In my last posting, I’ve explained incomes classification generated in Korea.

How to report your tax in Korea? -1

You who are reading this article probably have incomes in Korea. your incomes might be rent income from your real-estate in Korea, dividend/interest income from your financial asset in Korea or your..

g-tax.tistory.com

Depending on what kind of income you have, Tax filing obligation and way is different.

If you fail to report it correctly, you shall pay penalty taxes. So to avoid situation that paying penalty taxes,

Today’s posting will tell you how to report each income.(Wage & salary income , Business income)

1.Wage & salary income

If you only have wage & salary incomes, your tax liability finalized by year-end tax settlement in next year Feb.

-This is process of wage & salary income reporting-

1.Company withhold taxes from your salary

When you get your salary from your company every month, the company will deduct taxes from your salary in advance and report,pay these to NTS. you will get the rest of the money. This process is called 'withholding'

The Tax which company paid to tax office is not company's tax it's your taxes. So tax office will record it as your prepaid taxes.

And this withheld taxes are not confirmed tax. It just temporary taxes calculated by simplified tax table according to the tax law. Your tax liabilites will be decided by year-end tax settlement.

2.Company submit statement of payment

Company have a obligation to submit statement of payment to tax office.

In July and Jan, company should submit half year payment breakdown. and by 10th March, company submit payment breakdown for the whole last year.

*There are penalties for failiur of submission or late sunmission.

3.Year-end tax settlement in Feb.

This is the process of deciding your tax liabilities.

You will calculator your real taxes through this process. in the process you can deduct your tax with child tax credit, dependent tax deduct, and other tax deduction and tax credit item.

*If you want to know child tax credit and parent income deduction, please check below links.

Claiming child as a dependent on your income tax return

There is age limit on claiming your child as dependent when you file your income tax return or year-end tax settlement. As your children get older, some of the rules about claiming them as a dep..

g-tax.tistory.com

You can claim your parents as dependents on your tax return

To qualify as a dependent, the individual must meet several criteria, including living with you. you can claim your spouse/children/brother & sister/parents /spouse's parents who lives with you as..

g-tax.tistory.com

When the 'real' tax is confirmed. you should compare it with your prepaid taxes.

The total of your withholding taxes(preapaid taxes) are a lot than your ‘real’ taxes, you will get refund some of prepaid taxes. If it’s opposites, you shall pay taxes for the amount which is short of real taxes.

2.Business income

If you have business income, you have a obligation to file global income tax return in May.

Depending on your business income amounts, you can choose a couple of ways to file it.

Below are way to file business inomce tax return.

1.Expense rate

If your business incomes are low, you can file your business income tax easily with expense rate. NTS publish expense rates for each category of business. you can confirm your net-income by applying these rate to your business income.

Typically simplified 'expense rate' are quite high. so if you can use it, it’s advantageous for you. But if your business is in defficit, you’d better file with bookkeeping because expense rate can not reflect defficit.

2.Simplified bookkeeping

It’s bookkeeping but quite simple bookkeeping. You don’t need to make financial statements like income statement, balance sheet or trial balance. Just put sales and cost to the simplified book.

However it's not always possibile to file with simplified bookkeeping. It’s only for small business owner or freelance who has low income.

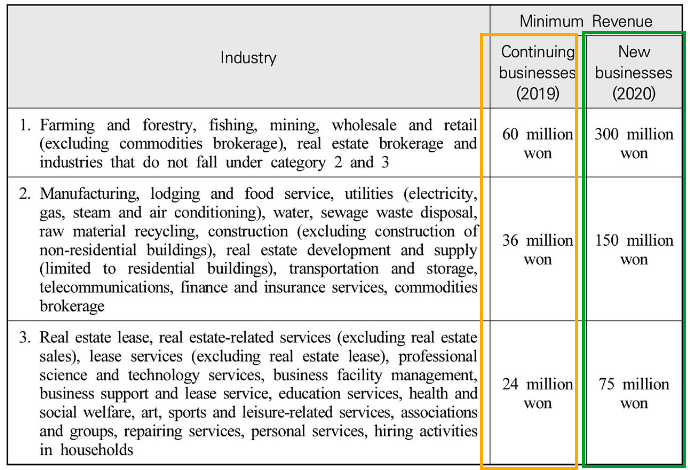

If you started your business this year, your threshold for simplified bookkeeping filing is right side amounts(75/150/300 million) you already have business from last year, your threshold for simplified bookeeping filing is left sides amounts(24/36/60 million).

As you can see, NTS is generous for the new business incomer.

3.Double-entry bookkeeping

If your business income is quite high and exceed the above threshold, you should file you global income tax with double-entry bookkeeping. That mean, you should make and submit financial statement like balance sheet, Profit & loss statement and trial balance to tax office. It can be challenging for those who are not good at tax & accounting.

So G-tax can help your tax filing with accuracy.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact us easily through direct message

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

'Personal Income tax filing' 카테고리의 다른 글

| How English teachers pay taxes in Korea? -1 (0) | 2022.11.25 |

|---|---|

| How to report your tax in Korea? -3 (0) | 2022.11.09 |

| You can claim your parents as dependents on your tax return (0) | 2022.10.05 |

| Claiming child as a dependent on your income tax return (1) | 2022.10.05 |

| Tax deadline in Korea (local tax) (0) | 2022.09.27 |