A tax treaty is an agreement between two countries aimed at preventing double taxation, which occurs when an individual or business is obligated to pay taxes on the same income or property in both countries. These treaties are typically negotiated and established by governments to promote international trade and investment, prevent fiscal evasion, and provide clarity and consistency in tax matters for residents and businesses operating across borders.

In most cases, when conducting business in Korea or generating income in Korea, Korean tax laws apply. However, tax treaties act as special tax regulations that take precedence over Korean tax law in specific situations. Typically, tax treaties come into play when you are receiving income from abroad and Korea, making payments to foreign entities, or when you are required to file tax returns in both Korea and another country.

1.Finding a tax treaty is relatively straightforward.

The Korea Tax Law website offers access to tax treaties that Korea has entered into with 94 countries worldwide. While the website may not have an English interface, the tax treaties themselves are available in both Korean and English.

국세법령정보시스템

txsi.hometax.go.kr

2. Limited Tax Rates in Tax Treaties

In Korean tax law, a standard tax rate of 20% is applied to interest, dividend, and royalty income. This means that when such income is generated in Korea, Korean companies are required to withhold and remit 20% of the taxes to the Korean tax authorities when making payments to foreign entities.

However, in most tax treaties, limited tax rates are specified. For example, in the case of Germany, when paying dividend income, if a foreign corporation applies for the limited tax rate as stipulated in the tax treaty, only a 5% tax rate is applied, resulting in reduced withholding tax.

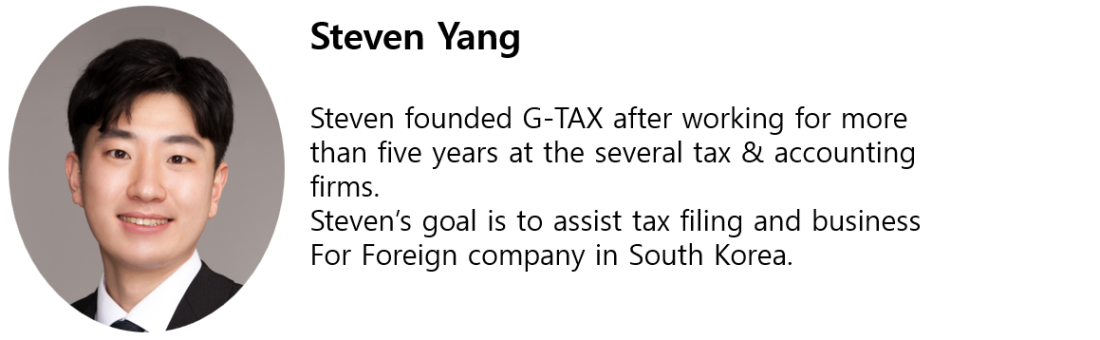

Thank you for read my article! I hope it helps.If you want to see more information about Korea tax and accounting, please follow us.And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace usG-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

you can contact me through the information in the name card.

Or Please fill in the below form so we can kindly contact you.

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com