When you or your company plan to buy land, a vehicle, or construct a factory in Korea, there are various factors to consider. You need to assess whether the prices are reasonable, the land location is suitable, and other relevant considerations.

However, one crucial aspect that should not be overlooked is taxes.

There are taxes associated with acquiring real estate or vehicles in Korea, known as acquisition tax. It can be quite complex because the tax rate varies depending on the reason for acquisition and the specific item you are acquiring.

Now, let's delve into the details of the acquisition tax rate.

1.Acquisition tax rates

It's intriguing because the tax rates vary depending on the cause of acquisition, as outlined in the tax law below. However, most foreigners and foreign companies will fall under the categories highlighted in the yellow boxes.

The first yellow box pertains to original acquisition, which implies not purchasing from others but constructing from the ground up. This is typically applicable to companies engaged in construction projects.

The second yellow box covers general acquisitions, excluding other specific reasons such as inheritance or property division.

For instance, If you purchase land to build a factory, you will face two different acquisition tax rates. When acquiring the land, you'll incur a tax of 4% (40/1000) based on the acquisition tax rate. Subsequently, when constructing the factory, the acquisition tax rate will be 2.8%.

In the case of buying land with an existing factory, the acquisition tax rate will be 4% (for the land) and 4% as well (for the factory, assuming it's already built and not newly constructed).

2.Taxes added to acquisition tax

In addition to the acquisition tax rates explained in the first paragraph, there are additional small taxes.

2-1. Special Rural Development Tax

This tax is added to the acquisition tax rate, and the tax rates are typically 0.2%.

2-2. Local Education Tax

The local education tax rate is calculated as follows:

(Acquisition tax rate−2%)×20%

For exampleⓐ, if your acquisition tax rates are 4%, the local education tax rate would be 0.4%

(4%−2%)×20%

For exampleⓑ And if your acquisition tax rates are 2.8%, the local education tax rate would be 0.16%

(2.8%−2%)×20%

Therefore, the total acquisition tax rates are the sum of the acquisition tax rate, special rural development tax rate, and local education tax rate.

3.there'ss a chance to get tax reduction!

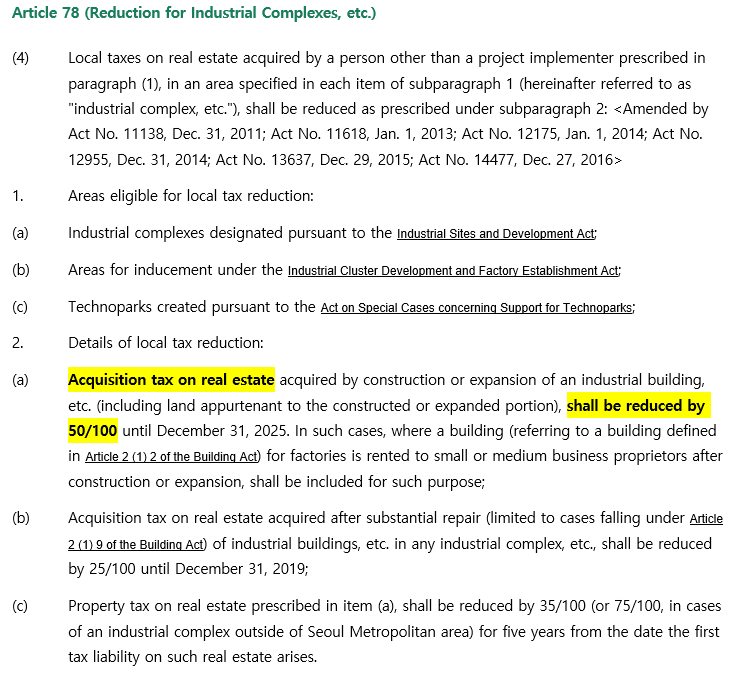

If the land or factory you are planning to acquire is located in a special region, such as an industrial complex designated by the government, you may be eligible for a tax reduction of up to 75%.

While the law specifies a reduced tax rate of 50%, there are additional reduction rates in effect as of the current date (2023.10.18), allowing for a total tax rate reduction of 75%.

Thank you for read my article! I hope it helps.If you want to see more information about Korea tax and accounting, please follow us.And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace usG-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

you can contact me through the information in the name card.

Or Please fill in the below form so we can kindly contact you.

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com