The standard VAT (Value Added Tax) rate in Korea is 10%, and it applies to almost all goods and services provided by your company to clients, except for certain non-VAT items. Consequently, when sending invoices to clients, your company adds a 10% VAT to the price of its goods and services.

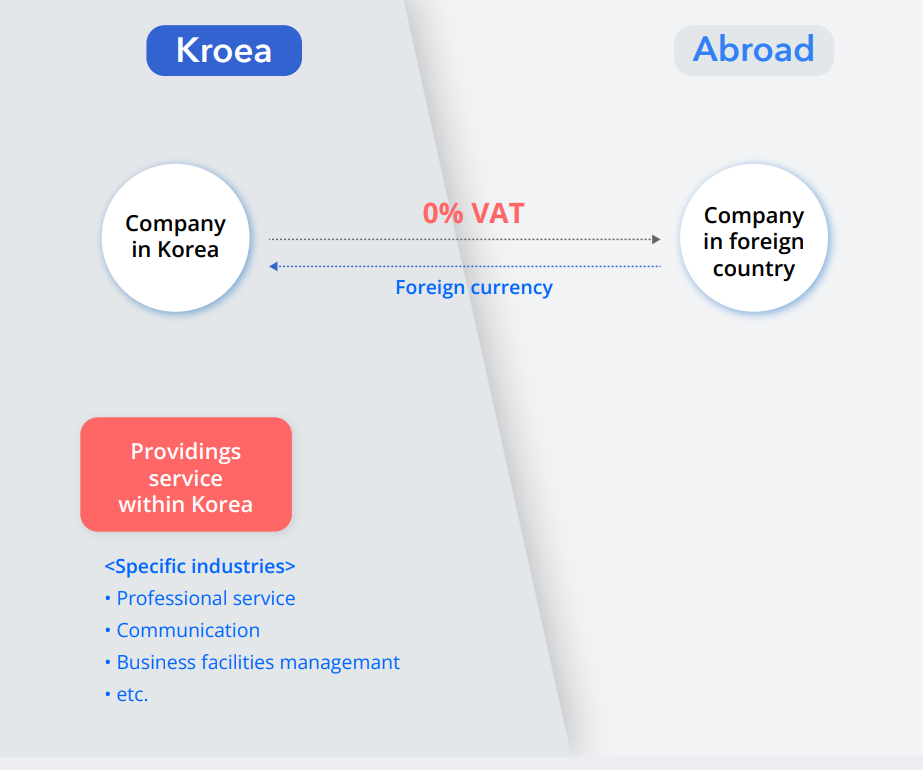

However, There are way to get 0% VAT tax rate for service under sepcifinc conditions.

Here's what I'm going to tell you.

1)Clients should be foreigners or foreign companies that do not conduct business in South Korea.

There are my previous post about the 0% VAT tax rate. The conditions for qualifying for a 0% VAT rate was as follows:

1) exporting goods abroad and 2) providing services outside of Korea.

Exporting goods and providing services abroad qualify for the 0% VAT rate because the locations where the exported goods are used or the services are provided fall outside the purview of Korean tax laws.

[VAT] Tax Rate for services supplied overseas (How to Qualify for the 0% VAT Tax Rate -2 )

The standard VAT (Value Added Tax) rate in Korea is 10%, and it applies to almost all goods and services provided by your company to clients within the country, except for certain non-VAT items. Consequently, when sending invoices to clients, your company

www.g-tax.kr

[VAT] Tax Rate for Exports in Korea (How to Qualify for the 0% VAT Tax Rate -1 )

The standard VAT (Value Added Tax) rate in Korea is 10%, and it applies to almost all goods and services provided by your company to clients within the country, except for certain non-VAT items. Consequently, when sending invoices to clients, your company

www.g-tax.kr

However, a 0% tax rate for services involving the acquisition of foreign currencies is quite exceptional.

it's because eventhough the services are conducted within South Korea, thereby falling under Korean tax law, the 0% VAT rate can be applied.

The primary aim of this benefit is to retain foreign currency within South Korea, and, therefore, a few conditions must be met to qualify for the 0% VAT tax rate.

2. Ensure you check the type of industry and the zero tax rate treaty between your client's country.

Not all services qualify for the zero VAT tax rate. only specific industries which indiciated in the tax law are eligible for the 0% VAT tax rate under tax laws related to services acquiring foreign currency.

Recognizing whether your business aligns with these industries can be challenging for business owners. An easy way to determine this is by checking your business registration documents, where you can find the your company's desiginated industry type.

If you're unable to verify this information or if the services listed in the documents differ from those your company is currently providing, we can assist you

and some type of industries in the upper picture(b),(h),(I) should also check the zero tax rate treaty with your client's conuntries.

3. Ensure you receive payment in foreign currency.

The primary goal of this advantageous 0% tax rate policy is to preserve foreign currency within South Korea. Therefore, it's essential for the company to receive payment in foreign currency and process it through a foreign exchange bank."

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com