As we approach the month of May, it is important to note that it is the season for individuals to file their personal taxes.

According to Korean tax law, any resident (regardless of nationality) who earned an income during the previous year (between January 1st and December 31st) is required to file their income tax return and pay any applicable taxes by the end of May, provided they have not met any of the following exceptions:

1.Exemption from filing income tax return in May

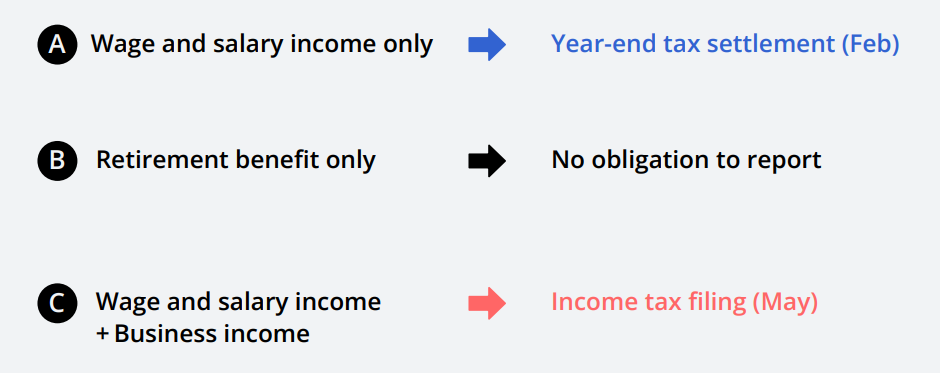

1.Individuals who only earn wage and salary income (typically as an employee) have already settled their year-end taxes in February.

*However, if they have other sources of income, they are still required to file their income tax return in May.

2.Individuals who solely receive retirement income are not required to include it in their income tax return for May.

3.Capital gain income is also not included in the income tax return for May.

4.Those who only receive public pension income are also exempt from filing their income tax return in May.

5.Individuals who have other income, but the total amount is below 3,000,000 KRW are also not required to file their income tax return in May.

*Other income means literally other income. In Korea there are 6kinds of incomes (Interest / Dividend / Business / Wage & Salary / Pension / Other)

So, unless you fall under one of the above exceptions,don't forget to file your income tax return and pay any applicable taxes before the end of May!

2.Real-Life Scenarios: Examples of Income Tax Filing in Korea

-------------------------------------------------Example 1--------------------------------------------------------

John worked for Samsung until 5/31/2022 and received a total salary of 50,000,000 KRW. He also received retirement income of 120,000,000 KRW at May/2022. Does John need to file his income tax return in May?

> No,

John does not need to file his income tax return in May. He only has wage and salary income, and retirement income is not included in income tax filing.

-------------------------------------------------Example 2--------------------------------------------------------

Philip has been working for Samsung and received a total salary of 120,000,000 KRW in 2022. He also earned income from giving lectures to other companies, totaling 40,000,000 KRW. Philip settled his year-end tax in February. Does Philip need to file his income tax return in May?

-> Yes

Philip needs to file his income tax return in May. Even though he settled his year-end taxes in February, he earned business income from another source, which requires him to file an income tax return in May.

-------------------------------------------------Example 3--------------------------------------------------------

Sarah has been living in Korea for more than 4 years and working for an overseas company, receiving a total salary of 150,000,000 KRW. Does Sarah need to file her income tax return in May?

-> Yes or No.

It depends on whether Sarah is a resident or a non-resident. If Sarah is a non-resident, she does not need to file her income tax return. However, if Sarah is a resident, she should report her income earned abroad to the Korea tax office. Please check the difference between residents and non-residents below.

3.Non-resident is also required to file income tax return.

*Resident means persons who has address in Korea or have lived in Korea more thatn 183days in a year , and non-resident mena persons who are not resident. (it's decided by the specific

Residents are required to report both their Korean income and any income earned abroad when filing their income tax return. On the other hand, non-residents are only required to report their income earned in Korea when filing their income tax return. Therefore, if you are a non-resident and have earned income in Korea, you must file your income tax return accordingly.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

or

Please write below form to contact me!

G-tax tax& accounting firm

If you send me a message through this platform, I’ll get back to you as soon as possible! Please fill out the form below and click on the [제출하기] button (the green button) to get in touch. I look forward to hearing from you!

form.office.naver.com

'Personal Income tax filing' 카테고리의 다른 글

| [Tax benefit]Tax Benefits Available to foreign employees in Korea - Part 1 (Special tax rate) (0) | 2023.09.26 |

|---|---|

| Income Tax Filing Checklist to Help You Cut Your Taxes! (0) | 2023.05.03 |

| Year-end tax settlement guide -1 [PDF downloads] (0) | 2023.01.30 |

| January 2023 Tax Deadlines (0) | 2023.01.11 |

| How English teachers pay taxes in Korea? -2 (0) | 2022.12.02 |