1.Corporate inocme tax filing (~3.31)

If you run a company in Korea, you need to pay taxes on the money you make. You have to file a special tax form called a "corporate income tax return" and send it to the tax office.

The deadline for this is three months after the end of each year, which is usually December 31st. But some companies choose a different year that ends in March, and they have to file their taxes by the end of June.

When you fill out the tax form, you need to include some financial documents like a balance sheet and a profit and loss statement. This will help you figure out how much money your company made, and how much tax you need to pay.

It can take a while to do all of this paperwork, so it's important to start early and make sure everything is accurate.

2.withholding tax filing(~3.10)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them. For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in February, you must file the withholding tax return by March 10th.

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return. For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

3.Submission of 'yearly' payment statement.(~3.11)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office.

Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

To meet the deadline, 'yearly' payment statements for salary income and business income must be submitted to the tax office by March 10th.

4.Submission of 'monthly' payment statement for business incomer and temporay salary income (~3/31)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

You can talk with me through below Whats App and Linkedin link

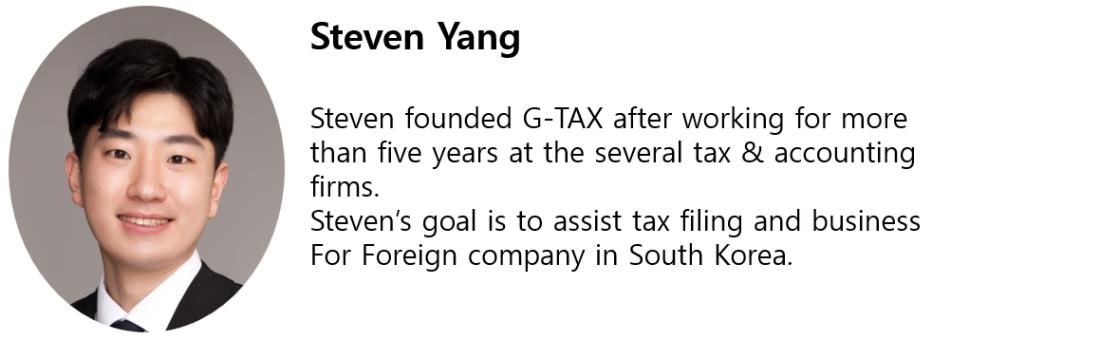

Thank you for read my article! I hope it helps.If you want to see more information about Korea tax and accounting, please follow us.And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace usG-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

you can contact me through the information in the name card.

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com

'Korea tax guide[Hometax]' 카테고리의 다른 글

| Important July Tax schedule (0) | 2024.06.28 |

|---|---|

| Stay on Top of Your Tax Obligations: Important Deadlines to Meet in April! (0) | 2024.04.05 |

| February Tax Deadlines in Korea (0) | 2024.02.01 |

| 2024 Tax calendar for business owners in Korea (0) | 2024.01.16 |

| Your January Tax Calendar : Must-Know Deadlines (0) | 2024.01.03 |