In our previous post, we discussed how to make corrections to a tax invoice that has already been issued forvarious reasons such as transaction cancellations, product or service returns, or errors in the invoice information.

[VAT] Are you familiar with the concept of a 'Corrected Tax Invoice'?

Have you come across the concept of a 'Corrected Tax Invoice'? A Corrected Tax Invoice is a type of invoice used to rectify errors or amend details on a previously issued tax invoice, primarily due to inaccuracies in the initial tax invoice or changes in t

www.g-tax.kr

Therefore, in this guide, I will demonstrate how to correct a tax invoice already issued using step-by-step screen captures to simplify the process.

1.Search 'Hometax'

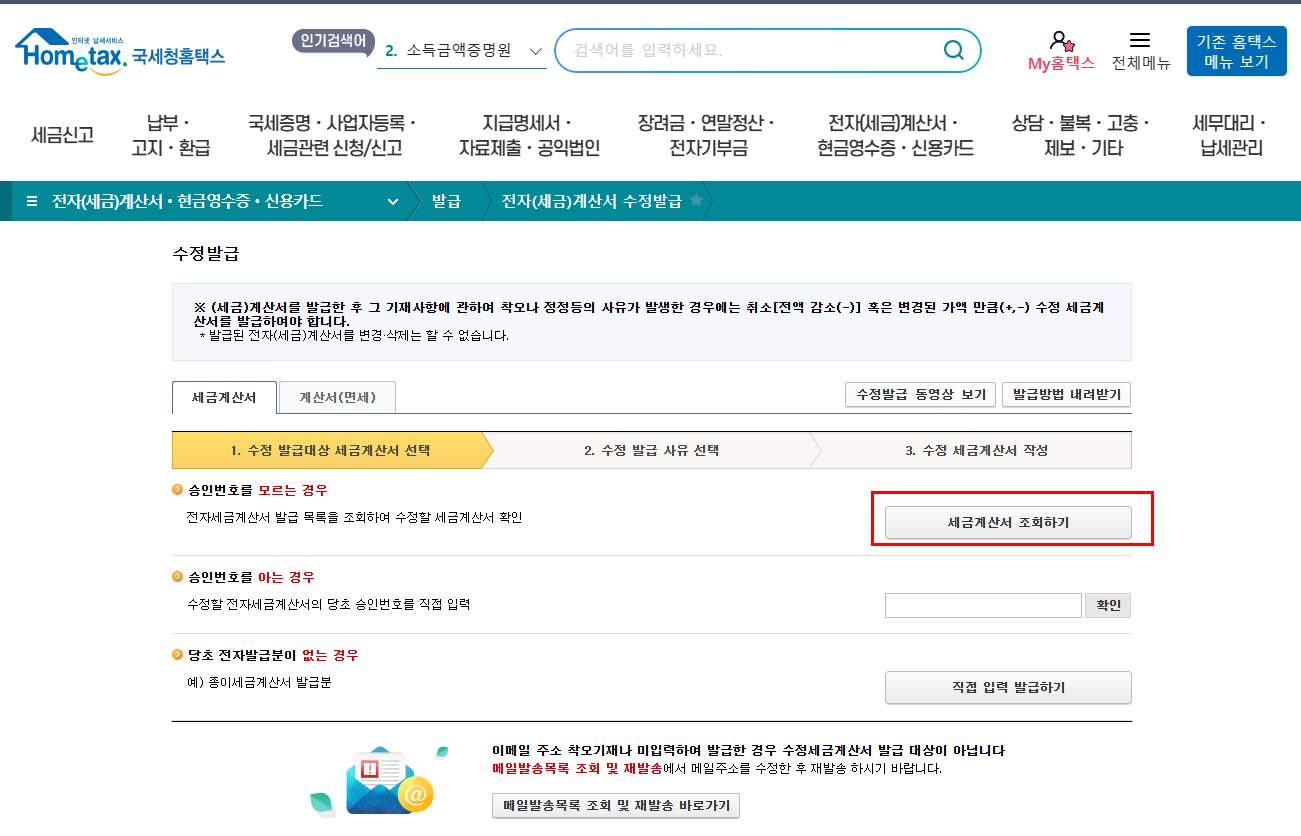

2.Click '전자(세금)계산서.현금영수증.신용카드 -> 전자세금계산서 발급 -> '발급 -> 전자(세금)계산서 수정발급'

In the 발급' (Issuance) section of Hometax, you'll find several subtabs. click on '전자(세금)계산서 수정발급' (Issuing corrected Tax Invoices).

3.Login with your digital certificate

The digital certificate should be the same one you initially used to issue the tax invoice.

4.Click '세금계산서 조회하기'

5.To locate the tax invoice that requires correction, follow these steps:

1.Set the period or month or business registration of your clients.

2.Click '조회하기' to initiate the search.

3.Once you identify the correct invoice, select it.

4.Then, click '수정세금계산서발급' to issue a corrected tax invoice.

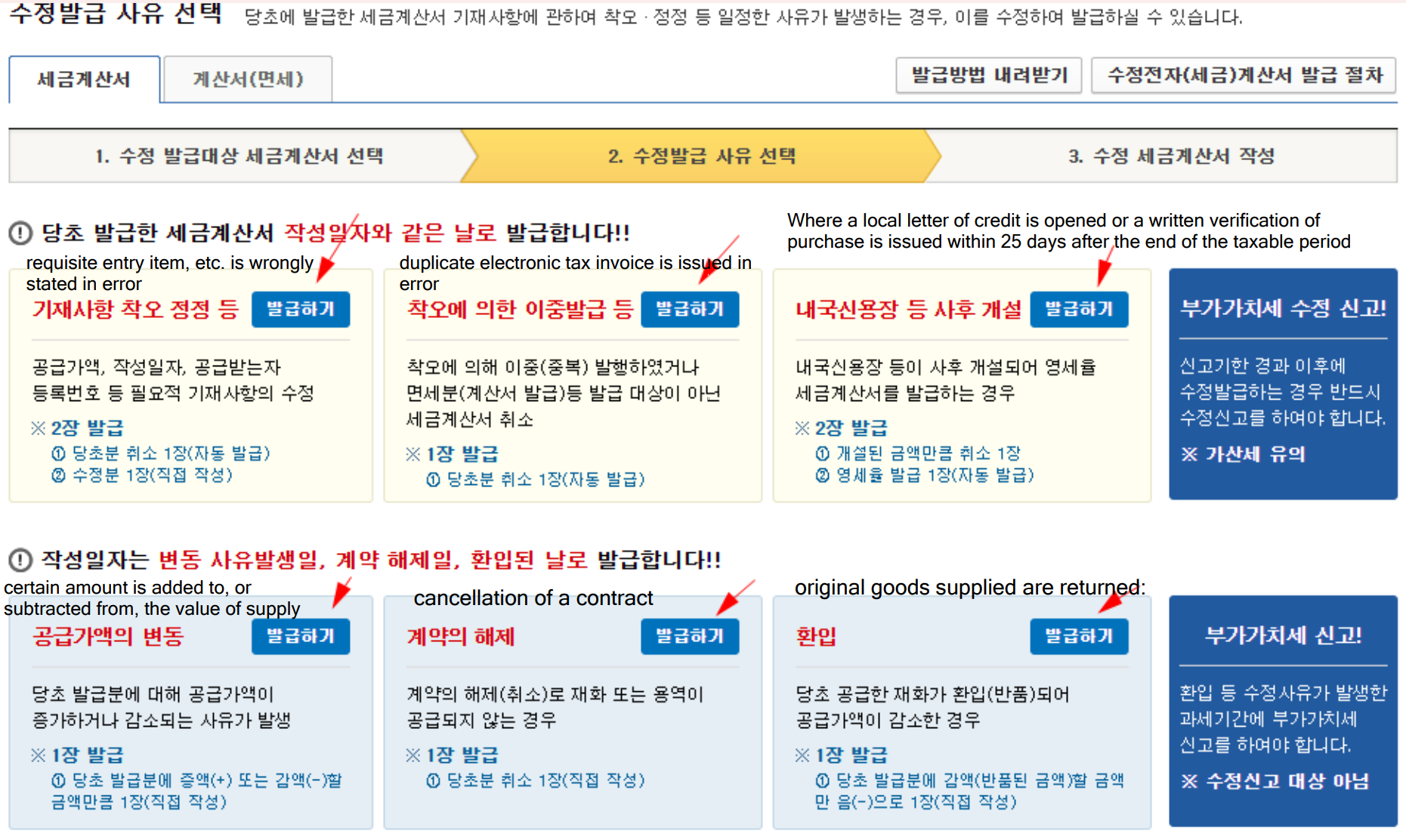

6.Following this, you will observe several '발급하기' (issuance) buttons in blue, adjacent to red labels. Each label represents a specific correction reason.

Choose the one that corresponds to your correction reason and then click '발급하기' to continue.

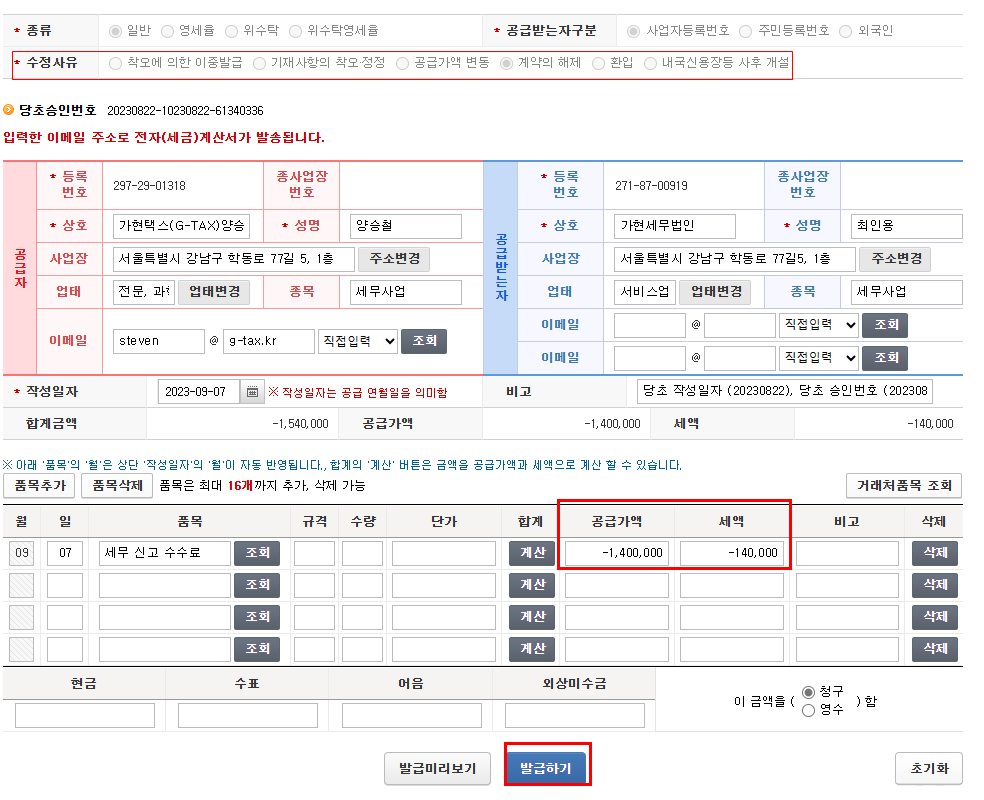

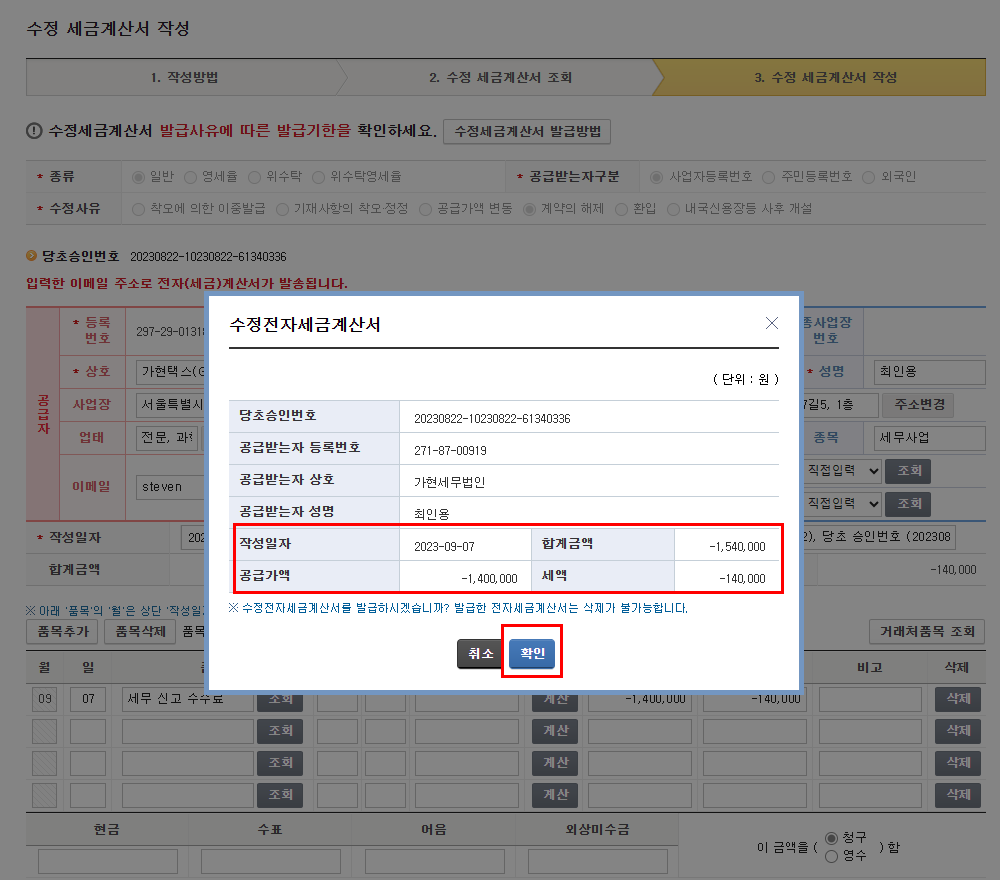

7.You will encounter the ' - ' (minus) amounts on the corrected tax invoice.

Please review these amounts carefully, and once you have confirmed their accuracy, click '발급하기' to proceed.

8.Once you've completed all the necessary information and clicked '발급하기' (Issue), a pop-up will appear. Please proceed by clicking '확인' (Confirm) to initiate the issuance process.

7.After clicking '확인,' a digital certificate pop-up will appear, You can then enter your digital certificate password and proceed by clicking '확인' (Confirm).

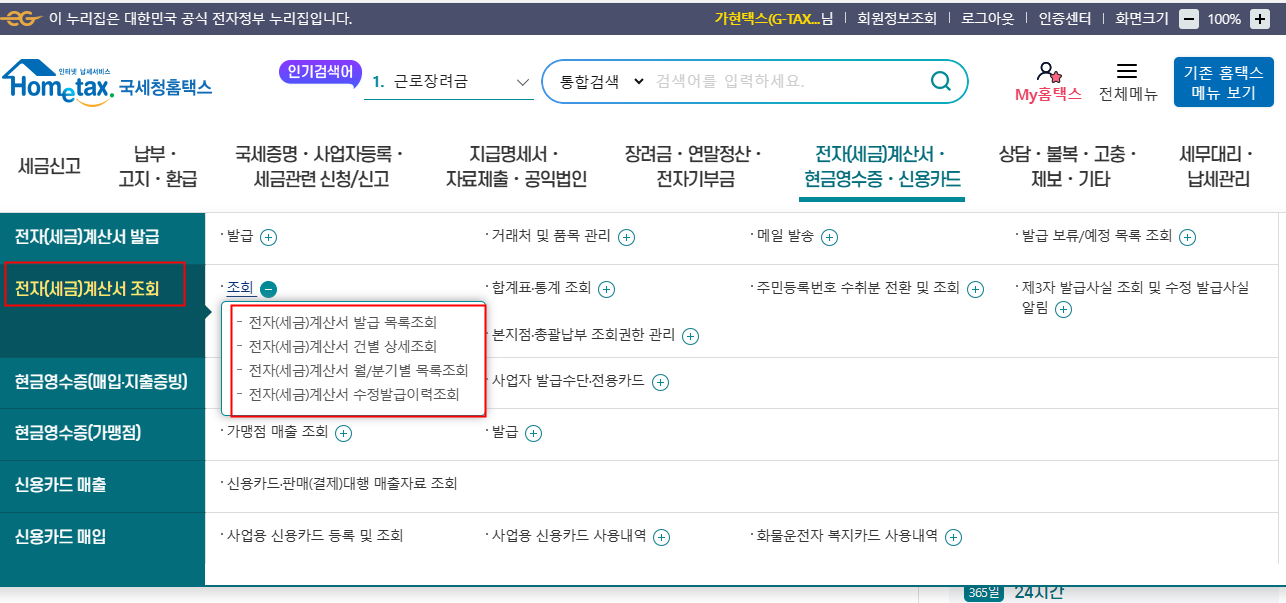

8.Once you've followed these steps and entered your digital certificate password, you've successfully issued a tax invoice. To review your issuance history, you can navigate to the '전자세금계산서 조회' (Electronic Tax Invoice Inquiry) tab-> 전자세금계산서 수정발급이력조회.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

'Korea tax guide[Hometax]' 카테고리의 다른 글

| Octobet Tax schedule in Korea (0) | 2023.10.05 |

|---|---|

| [Corporation set up] procedures you should complete after obtaining your business license in Korea (0) | 2023.09.13 |

| [VAT] Creating a Tax Invoice: A Step-by-Step Guide with Screenshots (0) | 2023.09.05 |

| September Tax schedule in Korea (0) | 2023.09.01 |

| How to register business bank account to Hometax (0) | 2023.08.31 |