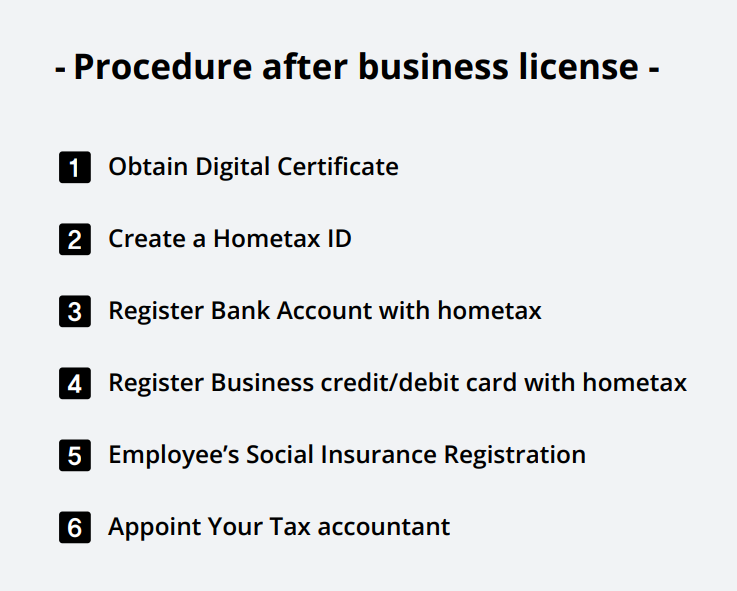

Once you have successfully obtained your business license in Korea, there are additional steps you should follow to ensure your business is compliant and fully operational.

Here's a step-by-step guide to these post-licensing procedures:

1.Obtain Digital certificates.

In Korea, digital certificates are crucial for your business operations. Nearly every procedure you undertake for your business will require these certificates. There are two types of digital certificates you need to acquire:

-General Authentication Certificate: This certificate is essential for verifying the identity of your business in various

website.

-Tax Invoice Issuing Certificate: This certificate is specifically for generating and issuing tax invoices, a fundamental aspect of your financial transactions.

You can obtain these digital certificates through authorized banks. Ensure you complete this step promptly, as it's vital for conducting business transactions in a secure and legally compliant manner.

2.Creat a Hometax ID

To streamline your tax-related processes and reduce the need for in-person visits to the tax office, it's essential to register for a Hometax ID. The Hometax website is a convenient govermental website where you can manage various tax-related tasks and obligations online.

Follow the below post to register for a Hometax ID.

To register to Hometax(NTS) is first step of your business (g-tax.kr)

To register to Hometax(NTS) is first step of your business

Hometax is Korea’s national tax service homepage. You can do almost everything related to tax through this homepage without going to tax office in person. To use this site, hometax, you need an ID & PW. Please follow below process. 1.Search

www.g-tax.kr

3. Register Your Business Bank Account with Hometax (Individual Business Owners Only)

According to Korea's income tax law, all business owners, especially individual business owners, are obligated to register their business bank accounts with the Korea tax office.

This registered account should be used when paying a salary or making payments to vendors and suppliers as part of your business operations. Ensure that you follow the below instructions to register it.

How to register business bank account to Hometax (g-tax.kr)

How to register business bank account to Hometax

Please follow the steps outlined below to register your business bank account with the Korea Tax Office. *Note that corporate bank accounts are automatically registered. If your company is categorized as corporate and not an individual business, you can pr

www.g-tax.kr

4. Register Your Business Credit/Debit Card with Hometax (Individual Business Owners Only):

While not a legal requirement, registering your business credit or debit card with Hometax is highly recommended for individual business owners.

This registration will simplify the process of collecting receipts and tracking expenses related to your business transactions, saving you valuable time.

Keep in mind that it's essential to update this information whenever you change your business credit or debit card to ensure accurate record-keeping and expense management.

Simplify Your Business Expense Management: Register Your Credit Card on Hometax and Wave Goodbye to Receipts!

Registering your credit card on Hometax can save you the hassle of collecting receipts. Follow the steps below to get started 1.Search ‘Hometax’ 2.Click '조회/발급' 3.Find '사업용신용카드' and Click '사업용 신용카드 등록' 4.Veri

www.g-tax.kr

5. Employee's Social Insurance Registration

Upon hiring employees, one of your primary responsibilities is to establish an employment contract. This step is not optional; it's a legal obligation for business owners.

Following the creation of employment contracts, you must ensure that your employees are registered for the four social insurance programs: National Pension, Health Insurance, Employment Insurance, and Industrial Accident Compensation Insurance.

You can independently send applications to each relevant organization to enroll your employees in the respective insurance programs.

Alternatively, you can provide employee information to your tax accountant and delegate the responsibility to them. Tax accountants are well-versed in these procedures and can efficiently manage the registration process on your behalf.

6. Appoint Your Tax Accountant in Hometax

Handling tax and accounting matters in Korea can be complex, and it's often advisable to hire a trustworthy tax accountant to assist with these responsibilities. To enable your tax accountant to effectively support your business, you should appoint them through Hometax. This allows them access to your financial and tax information, ensuring they can fulfill their role efficiently.

Appointment process of your tax accountant in hometax. (g-tax.kr)

Appointment process of your tax accountant in hometax.

When you have found reliable qualified tax accountant for your business in Korea, the next step is appoint the tax accountant as your tax preparer in the Hometax site. Through this process, your tax accountant can check and see lots of thing which

www.g-tax.kr

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

'Korea tax guide[Hometax]' 카테고리의 다른 글

| November Tax schedule in Korea (0) | 2023.11.01 |

|---|---|

| Octobet Tax schedule in Korea (0) | 2023.10.05 |

| [VAT]Corrected Tax Invoice issuance: A Step-by-Step Guide with Screenshots (0) | 2023.09.07 |

| [VAT] Creating a Tax Invoice: A Step-by-Step Guide with Screenshots (0) | 2023.09.05 |

| September Tax schedule in Korea (0) | 2023.09.01 |