If you are an employee working for a company, you will receive payment in the form of a salary from the company.

(It's same even if you are a representative of a corporate!)

And You can observe a few items that have been deducted from your contracted salary (gross salary), highlighted in red in the sections below.

These factors can be quite frustrating as they result in a decrease in your gross salary, ultimately leading to a lower amount being deposited into your bank account.

Unfortunately, these deduction parts are unavoidable; however, it's important to verify whether the figures are accurate or not.

Today, I will elaborate on how income taxes are calculated in your pay slip.

1.Simplified tax table for wage and salary inocme

Income taxes are computed based on the applicable tax table.

Upon examining the table, you will notice that the left side contains the gross salary (highlighted in red), while the corresponding right side displays the taxes (highlighted in green) that need to be deducted based on your salary. Additionally, the upper blue sections pertain to the number of dependents..

Example 1: If your gross salary is 2,500,000KRW and you have no dependents, the applicable deductions from your pay slip would amount to 39,690KRW (with an additiona10% local tax of 3,960KRW).

Example 2: In the scenario where your gross salary is 2,500,000 and you have 2 dependents, the deductions from your pay slip would be 32,020KRW (with an additional 10% local tax of 3,200KRW).

Example 3: In the scenario where your gross salary is 5,000,000 and you have no dependents, the deductions from your pay slip would be 335,470KRW (with an additional 10% local tax of 33,540 KRW).

As you may have observed, income taxes do not increase at a uniform rate; they tend to rise more significantly as salaries increase. This implies that the higher your gross salary, the greater the tax burden becomes. Consequently, your net income does not experience as substantial an increase as one might anticipate when gross salary rises.

2.Year-end tax settelement

These taxes are essentially a standardized calculation based on the table and do not account for the unique circumstances of each employee. Therefore, during the annual year-end tax settlement, which occurs every February, employees recalculate their taxes. This process enables them to receive a refund for any excess taxes paid throughout the year according to the tax table, or alternatively, pay additional taxes if necessary.

Thank you for read my article! I hope it helps.

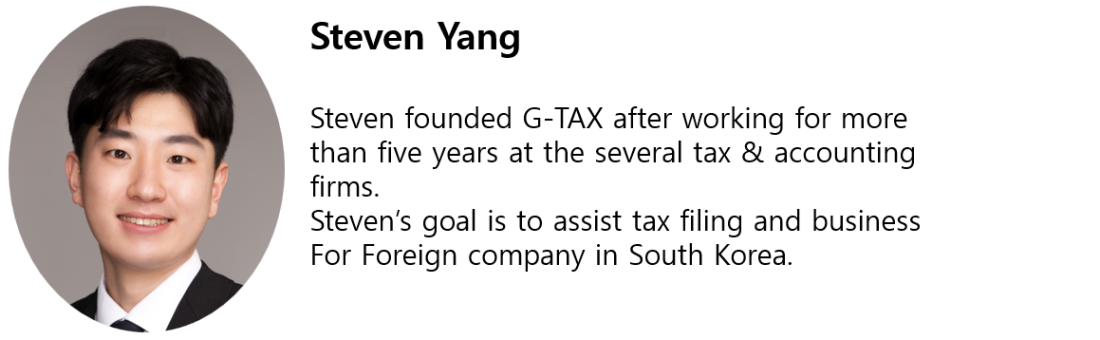

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.

or

Please write below form to contact me!

G-tax tax& accounting firm

If you send me a message through this platform, I’ll get back to you as soon as possible! Please fill out the form below and click on the [제출하기] button (the green button) to get in touch. I look forward to hearing from you!

form.office.naver.com