Please follow the steps outlined below to register your business bank account with the Korea Tax Office.

*Note that corporate bank accounts are automatically registered. If your company is categorized as corporate and not an individual business, you can proceed to skip this process.

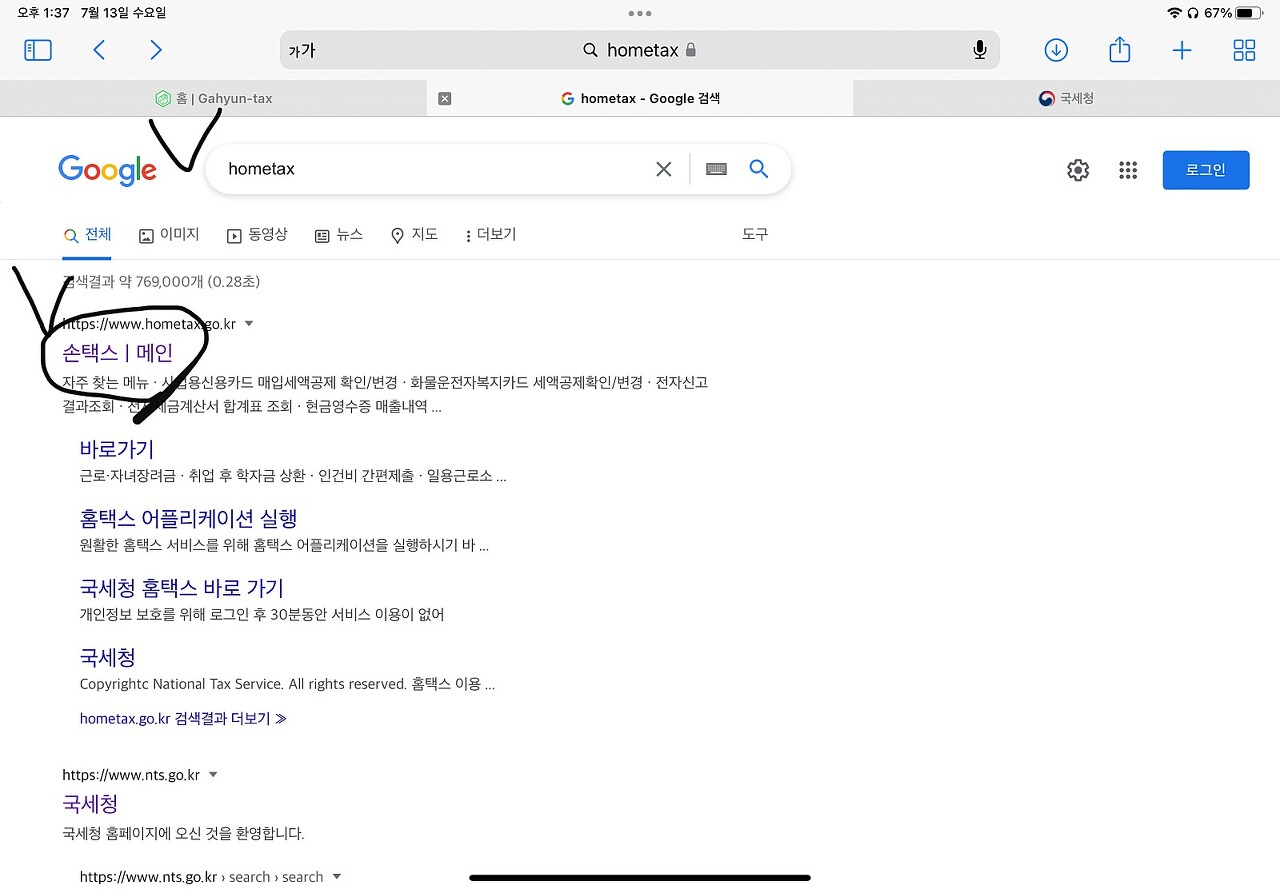

1.Search ‘Hometax’

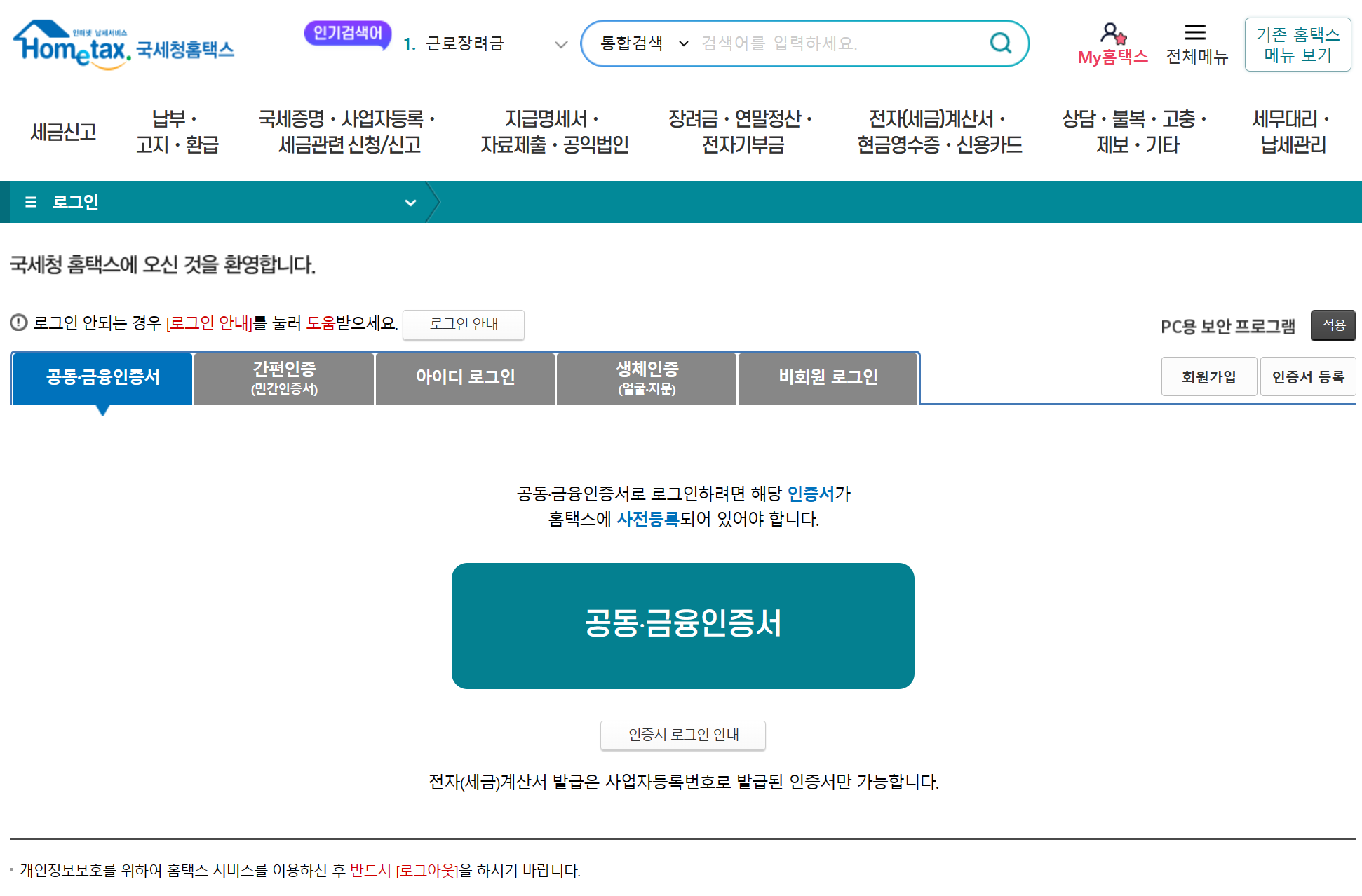

2.Click 국세증명.사업자등록.세금관련 신청/신고 -> 사업용 공익법인 계좌 개설/조회

3.Log in to Hometax

4.Enter your business registration number -> Click '계좌추가' -> input your bank and bank account number -> Click '신청하기'(Apply)

2.what’s the meaning of business bank account?

As per Article 160-5 of the Korea Tax Act, all business owners are required to register their business bank accounts with the Korea Tax Office. These registered accounts should be utilized for any financial transactions related to the business, including receiving sales payments from clients and making payments for employee salaries or vendor services.

Failure to adhere to this requirement can result in the imposition of penalty taxes. It is imperative for business owners to comply with this regulation to ensure smooth financial operations and avoid any potential financial repercussions.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact us easily through direct message

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

you can contact me through the information in the name card.