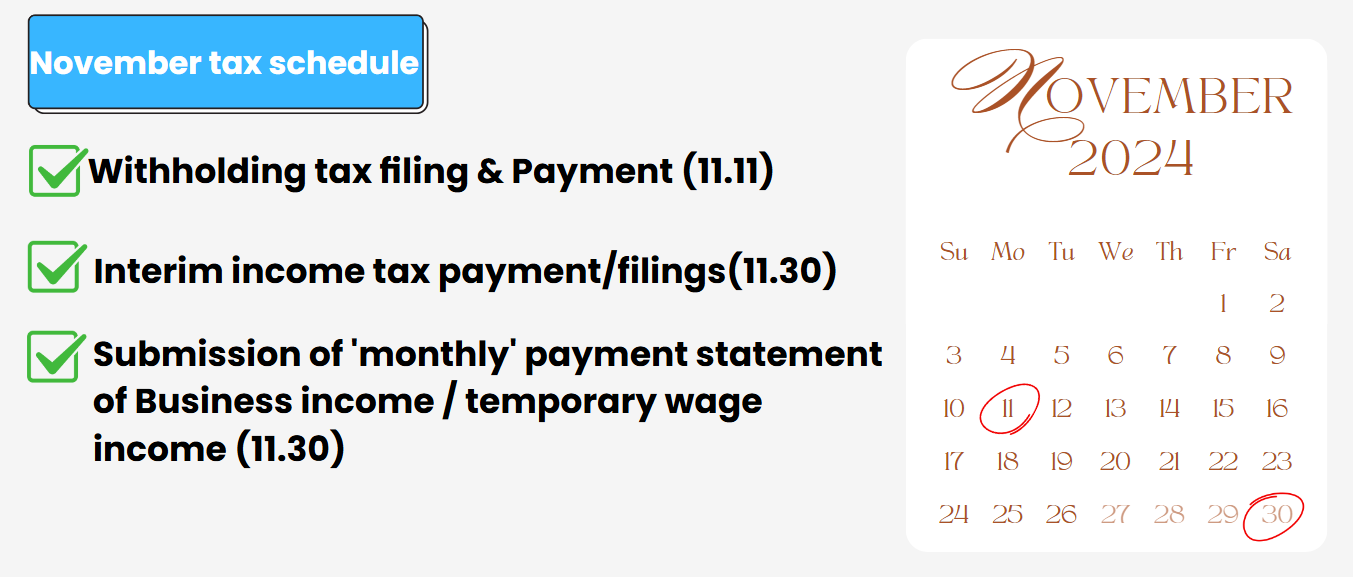

1.Withholding tax filing(11/11)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,500,000 KRW, you must deduct 35,600 KRW for taxes, and pay your employee 2,464,400 KRW. The 35,600 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Oct, you must file the withholding tax return by Nov11th(it's typically 10th but as 10th November is Sunday, it's 11th)

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

*If you want to know about non-taxable items for your salary, Please refer below link.

2.Interim Income tax payment or filing(~11/30)

Interim inomce tax, a form of advanced payment for the next year's May regular income tax filing, is due in Novemebr. This advanced payment allows for the amounts paid in November to be deducted from the income tax payable amounts calculated in the following year's May. Consequently, Some business owner may be eligible for a tax refund of a portion of the interim tax payment thay made.

In most cases, the tax office sends a tax bill to individual business owners, with the amounts calulated as a half of the tax paid in previous year's regular income tax filing. However, in some case Individual business owner have the option to calculate their half-year income tax(Jan~June) and file it themsleves.

3.Submission of payment statement.(~11/30)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

steven@g-tax.kr / +82 2 467 2025

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| March Tax schedule in Korea (0) | 2025.02.24 |

|---|---|

| February Tax schedule in Korea (0) | 2025.02.04 |

| October Tax schedule in Korea 2024 (2) | 2024.09.25 |

| [Corporation set up] How foreigners enter the domestic business in Korea? - 2 (Difference between 'Stock company' and 'Limited company) (1) | 2024.09.03 |

| September Tax schedule (0) | 2024.08.27 |