I suppose the most frightening thing for any business owner is the fear of a tax investigation.

A tax investigation is the tax office's examination of a taxpayer, usually a business owner or company, and their tax return. The tax office reviews the tax returns from the previous year to ensure they comply with the law and that the accounting is accurate.

During an investigation, if discrepancies are found, the tax office can impose additional taxes and penalties. Usually, tax investigations target the previous 2 to 5 years, and the penalty taxes can be substantial. In some cases, companies that struggle to handle their taxes may face bankruptcy.

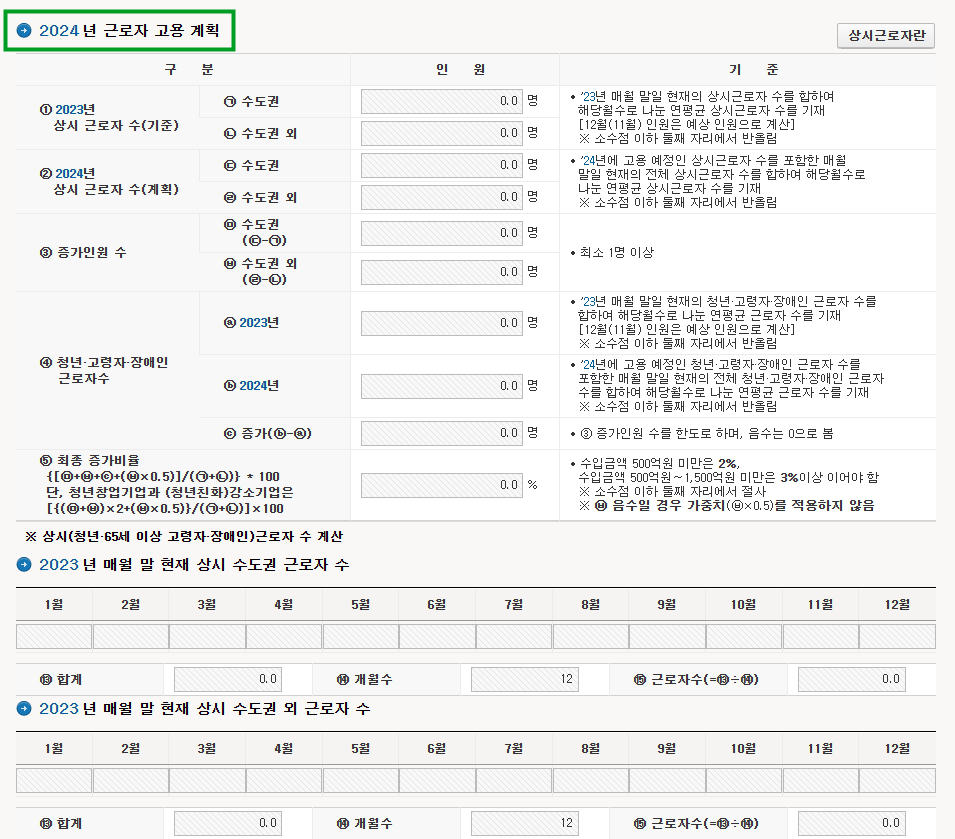

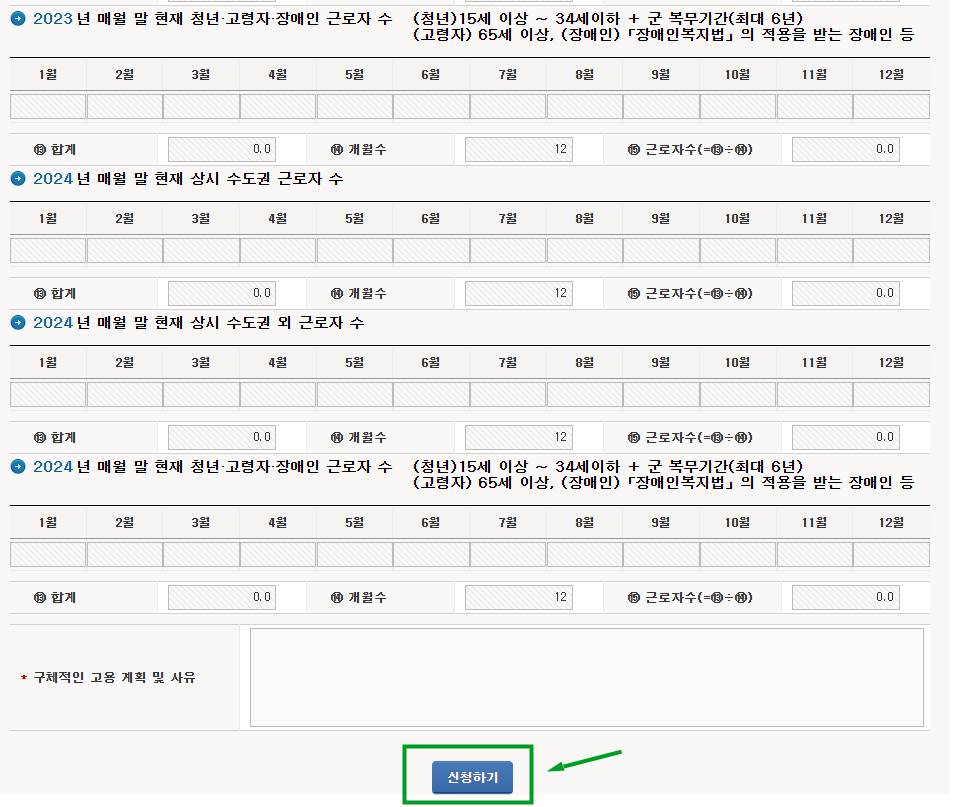

Last month, there was an interesting announcement from the NTS (National Tax Service in Korea). The NTS stated that SMEs (Small and Medium-sized Entities) submitting a plan to increase their employees by at least 2-3% in 2024, compared to 2023, and implementing the plan, will be exempt from tax investigation for the year 2022.

The policy only applicable to Small & medium size companies with a previous year's revenue underf 150,000,000,000 KRW and total assets amounts under 200,000,000,000 KRW.

The process is quite simple. visit the Hometax (www.hometax.go.kr) website and follow the picture guide below.

NTS announce such policies from time to time. G-tax provide this kind of information to foreigner & foreign corporation to assist them in their business endeavors!

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| 2024 Tax calendar for business owners in Korea (0) | 2024.01.16 |

|---|---|

| Your January Tax Calendar : Must-Know Deadlines (0) | 2024.01.03 |

| DecemeberTax schedule in Korea (0) | 2023.11.28 |

| Starting a New Business in Korea : A Simple Guide to Registration (0) | 2023.11.07 |

| November Tax schedule in Korea (0) | 2023.11.01 |