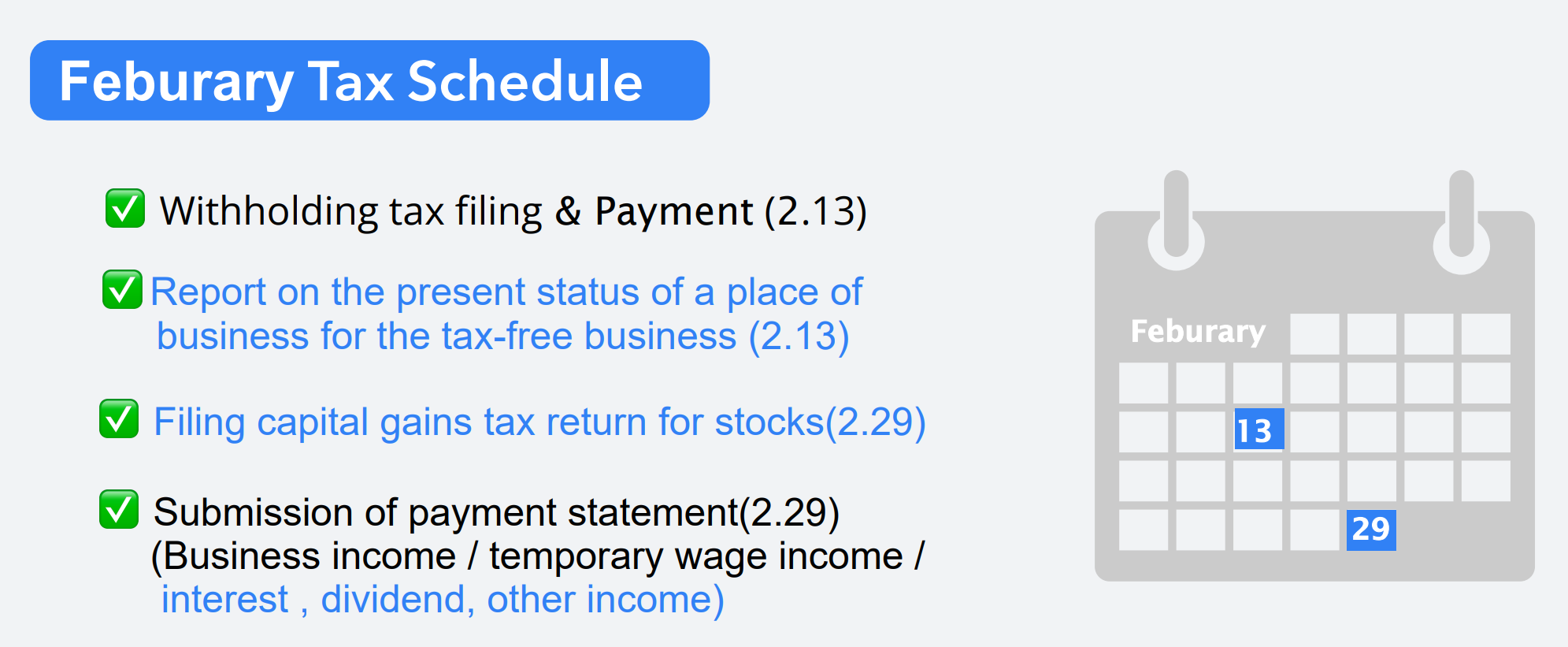

1.Withholding tax filing(~2/13)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Dec, you must file the withholding tax return by Jun10th.

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

2.Report on the present status of a place of business for the tax-free business(~2/13)

Unlike general businesses that have an obligation to file their VAT return quarterly, tax-free businesses don't file their VAT return. Instead, they should report the business's current status (number of employees, sales, costs, and others) by the 10th of every February. (This year, as the 10th of February is a national holiday, it's extended to the 13th.)

3.Filing capital gains tax return for stocks(~2/29)

The due dates for filing capital gains tax on stocks are two months from the end of the half-year in which the resident transfers an asset.

Here's a examples.

If the transfer happens on January 18, 2023, the filing due date is August 31, 2023.

If the transfer occurs on June 18, 2023, the filing due date remains August 31, 2023.

However, if the transfer takes place on October 18, 2023, the filing due date shifts to February 29, 2024.

Understanding Capital Gains Tax on Company Stock Sales -1 (Individual)

1.Capital gain taxes - Individual share holders Capital gains taxes are what you pay when you transfer assets, like a house, building, land, real estate rights, or stocks, to someone else. To figure it out, you subtract the acquisition price from the trans

www.g-tax.kr

4.Submission of payment statement.(~2/29)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

In February, unlike other months where you submit a payment statement for just that month, the company should make a payment statement for the entire previous year. As the amounts are significant, the penalty taxes for not submitting it are also substantial. Please make sure not to miss this.

'Korea tax guide[Hometax]' 카테고리의 다른 글

| Stay on Top of Your Tax Obligations: Important Deadlines to Meet in April! (0) | 2024.04.05 |

|---|---|

| March Tax Deadlines in Korea (0) | 2024.03.11 |

| 2024 Tax calendar for business owners in Korea (0) | 2024.01.16 |

| Your January Tax Calendar : Must-Know Deadlines (0) | 2024.01.03 |

| A surefire way to steer clear of tax investigation (0) | 2023.11.30 |