There is age limit on claiming your child as dependent when you file your income tax return or year-end tax settlement.

As your children get older, some of the rules about claiming them as a dependent on your tax return changes.

It’s important to know the rules, because it can decrese your tax liabilites..

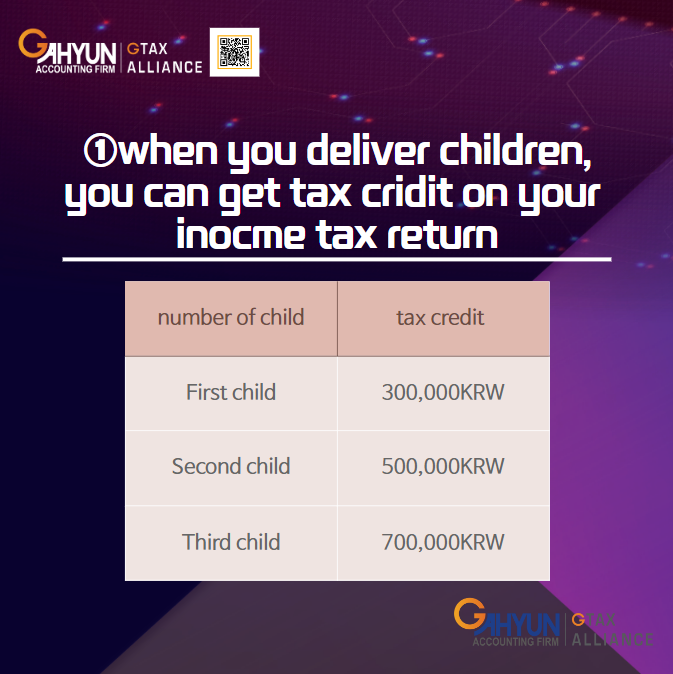

1.when you deliver a child

There is tax credit you can get when you give a birth. And the tax credit amounts increase when you deliver a second, a third child.

First child : 300,000KRW

Second child : 500,000KRW

Third child : 700,000KRW

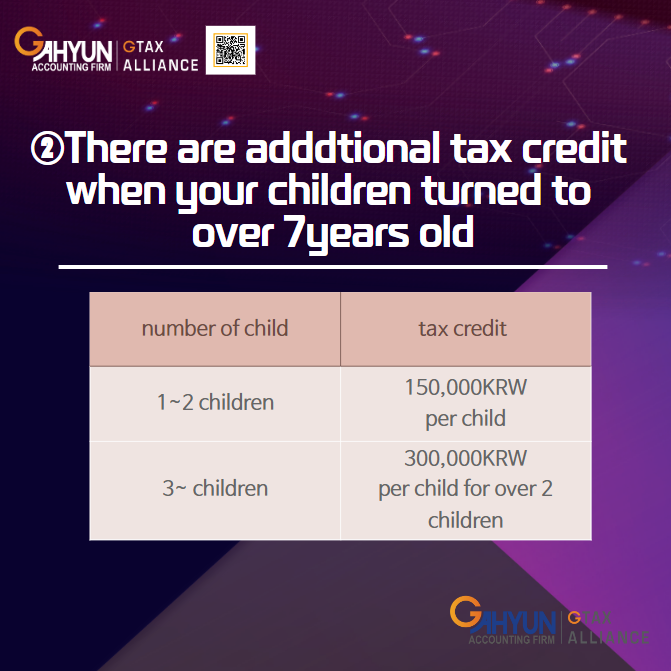

2.When your child turned to over 7years old

Tax credit for your children is possible when your children become over 7years old. As same as the tax credit of birth, here is also differential depending on the number of children.

1~2 children : 150,000 KRW per child

3~ children : 300,000 KRW per child for over 2 children.

From 7years old to 19years you can tax credits every year.

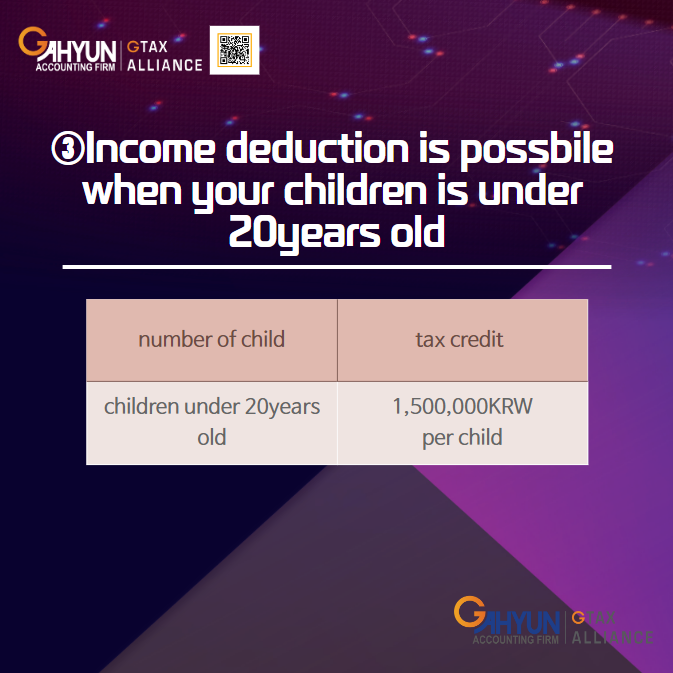

3.when your children is under 20 years old

If your children is under 20years old, you can get 1,500,000KRW income deduction.

*Do you know about difference of tax credit and income deduction?

Tax credit reduce your tax payable amount directly, becasue it applies to the calculated tax amounts. For example, your calculated amounts are 1,000,000 and your tax credit is 300,000, than your tax payable amounts are 700,000.

However income deduction reduce your income amounts. It applies to the income amounts before calculate tax amounts. So it can reduce your tax payable by amounts by reducing income amounts but not directly.

4.Exceptions about child tax credit and income deduction.

1)When your children has income, children income deduction as dependent is not applicable. Even if you children is under 20years old.

2)If your children has been deemed disabled, there is no age and income limit for claiming your children as dependent.

3)Children became 20years old in the tax year is considered to still 19years old and is possible to claim as dependent.

We can’t detail every possibile dependent senario here. G-tax team can help your income tax return filing and help you determin who you can claim as a dependent.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact us below email or mobile.

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

www.g-tax.kr

'Personal Income tax filing' 카테고리의 다른 글

| How to report your tax in Korea? -2 (0) | 2022.10.05 |

|---|---|

| You can claim your parents as dependents on your tax return (0) | 2022.10.05 |

| Tax deadline in Korea (local tax) (0) | 2022.09.27 |

| Tax deadline in Korea (National tax) (0) | 2022.09.27 |

| How to report your tax in Korea? -1 (0) | 2022.09.14 |