As a tax accountant mainly working with foreigners in Korea, most of our clients establish businesses in Korea, obtain a D-8 (investment visa), and later need to renew it.

Preparing for a visa renewal in Korea can be quite frustrating due to the extensive list of required documents.

In this post, I’ll guide you through the necessary documents, explanations of each, and how to prepare them.

There are basic documents like the application form, passport copy, and photos. However, this post will focus on the legal and tax-related documents required for visa renewal.

①Documents related to company's basic information

1.외국인투자기업등록증(증명서) Foreign Investment Company Registration Certificate

This document proves that your company is a foreign-invested enterprise. It includes details about the investor (typically you), as well as information about your company and the invested capital. It is usually issued by a bank or KOTRA.

2.사업자등록증 Business license

You need a business license when starting a business in Korea. This document contains essential information such as the company name, establishment date, industry type, and more. It is issued by the tax office.

3.법인 등기부등본 Corporate court registry

If your business is a corporate entity, you must obtain this document from the court to apply for a business license. You can get it online from Registry Office

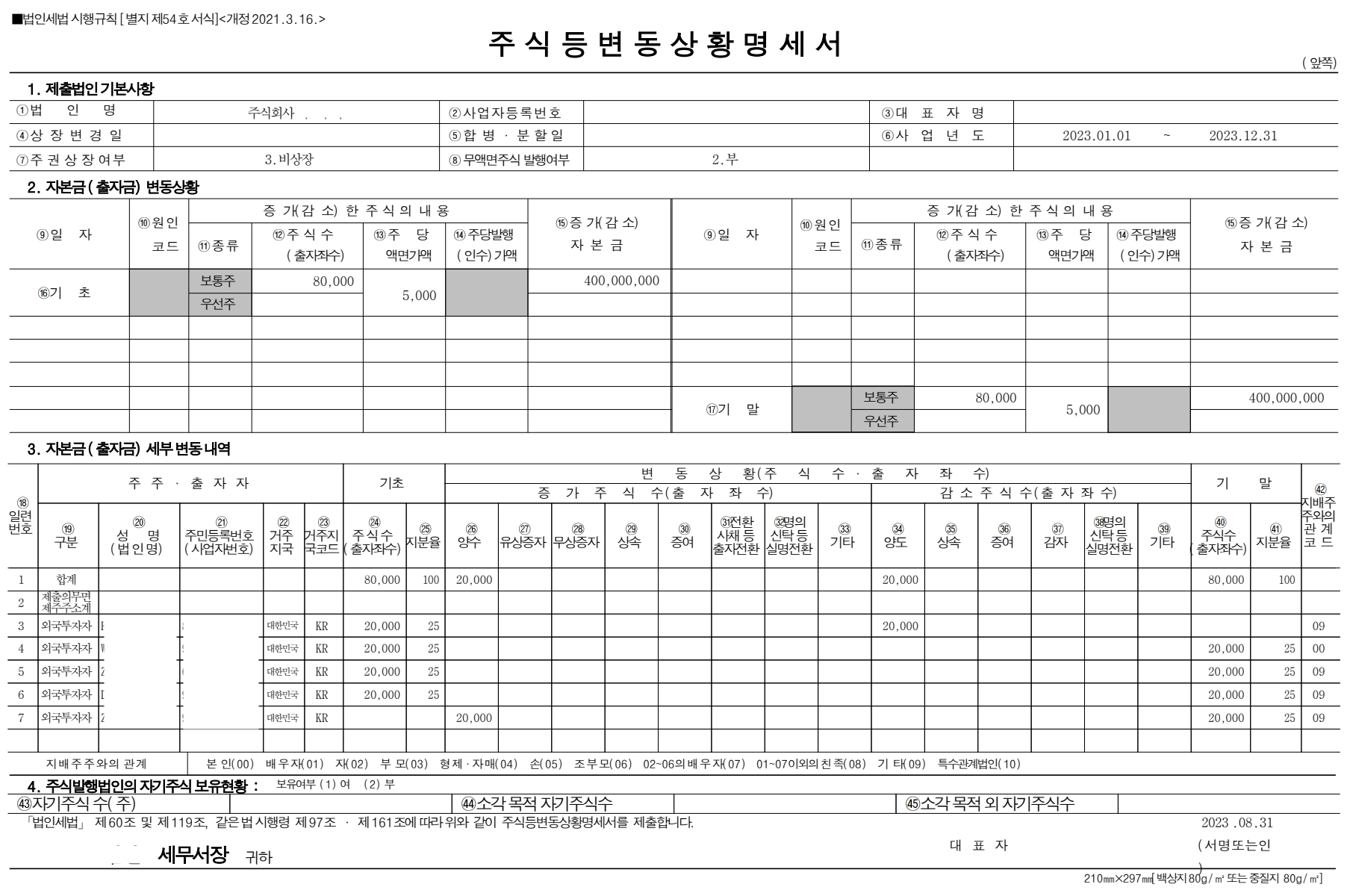

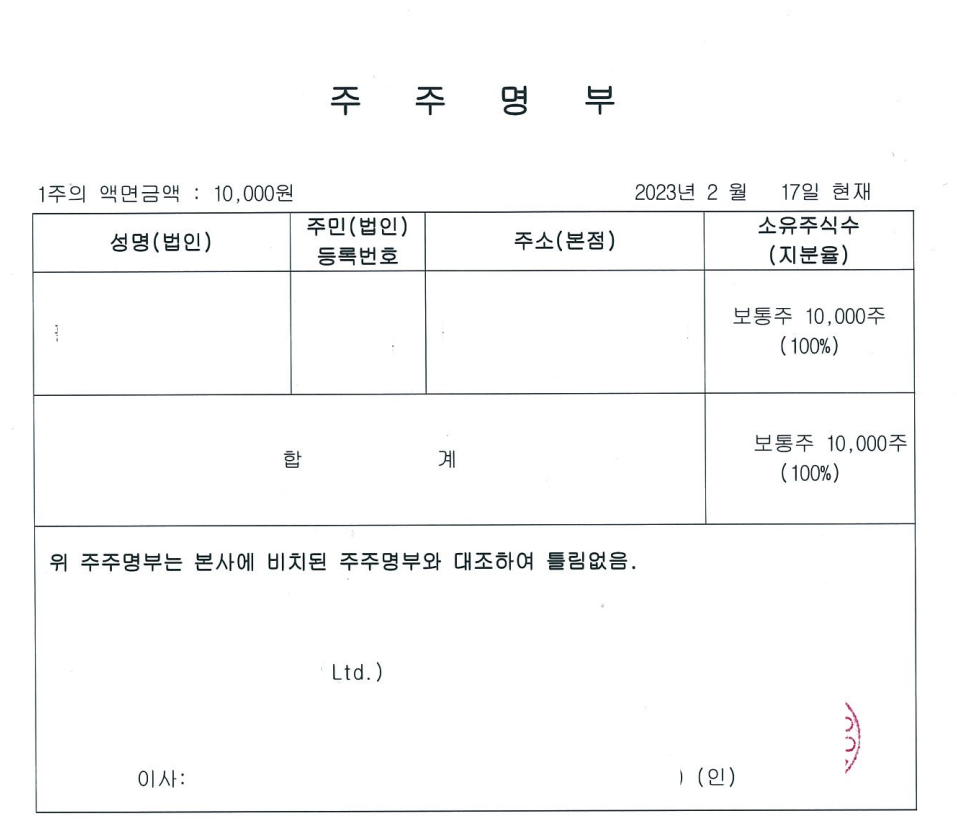

4.주식등변동상황명세서, 주주명부 Stock change status statement, shareholder list.

This document shows a corporate business's shareholder information and the ownership percentage of each shareholder.

The key difference is that the Stock Change Status Statement records any transfers of shares and is submitted as part of the corporate income tax filing.

On the other hand, the Shareholder List only shows shareholder information and ownership at a specific date. It is an internal company document and not an official form.

②Documents related to company's revenue and tax payment

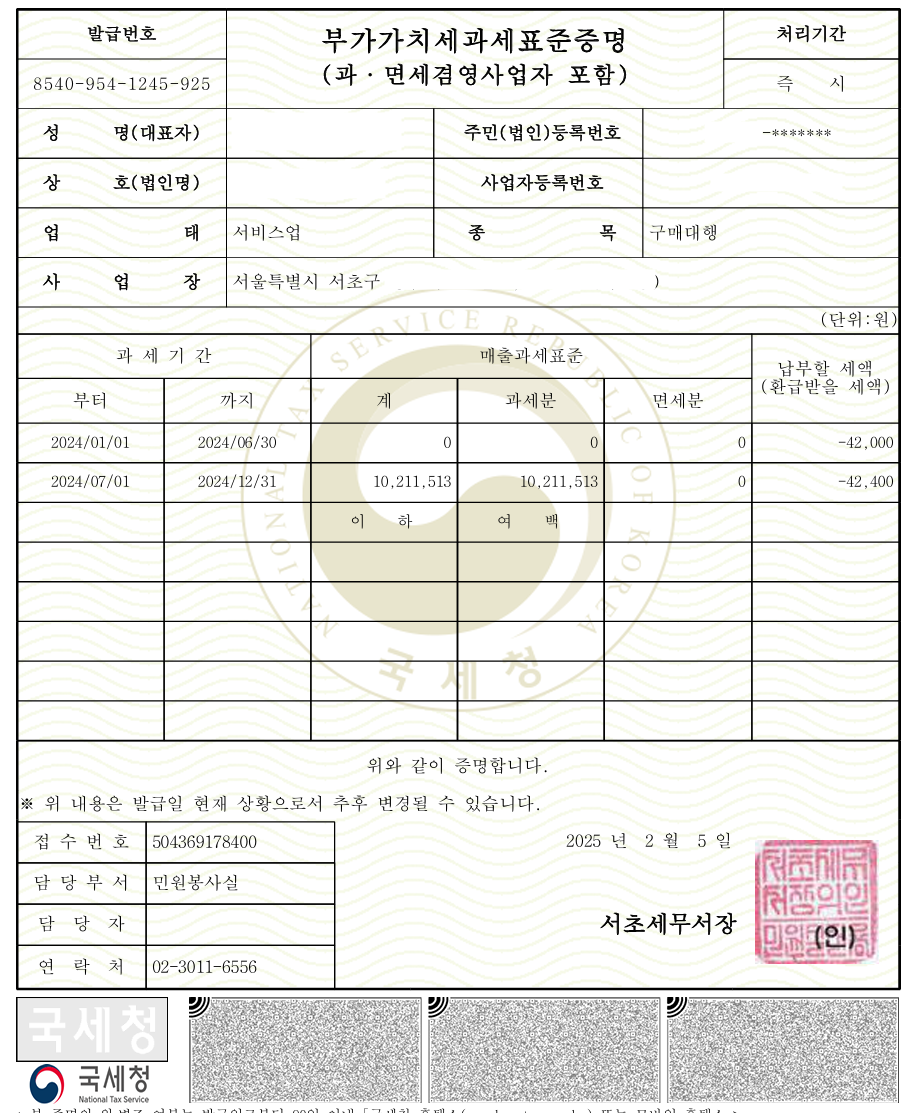

5.부가가치세 과세표준 증명원 Value Added Tax Tax Base Certificate

This is an official document issued by the tax office that shows the company's sales amounts as reported in its VAT return. Since it is based on the filed VAT return, it can only be obtained after the company has submitted its VAT filing.

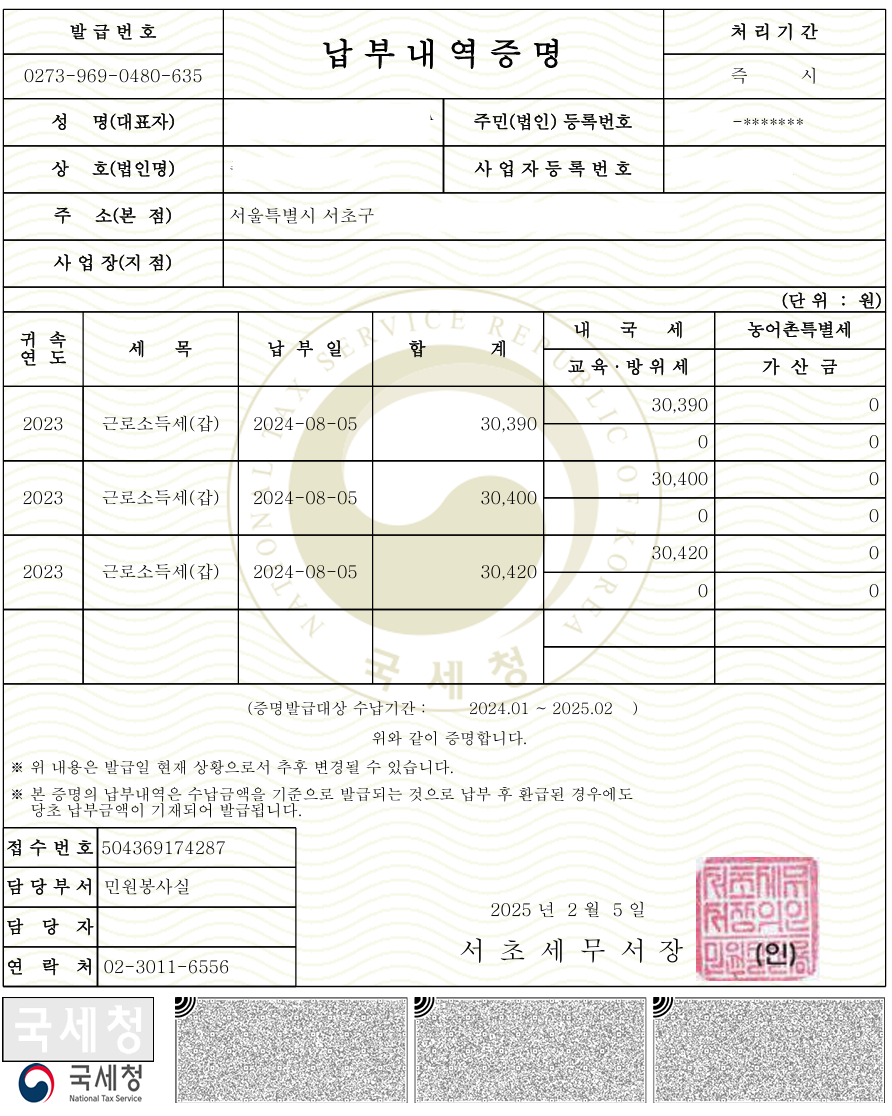

8.회사의 세금 납부내역증명 Proof of National Tax Payment

This is an official document issued by the tax office that shows the company's tax payment history.

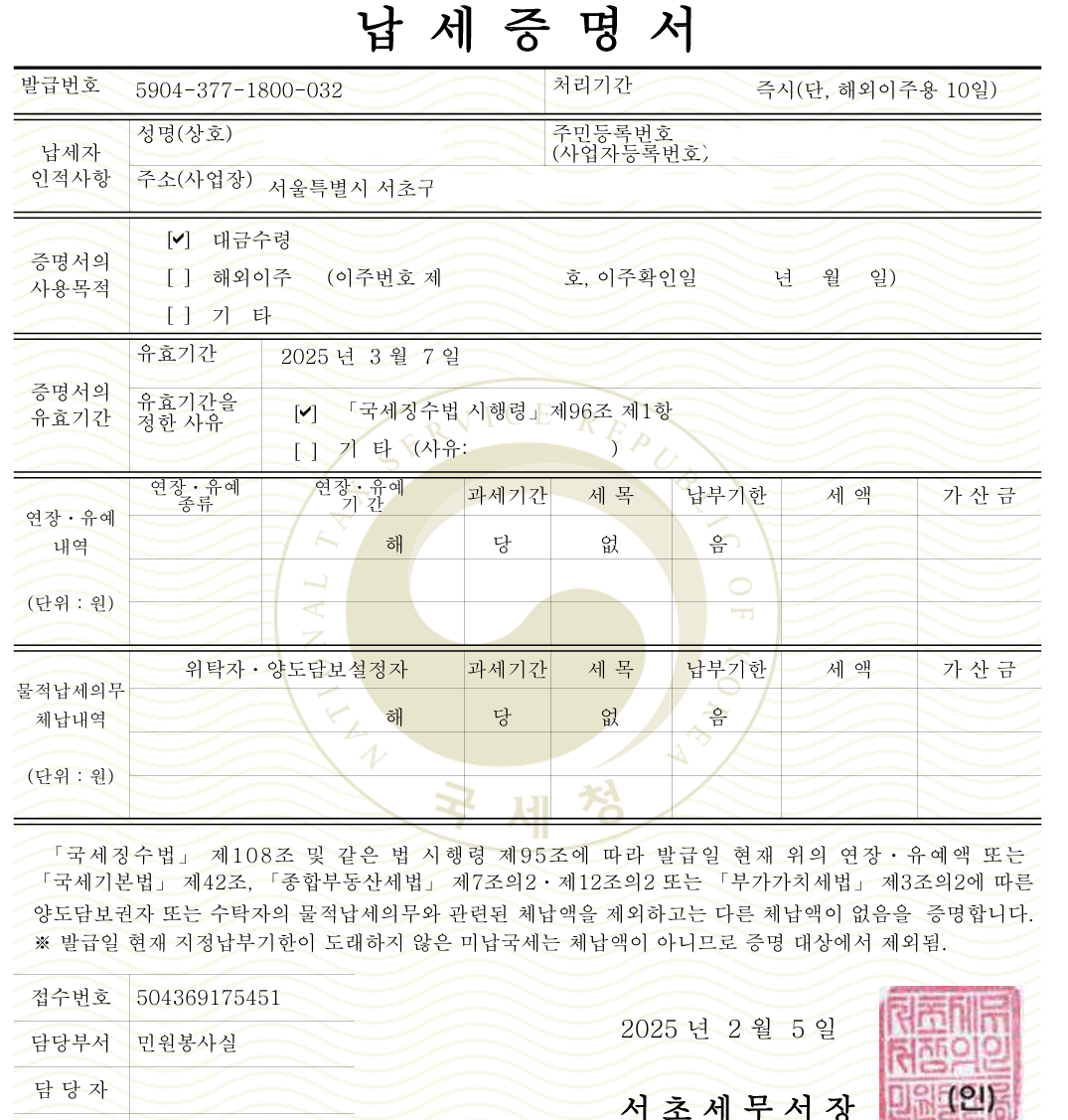

9.회사의 국세완납증명서 National Tax Payment Certificate

This is an official document issued by the tax office, confirming that the company has no unpaid taxes (it does not provide specific tax details). This document cannot be issued if the company has any outstanding tax payments.

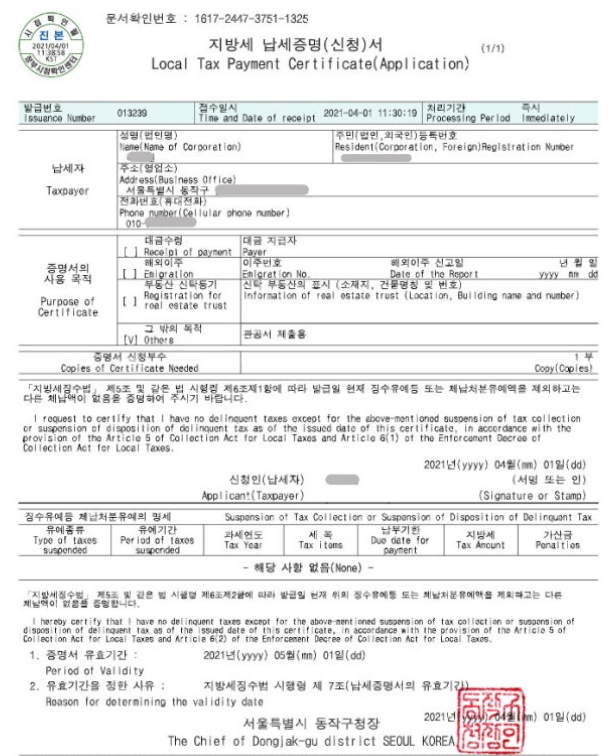

10.회사의 지방세납세증명서 Proof of local Tax Payment

In Korea, there are two types of taxes: national taxes and local taxes. National taxes are managed by the tax office, while local taxes are managed by the district office. This document confirms that the company has paid all local taxes and has no unpaid local taxes.

③Documents related to individual's income provement.

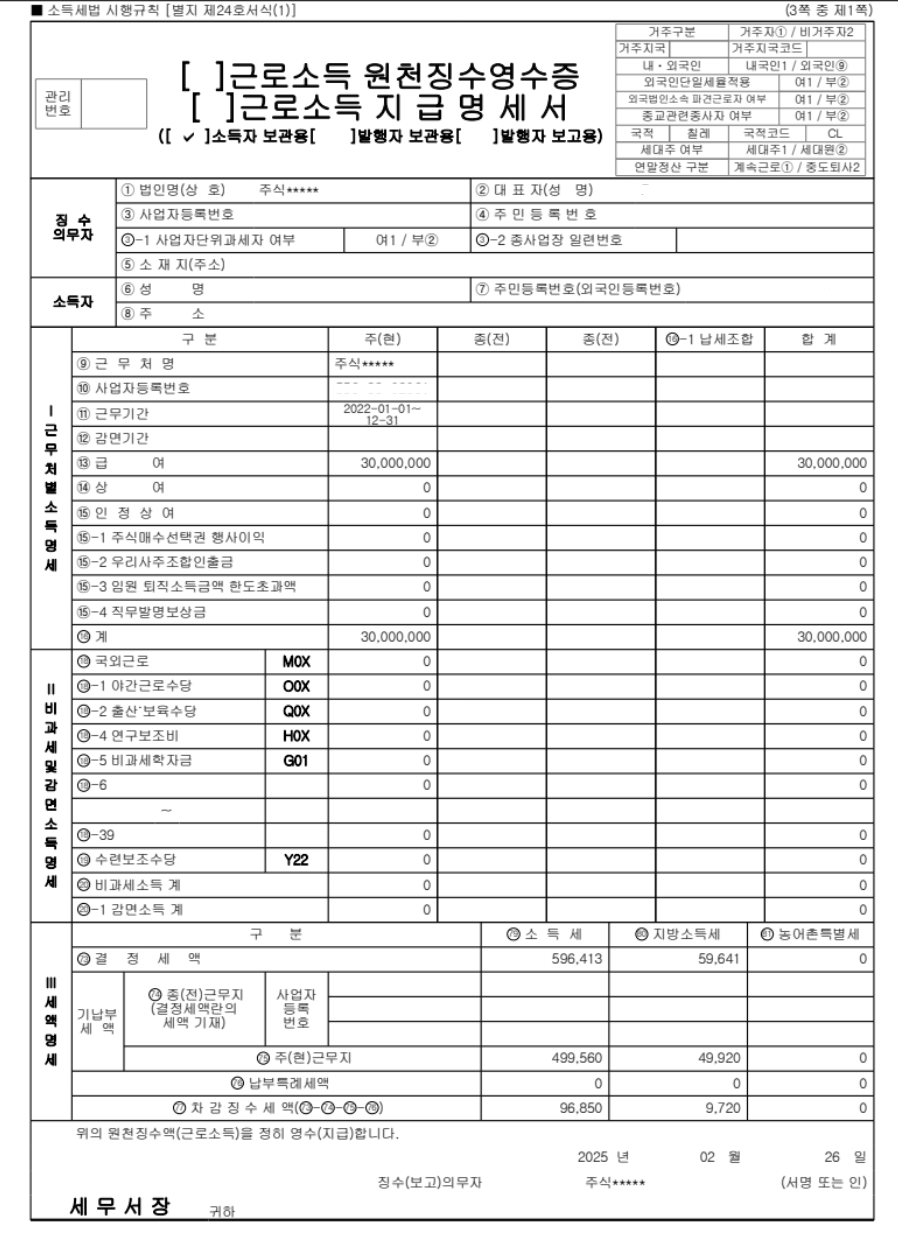

11.개인 근로소득 원천징수영수증 Personal employment income withholding tax receipt.

This document shows the employee's total salary for the year and the company information where the employee works. As a company representative receiving a salary from your company, you can obtain this document. However, if you have not reported any of your income, you will not be able to receive it.

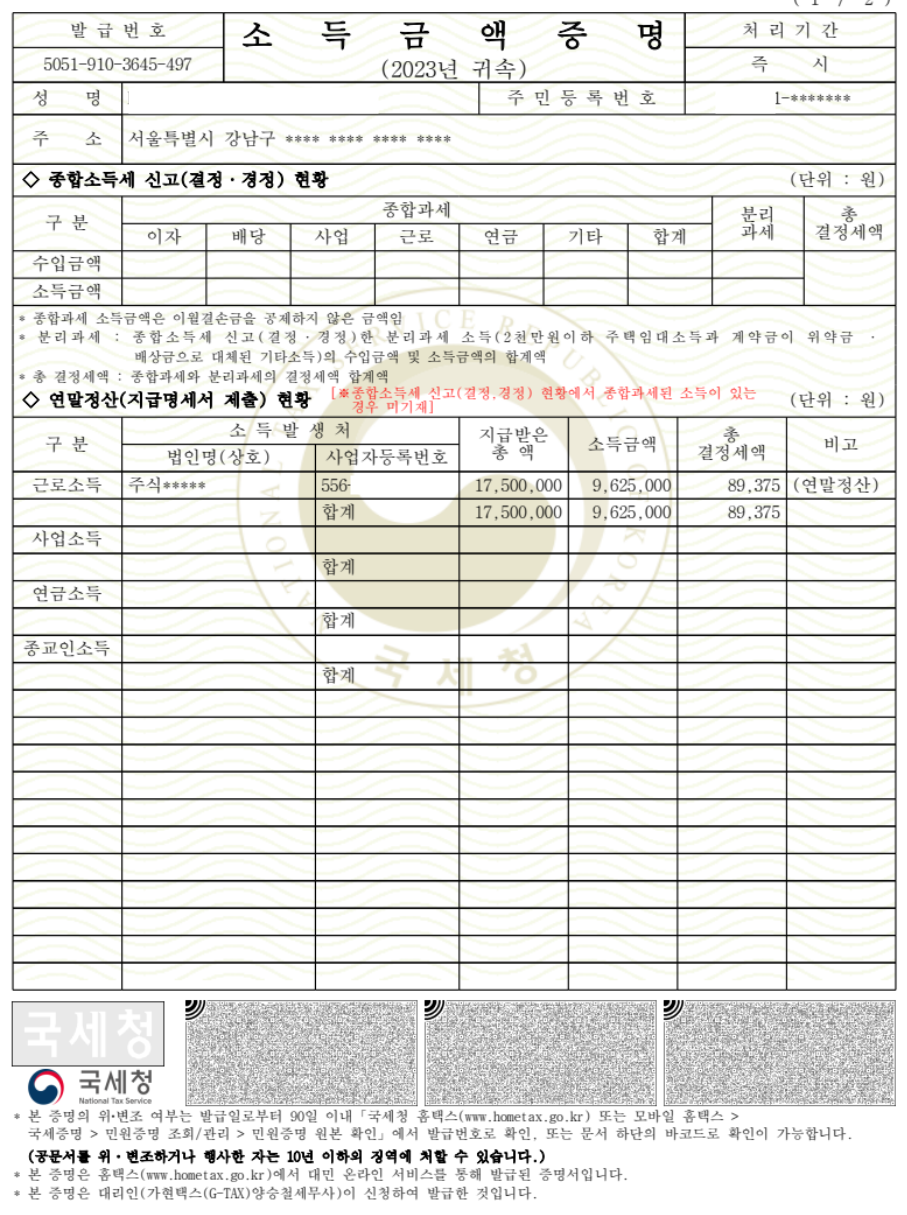

12.개인 소득금액 증명원 Proof of personal income

This is an official document issued by the tax office containing individual information. It can be obtained when a company reports an employee's salary to the tax office, or when an individual files their income tax with the tax office.

There can be additional document that immgtation request. if you are struggling prepare the documents please contact us.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr