To qualify as a dependent, the individual must meet several criteria, including living with you.

you can claim your spouse/children/brother & sister/parents /spouse's parents who lives with you as dependent on your income tax return.

You can get 1,500,000KRW income deduction for a dependent. if you have 3 dependents you are going to get 4,500,000 income deduction and it will reduce your tax liabilites.(if your tax rate are 24%, the reduced taxes are 1,080,000)

The catch is that they must get very little of thier own money and you must provide them financial support. and they must be qualify age criteria to claim on your tax return.

1.Income limit for dependent

To claim your spouse,children,brother & sister,parents,spouse's parents as dependent on yout income tax return, their income of year should be lower than 1,000,000 KRW. If they work as employee, their wage&salary income before tax should be under 5,000,000KRW a year.(It will be 416,666 KRW per month)

The income includes retire benefit and capital gains. so even if they don't have regular incomes, when they get these income as one time, and the income exceeds 1,000,000KRW, you can not claim them as dependet in the year.

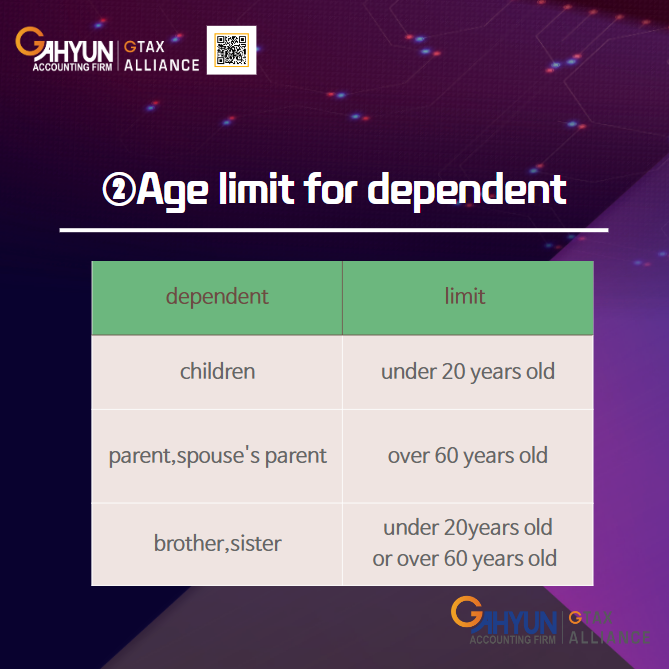

2.Age limit for dependent

Children, foster child should be old under 20years old.

Your parents, spouse's parents should be over 60years old.and your sibilings should be old under 20years old or over 60years old.

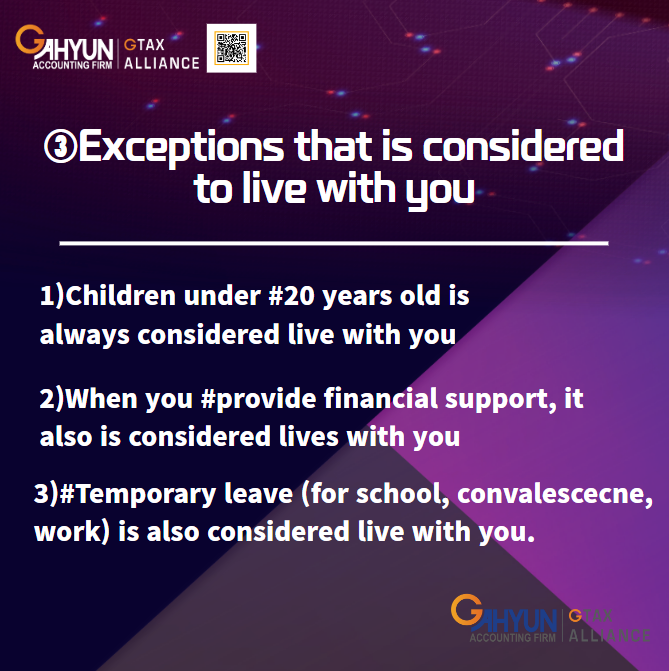

3.Exception that is considerd lives with you (even if you don't live with your dependent)

The rule is that your dependents should live with you. however, there are some exception that is considerd your dependets live with you even if don't.

1)Children under 20 years old is always considered live with you

2)When you provide financial support, it also is considered lives with you

3)Temporary leave (for school, convalescecne, work) is also considered live with you.

It's always beneficial to claim your families as dependent when you can. but the tax laws for doing can feel complex and intricated. if you're still a little confused, G-tax team can help you.

So don't streess filing your income tax return. instead contact us for tax answers you can trust.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact us below email or mobile.

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

www.g-tax.kr

'Personal Income tax filing' 카테고리의 다른 글

| How to report your tax in Korea? -3 (0) | 2022.11.09 |

|---|---|

| How to report your tax in Korea? -2 (0) | 2022.10.05 |

| Claiming child as a dependent on your income tax return (1) | 2022.10.05 |

| Tax deadline in Korea (local tax) (0) | 2022.09.27 |

| Tax deadline in Korea (National tax) (0) | 2022.09.27 |