Having conducted numerous meetings with foreign individual business owners and corporate representatives in Korea, I've discovered that issuing tax invoices can be a source of frustration for them. The primary reason for this frustration is the lack of an English interface on Hometax, coupled with the complexity of the process.

Therefore, in this guide, I will demonstrate how to issue a tax invoice using step-by-step screen captures to simplify the process.

1.The initial step involves obtaining a digital certificate from your bank.

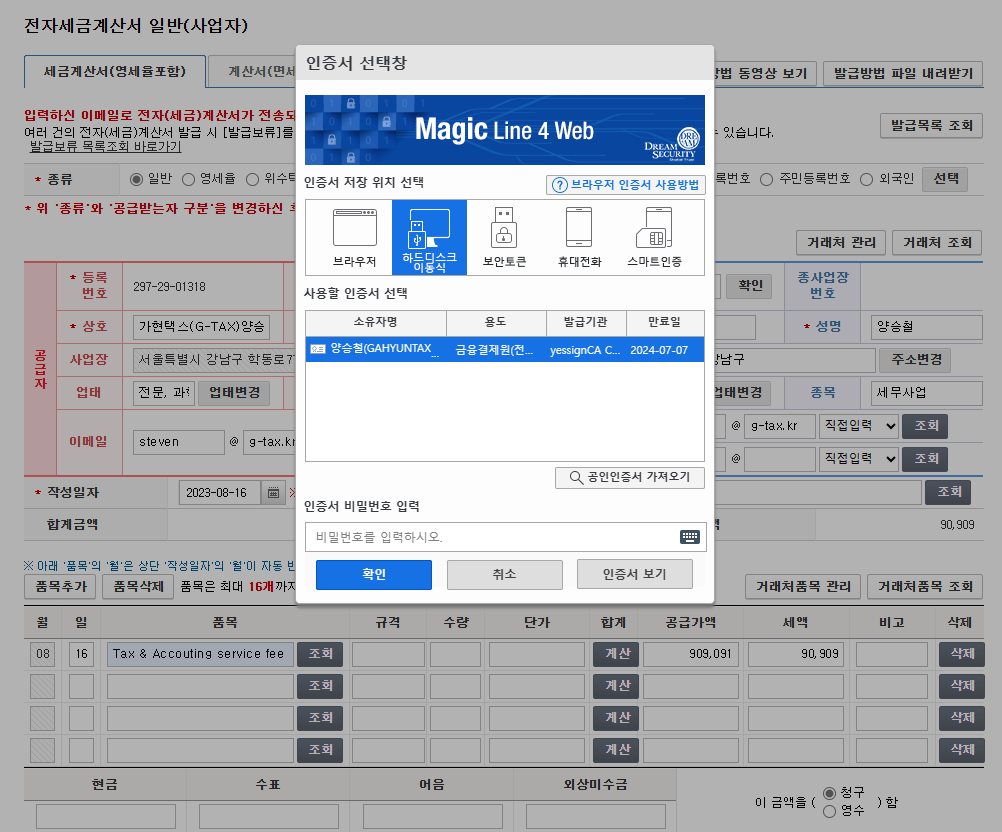

There are two types of digital certificates available: one for general use and another specifically designed for tax invoice issuance. In the image below, the digital certificate highlighted in the red box is intended for tax invoice purposes (용도: 금융결제원 전자세금용)."

In the case you don't have it, it's not possible to issue tax invoice. so you should go bank website and get the one.

or it's also possible to visit bank in person to get the digital certificate.

2.Search 'Hometax'

3.Click '전자(세금)계산서.현금영수증.신용카드 -> 전자세금계산서 발급 -> '발급'

In the 발급' (Issuance) section of Hometax, you'll find several subtabs. If you're issuing a single tax invoice to a client, simply click on '전자(세금)계산서 건별발급' (Issuing Tax Invoices Individually).

4.Login with your digital certificate

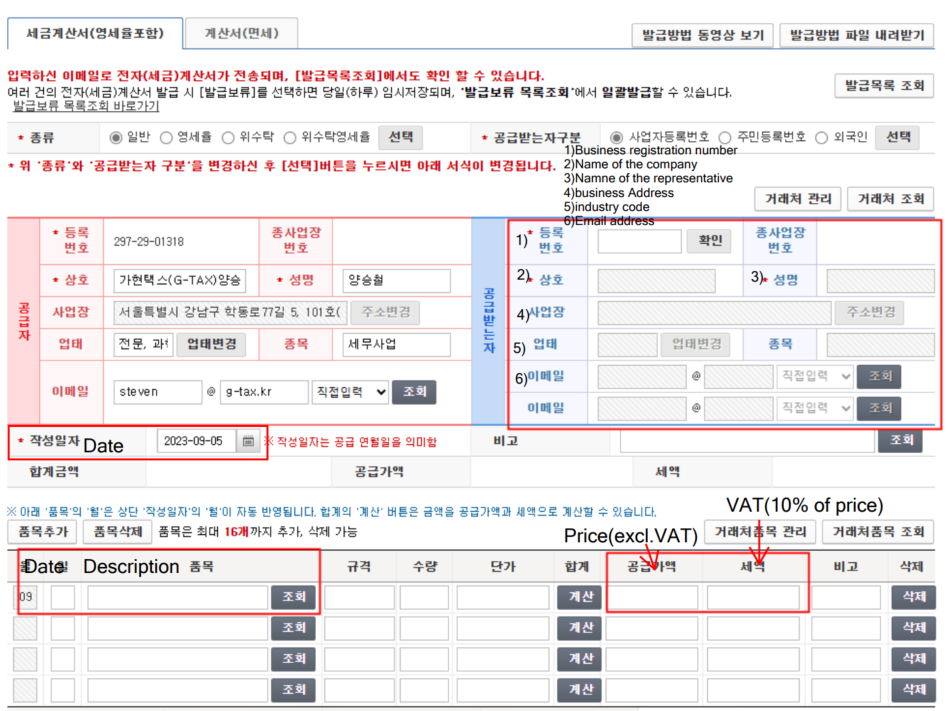

5.You should fill in tax invoice details(Business registration number, name of the company, VAT amouns and so on..)

1)Obtaining your client's business license and email address in advance is advisable. This proactive step allows you to accurately complete your client's information when filling out the invoice.

2)Date(작성일자) is not means the day you issue a tax invoice,

It's important to note that it doesn't refer to the day you issue the invoice. Instead, it signifies the date on which your goods were delivered or services were provided. it means the day your goods are delivered or services are proivded.

Example 1

When generating a tax invoice based on an agreement made for issuance on August 30th, even if the actual invoice issuance occurs on September 10th, it is essential to use the agreed-upon date, which is August 30th, on the invoice.

3)Price and VAT Clarification: The most critical parts of a tax invoice is the 'Price' (공급가액) and 'VAT' (세액).

Example 2

If you've agreed to a transaction amount of 1,000,000 KRW excluding VAT, you should enter 1,000,000 KRW in the 'Price' (공급가액) field and 100,000 KRW in the 'VAT' (세액) field.

Example 3

Conversely, if your agreement includes VAT within the 1,000,000 KRW, you should enter 909,091 KRW in the 'Price' (공급가액) field and 90,909 KRW in the 'VAT' (세액) field.

6.Once you've completed all the necessary information and clicked '발급하기' (Issue), a pop-up will appear. Please proceed by clicking '확인' (Confirm) to initiate the issuance process.

7.After clicking '확인,' a digital certificate pop-up will appear, similar to the one below. You can then enter your digital certificate password and proceed by clicking '확인' (Confirm).

Once you've followed these steps and entered your digital certificate password, you've successfully issued a tax invoice. To review your issuance history, you can navigate to the '전자세금계산서 조회' (Electronic Tax Invoice Inquiry) tab.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card!