If you got a message or letter from NTS like below, you should difinitely check this post!

1.What is comprehensive (personal) income tax in Korea ?

Personal income tax, known as 종합소득세 in Korean, is a tax that individuals must file and pay every May for the income they earned the previous year, from January 1st to December 31st. (In May 2024, incomes from January 1st, 2023 to December 31st, 2023 should be filed).

It is similar to CIT (corporate income tax), which corporate businesses file and pay every March for the income earned in the previous year. However, personal income tax targets individual income, not corporate income.

But not everyone who earns income is required to file personal income tax in May. For example, individuals who only have salary income from a company may not have an obligation to file an income tax return during year-end tax settlement. However, there are cases when they are required to file income tax returns in May. Let's check who the subject is.

2.Who are required to file income tax?

In Korea, there are 8 kinds of income. and depending on what income you have, the income tax filingo obligations are different.

- Retirement income and capital gains(transfer income) are not considered income for personal income tax filing. For capital gains, there might be tax filing obligations for those who sold assets, but let's discuss that later, not today.

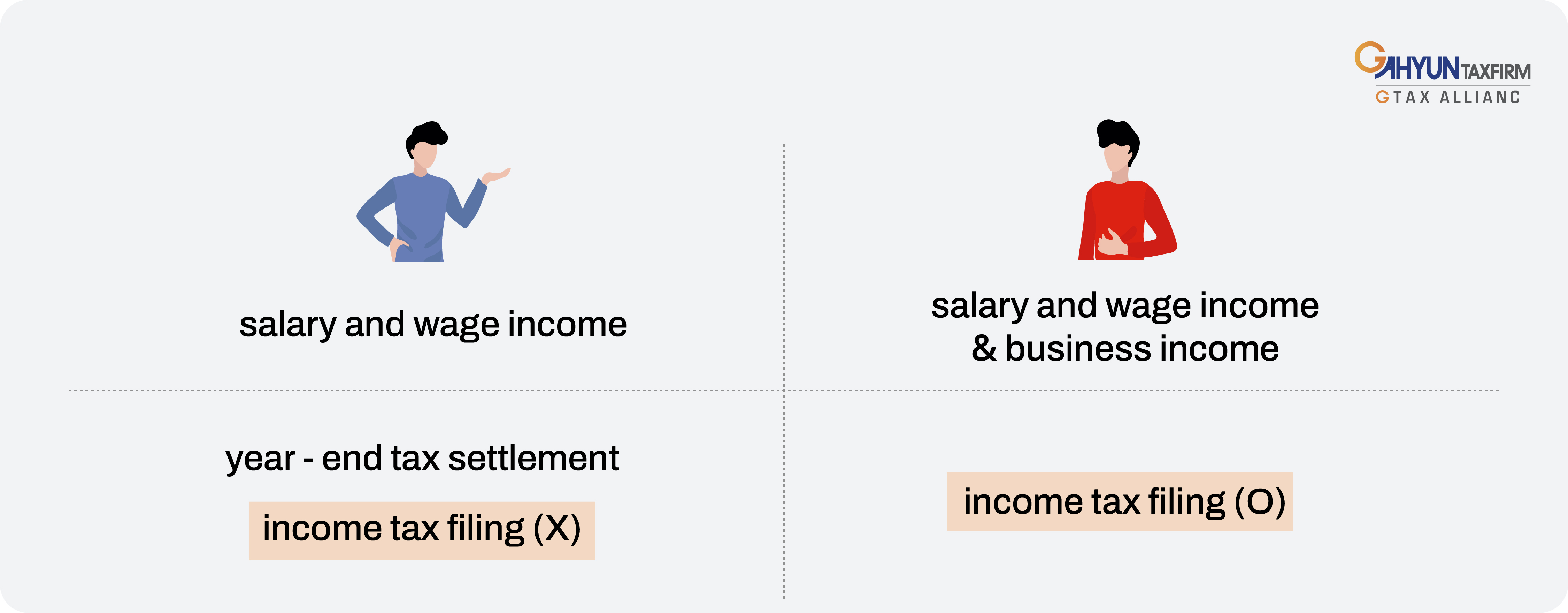

- Salary and wage incomes are settled through year-end tax settlement in January or February. So, individuals who only have salary and wage income are not required to file personal income tax in May since they already completed income tax filing through the year-end tax settlement.

- Business incomes are required to file income tax returns in May. Business income is income that you make through your business license or as a freelancer contracted with other businesses.

- Other income is required to file income tax returns when the amounts exceed certain thresholds (3,000,000KRW).

- Interest and dividends income are required to file income tax returns when the amounts exceed certain thresholds (20,000,000KRW).

So, if an individual has only salary and wage incomes, there would be no obligation to file an income tax return (and the NTS knows your incomes, so they will not send you a letter about income tax filing).

However, even if you have salary and wage incomes, you may also have other kinds of income which require income tax filing, in which case you should file an income tax return.

For example

- 'Sarah' works for a company and receives a salary every month. But she also earns money as a freelancer working for another company.

In this case, Sarah will do a year-end tax settlement in February with her company. But she should also file an income tax return in May because she has business income in addition to salary and wage income.

2. 'Peter' works for a company and receives a salary every month. He did a year-end tax settlement in February, but he didn't prepare it well and wants to do it again.

In this case, Peter does not have an obligation to file an income tax return because he only has salary and wage income and he already completed a year-end tax settlement. Nevertheless, if he wants to apply for more deductions or make other adjustments, he can do so through income tax filing in May.

3.How CIT payabale amoutns are calculated?

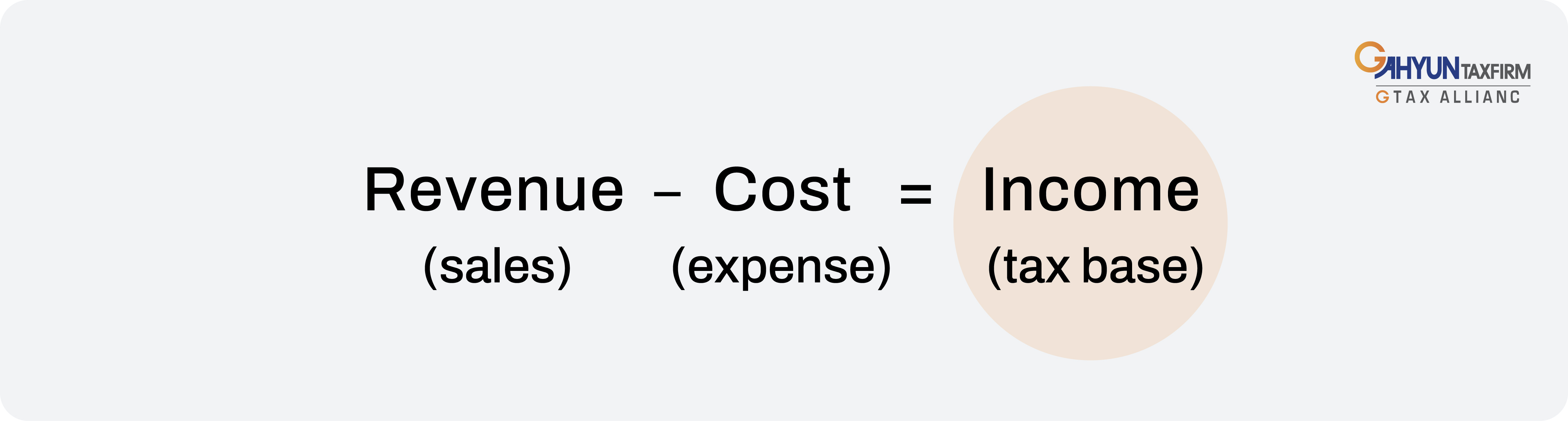

First, you should calculate each 'income'. You should understand that 'revenue' and 'income' are different concepts.

Revenue (sales) means the total money you receive. By deducting costs (money you spent to generate the revenue) from the revenue, you can calculate 'income'.

Revenue - Cost = Income.

For business income, the cost for revenue (sales) can be calculated by making a financial statement, but for other income, it's challenging. (How can you exactly calculate the cost for your salary?) So, every income has a formula to calculate cost in the law, and by using this method, you can calculate each income.

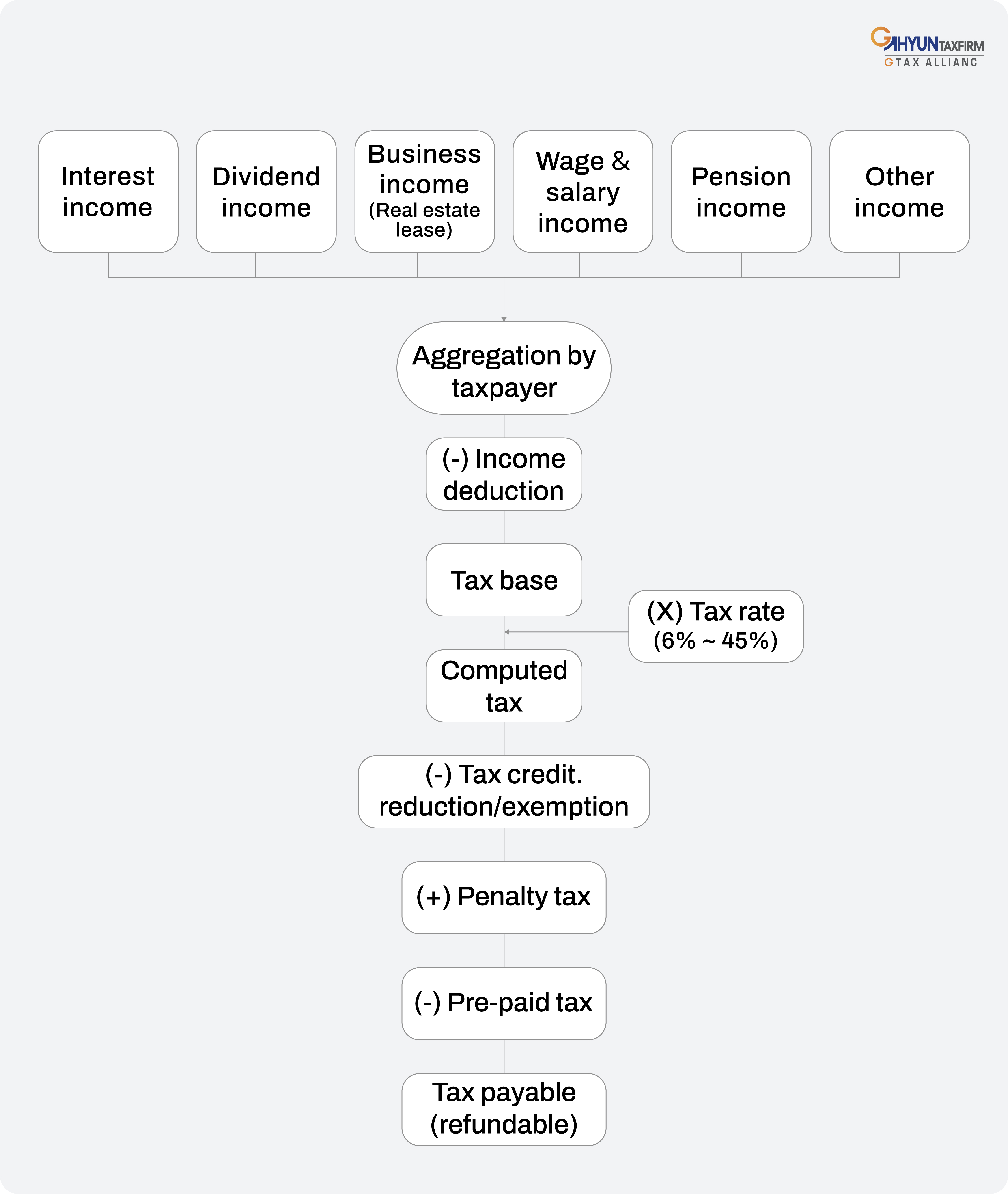

Second, you should aggregate all your incomes and apply the tax rate. That's why we call it comprehensive income tax.

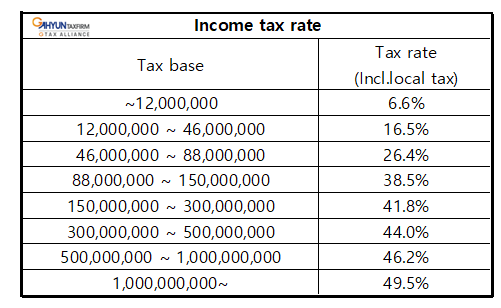

Income tax rates in Korea are as follows: (tax base means income)

Third, you can check for any deductions that you can apply to decrease your income tax payable.

You can claim dependents to reduce your taxable income, or you can apply tax credits that suit your situation to decrease the calculated tax amounts.

4.What should I care to prepare Personal income tax well?

- In a letter NTS sends you about your income tax filing, there will be reported incomes under your name. Firstly, you should check that the reported income is correct. If it's not correct, you should report it to NTS.

- You might have prepaid taxes for your incomes. For example, if you work as a freelancer for another company, you pay 3.3% of your income by deducting the money you receive from the company. If you have a business, you might pay interim income tax in November.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

you can contact me through the information in the name card.

Or Please fill in the below form

G-tax (Tax & Accounting service)

Thank you for contacting us! Please fill the questionnaire in. We will reach out to you as soon as possible.

docs.google.com

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr