If you are only using a company credit card for your business purchase, you can skip this post. However, if you are paying in cash sometimes, transferring money through the bank system, or using a platform (e.g., Naver Pay), you should definitely check this post to reduce your taxes.

1]Only four kinds of receipts are recognized as proper receipts by law.

There are four types of legally recognized receipts: tax invoices, non-tax invoices, credit card receipts, and cash receipts.

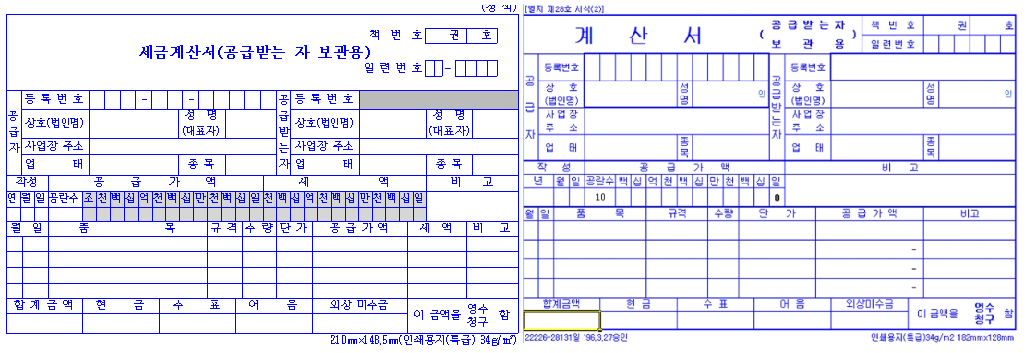

'Tax invoices' and 'non-tax invoices' can be issued electronically or in an authorized paper format.

Tax invoices and non-tax invoices look almost the same, except for the word "tax" (세금). Another difference is that non-tax invoices do not have a section for 'tax amounts' (세액) because they are for non-taxable items. Typically, these invoices are issued electronically.

For 'credit card receipts', it can be challenging to collect all the receipts. Therefore, please check the post below and register your card with Hometax. By doing this, you won't need to collect the receipts yourself.

Simplify Your Business Expense Management: Register Your Credit Card on Hometax and Wave Goodbye to Receipts!

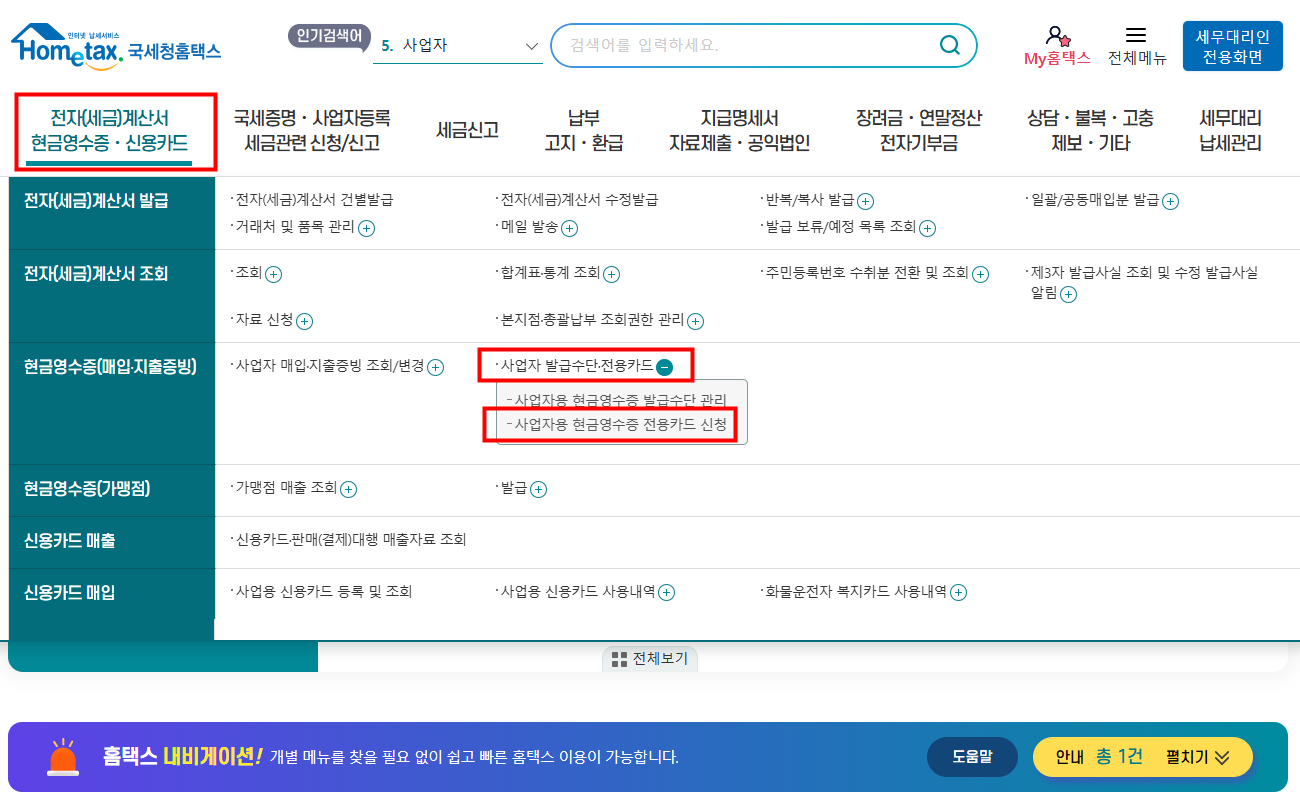

Registering your credit card on Hometax can save you the hassle of collecting receipts. Follow the steps below to get started 1.Search ‘Hometax’ 2.Click '전자(세금)계산서, 현금영수증, 신용카드 -> Click '사업용 신용카드 등록

www.g-tax.kr

2] How About 'Cash Receipts'?

These days, especially in Korea, there are fewer opportunities to use cash because almost everything can be paid for with a credit card. However, if you do pay in cash, you should ask the clerk for a cash receipt for business expenses and provide your business registration number. This distinction is crucial because there are two kinds of cash receipts:

1) Cash Receipt for Income Deduction: This is for employees who need to do year-end tax settlement. Employees (specifically those with salary and wage income) can get some deductions when they obtain a cash receipt for income deduction.

2) Cash Receipt for Business Cost: This is for companies. Companies can use this cash receipt to account for the cost in their VAT and CIT (Corporate Income Tax).

So, if you are running a business and purchase something for your business with cash, you should tell the clerk your business registration number (or input the number into the machine) and get a cash receipt for business costs.

Additionally, if you are using a gift certificate (Gift-con), you can get cash receipts for the amounts spent.

3] Memorizing Your Business Registration Number

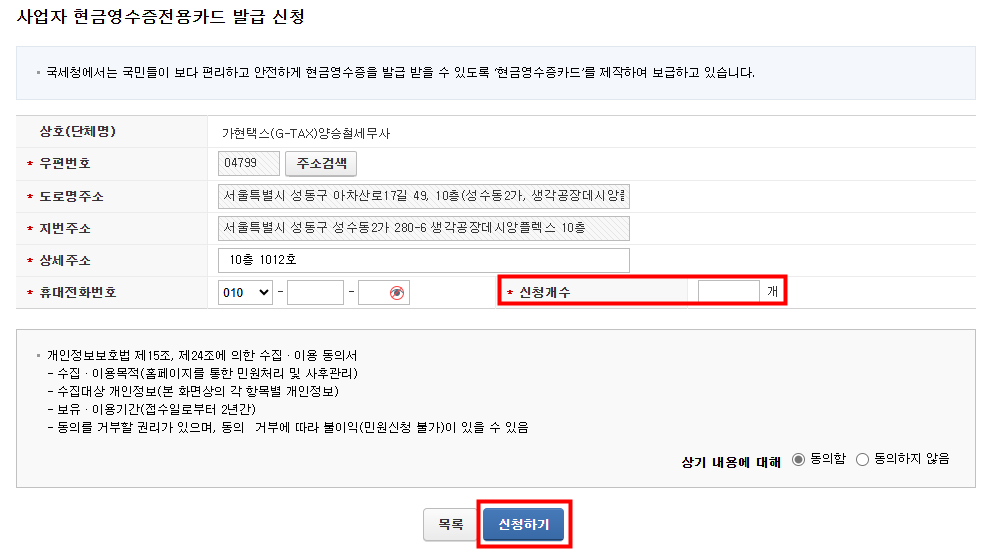

You need to know your business registration number to get cash receipts. If memorizing this number is difficult, there is a solution: you can obtain a 'cash receipts card.' With this card, you don't need to remember your business registration number. Simply hand the card to the clerk, and they will issue the cash receipt for you.

Please follw below screenshot to apply it!

You can set the number of cards you need and click '신청하기' to request them. The cards will be delivered to your business address, and it's free!

4]Way to get cash receipts when you Pay through Platforms (e.g., Naver Pay, Delivery Apps)

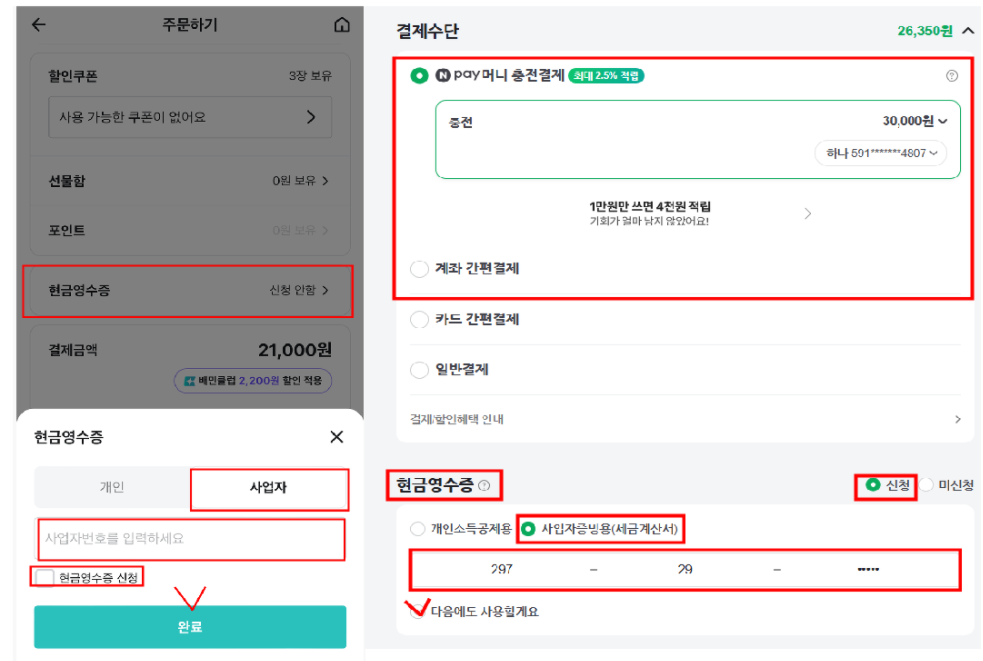

When you pay through platforms like Naver Pay or delivery apps, you can input your business registration number and have the platform remember it for future payments made through bank transfer or other methods (except credit card).

Below are examples of paying through a delivery app (Baemin) and Naver Pay. As you can see, you should choose the option for a cash receipt for business costs (사업자증빙용).

These are just two examples; there are numerous platforms for payments, and every platform has a similar tab for cash receipts!

These might seem small, but small savings can add up significantly when collected well!

Please check and do not miss this opportunity to reduce your taxes!

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

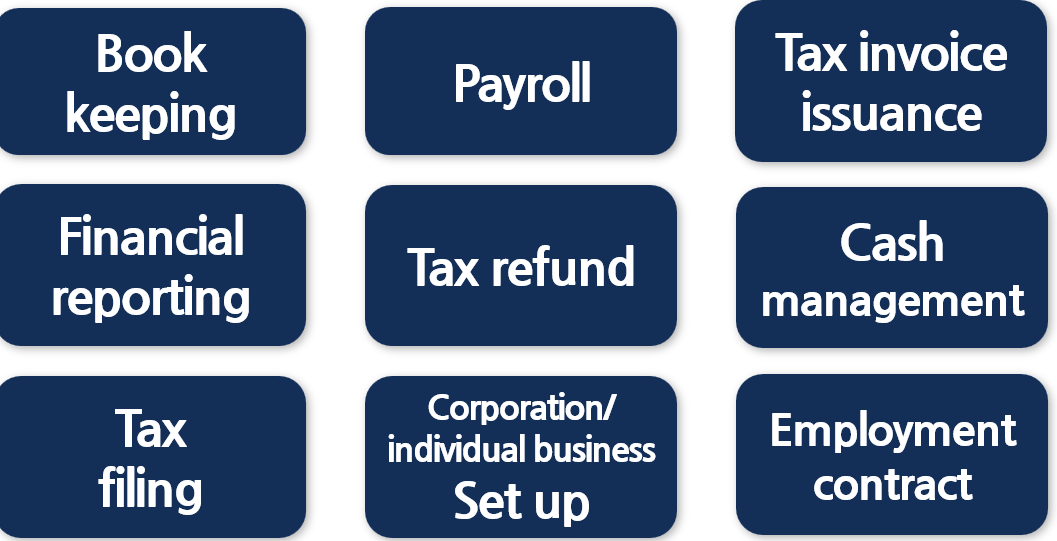

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| What is this taxes?(Local tax pro rata business portion) (0) | 2024.08.05 |

|---|---|

| August Tax schedule you should not miss! (0) | 2024.08.02 |

| Important July Tax schedule (0) | 2024.06.28 |

| Stay on Top of Your Tax Obligations: Important Deadlines to Meet in April! (0) | 2024.04.05 |

| March Tax Deadlines in Korea (0) | 2024.03.11 |