It's very important to know when taxes are due in Jan.

And, for many business onwers, there are more tax deadlines to care about than just the due date for your corporate income(or income tax) tax return.

If you miss a tax deadline, the NTS (Korea National Tax Service) can hit you hard with penalties and interest.

So, I'd like to introduce you what taxes you should pay and what other obligations you have in January.

Even if it's not about tax filing, there are also obligation for submuission of documents. you should care about it also because there are also penalties for failure of submission

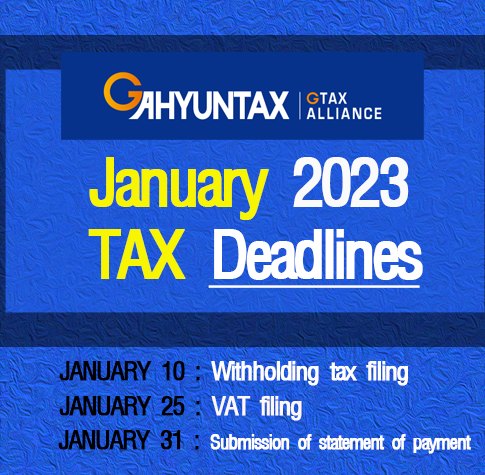

January 10

1.withholding tax filing and payment

When you paid to income to someone(it could be salary, business income or royalty)

You should deduct taxes from income and pay the withholded taxes by 10th of next month

So, by January 10th, you should report income and pay taxes in Dec to NTS.

*By your application, you can file withholiding tax half yearly

you can get this half-year filing systen only your employees are below 20

January 25

2.Value-added tax filing and payment

Corporate business : 4Q (2022 Oct/Nov/Dec)

Individual business : 3,4Q (2022 July/Aug/Sep/Oct/Nov/Dec)

It is important because your company's sales and costs are deciding by VAT filing.

Your VAT payable amounts are decided by VAT refudnable amount and VAT payable amount.

Vat refundable amount and some of credit card usage amount will be deducted from the vat payable amounts,

and you should pay the left vat payable amounts.

January 31

1.Submission of statement of payment(business incomer)*paid Dec 2022

2.Submission of statement of payment(part-time incomer)*paid Dec 2022

When you file withholiding tax return(by 10th of every month), you only report figures not incomers information(name, social securities numbers),NTS can recognize incomers information by your submission of statement of payment.

It is used to submit by yearly, or half yearly. But the rule changed, so you should submit it every month now.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

Helping Foreign corpration and individual business's tax & Financial goals

Steven Yang / Certified Tax Accountant

(+82) 0 10.9599.7152

steven@g-tax.kr

G-tax

Linked in www.linkedin.com/in/steven-yang-49416421b

Facebook Steven Yang | Facebook

Instgram : @gtax_steven

Homepage : www.g-tax.kr /

'Personal Income tax filing' 카테고리의 다른 글

| Who is Required to File an Income Tax Return in Korea? (0) | 2023.04.24 |

|---|---|

| Year-end tax settlement guide -1 [PDF downloads] (0) | 2023.01.30 |

| How English teachers pay taxes in Korea? -2 (0) | 2022.12.02 |

| How English teachers pay taxes in Korea? -1 (0) | 2022.11.25 |

| How to report your tax in Korea? -3 (0) | 2022.11.09 |