In succession to previous posting, I will talk about taxes of english teacher in Korea. (Especially teachers working for Hagwon)

If you want to see my last posting, please check below link.

How English teachers pay taxes in Korea? -1

In Korea which have super high educational passion (especially for English!), tons of foreign english teachers are working in Korea. They work at Public school, University or Private academy(in Korean, Hagwon). As they work and get paid in Korea, they shou

g-tax.tistory.com

In last posting, I talked about business incomer’s income tax filing.

If you are not a new to reporting income tax, in other words, this is your second time or more to report your income tax in Korea, you have two options.

1.First one is calculating your taxes with standard expense rate(not simplified expense rate. because your income would exceed 24M KRW in a year)

For your reference, expense rate are 61.7%(simplified expense rate) and 18.4%(standrd expense rate)

Example)

‘Charlie’ (English teacher working in Korea)

-Income 2021 - 60,000,000

-Income 2022 - 65,000,000

->in 2022, business income amounts exceed 24,000,000. So Charlie should file income tax return with standrd expense rate.

65,000,000 - *(Rent, Payroll cost, cost of sales) - (65,000,000 x 18.4%) = 43,040,000

43,040,000 is your tax base.

43,040,000 x 15% -1,080,000 = 5,376,000

Charlie should pay 5,376,000KRW as income tax for 2022.

*When you use standard expense rate, you can deduct rent, payroll cost, cost of sales. but typically, english teacher don't have payroll cost or cost of sales. only rent could be deductible(if you pay rent) so this examples, we assume it 10,000,000 KRW

2.Secone option is calculating your taxes with book-keeping(double entry book-keeping or simplified bookkeeping

Filing tax with book-keeping requires receipts you have paid for your business.

The more you expend for your business, the less your tax base will be. and it will brings you low tax payable amount.

Your major expenditure will be rent, transportation and food. or it might be money for drinking.

3.Way to deduct rent from your tax

If your company (Hagwon) cover your rent, it's impossible to deduct rent from your tax return.

but if you pay rent by your selves. it’s possibile to deduct. you are paying 2 kind of rent to lessor.

1.Deposit

2.Monthly rent

Deposit is the money you can get back when the rent contract is over. so surely, it's not deductible item.

monhlty rent and managing expense is deductible item. and to deduct you should get receipt called tax invoice(세금계산서 in Korean). but lessor might deny to issue it to you. than you should prepare 'rent contract' and 'bank transfer history of your rent'

4.Way to deduct other expenses from your tax

To duduct your other expense from your tax, you should have credit card recitpts.

It's best to use your credit card when you pay for your meal, transporation, and all otherthing.

Even if you don't collect receipts, if you used credit card, you can get the receipts easily through card company homepage.

Example)

Charlie

-Income 2021 - 60,000,000

-Income 2022 - 65,000,000

->in 2022, business income amounts exceed 24,000,000 Charlie should file income tax return with standrd expense rate or

| 65,000,000 |

| -Rent 10,000,000(tax invoice or transfer history) |

| -Meal 15,000,000(credit receipt) |

| -Entertainment expense 5,000,000(credit receipt) |

| -office Supplies 6,000,000(credit receipt) |

| -Transporation 2,500,000(credit receipt) |

=26,500,000

26,500,000is your tax base.

26,500,000 x 15% -1,080,000 = 2,895,000

Charlie should pay 2,895,000 KRW as income tax for 2022.

(When charlie caclulated it with standard expense rate, it was 5,376,000. tax payable amounts decreased 2,481,000KRW)

5.Please contact us if you belong to below! to save your taxes.

| 1.When you get paid, the company(Hagwon) withhold 3.3% of taxes from your salary |

| 2.Your company don't cover your social insurance (health insurance or national pension) |

| 3.I want to know my income tax payable amounts in advance and wnat to cut my tax down. |

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us.

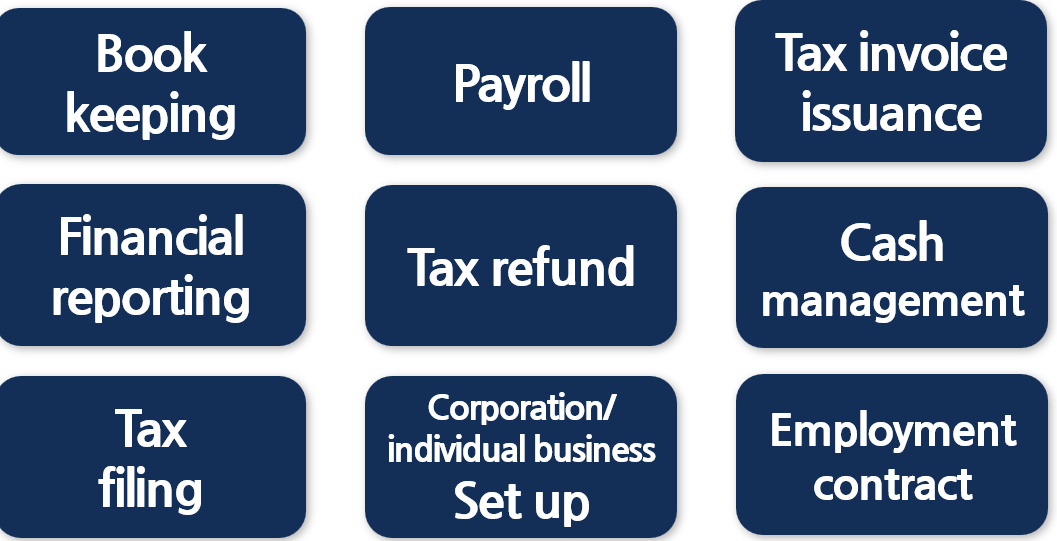

Helping Foreign corpration and individual business's tax & Financial goals

Steven Yang / Certified Tax Accountant

(+82) 0 10 9599 7152

steven@g-tax.kr

G-tax

Providing service

Linked in www.linkedin.com/in/steven-yang-49416421b

Facebook Steven Yang | Facebook

Instgram : @gtax_steven

Homepage : www.g-tax.kr /

'Personal Income tax filing' 카테고리의 다른 글

| Year-end tax settlement guide -1 [PDF downloads] (0) | 2023.01.30 |

|---|---|

| January 2023 Tax Deadlines (0) | 2023.01.11 |

| How English teachers pay taxes in Korea? -1 (0) | 2022.11.25 |

| How to report your tax in Korea? -3 (0) | 2022.11.09 |

| How to report your tax in Korea? -2 (0) | 2022.10.05 |