VAT] Tax Rate for services acquiring foreign currencies (How to Qualify for the 0% VAT Tax Rate -3)

The standard VAT (Value Added Tax) rate in Korea is 10%, and it applies to almost all goods and services provided by your company to clients, except for certain non-VAT items. Consequently, when sending invoices to clients, your company adds a 10% VAT to t

www.g-tax.kr

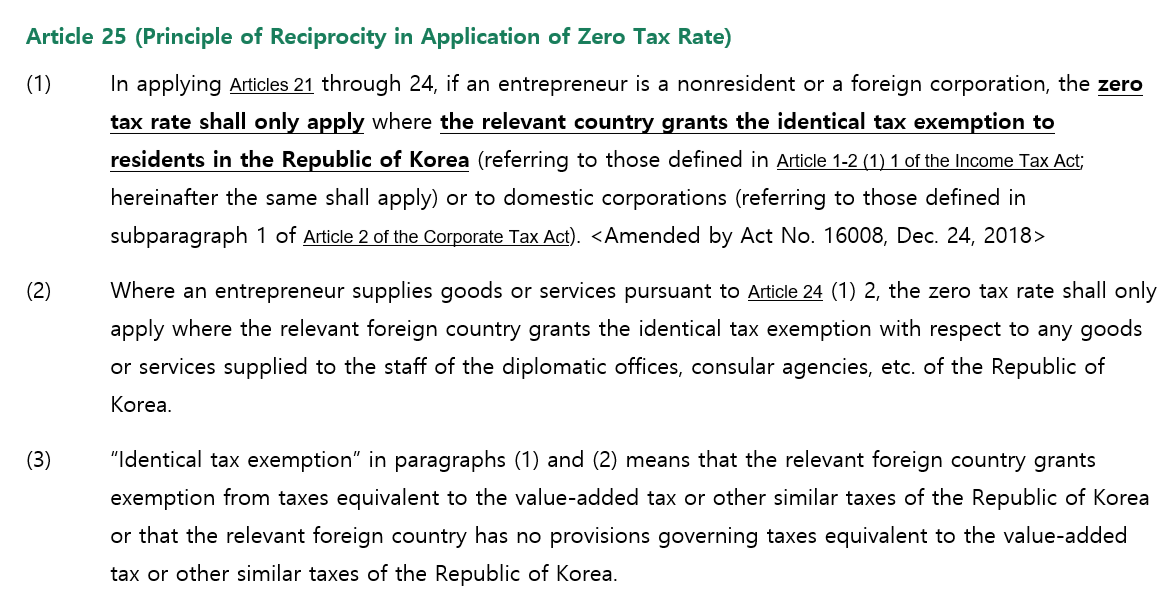

In our last post, I explained a method to apply 0% VAT tax rate for services acquring in foreign currencies. as mentioned, not all types of industries qualify for the zero VAT tax rate. Even if your business qualify the industry list, It is essential to verify whether Korea and the client's coundtry have an agreement on a 0% VAT rate, especially if you business falls under the categories of 1)professional services / 2)Business facilities management and business support services / 3)Investment advisory.

*Countries Korea has an agreement about mutual duty free country.

| 1 | Greece (Revised on August 1, 1998) |

| 2 | South Africa (Revised on August 1, 1998) |

| 3 | Netherlands (Revised on August 1, 1998) |

| 4 | Norway (Revised on August 1, 1998) |

| 5 | New Zealand (Revised on August 1, 1998) |

| 6 | Denmark (Revised on August 1, 1998) |

| 7 | Lebanon (Revised on August 1, 1998) |

| 8 | Liberia (Revised on August 1, 1998) |

| 9 | Malaysia (Revised on August 1, 1998) |

| 10 | United States (Revised on August 1, 1998) |

| 11 | Venezuela (Revised on August 1, 1998) |

| 12 | Belgium (Revised on August 1, 1998) |

| 13 | Saudi Arabia (Revised on August 1, 1998) |

| 14 | Germany (Revised on August 1, 1998) |

| 15 | Sweden (Revised on August 1, 1998) |

| 16 | Switzerland (Revised on August 1, 1998) |

| 17 | Singapore (Revised on August 1, 1998) |

| 18 | United Kingdom (Revised on August 1, 1998) |

| 19 | Iran (Revised on August 1, 1998) |

| 20 | Italy (Revised on August 1, 1998) |

| 21 | India (Revised on August 1, 1998) |

| 22 | Indonesia (Revised on August 1, 1998) |

| 23 | Japan (Revised on August 1, 1998) |

| 24 | Taiwan (Revised on August 1, 1998) |

| 25 | Chile (Revised on August 1, 1998) |

| 26 | Canada (Revised on August 1, 1998) |

| 27 | Thailand (Revised on August 1, 1998) |

| 28 | Panama (Revised on August 1, 1998) |

| 29 | Pakistan (Revised on August 1, 1998) |

| 30 | Finland (Revised on August 1, 1998) |

| 31 | Australia (Revised on August 1, 1998) |

| 32 | Hong Kong (Revised on August 1, 1998) |

| 33 | France (Revised on August 1, 1998) |

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com