Do your company have employees? than I'm sure your company pay salary to your employees.

When you pay salary, you should pay 'net salary' which deducted taxes (if need, social insurances too) from salary not the total amounts of salary which is before tax.

And deducted taxes should be paid to tax office. yes it means company pay employees taxes on behalf of them from their salary.

we call this process 'withholding', and the taxes you deduct from salary are withholing tax.

and it's can also occur when you pay for freelancres,part-timers or loyat, etc not only employee's salary.

when you pay withholding taxes to tax office, you also should file withholding tax return. after filing, you will get receipt for the tax return and tax payment slip to pay taxes.but unfornutely, it's all written in Korean and don't provide english verson.

So, today I am going to exaplain each forms related to withholding tax.

1.Withholding tax return

What you should care about on this tax return is 총지급액(Total payment amount) and 소득세등(withholded tax).

-Total payment amounts(총 지급액)

It's income amount before deducting tax.

Depending on the type of income, it can be sorted to 8 kinds of income. (wage & salary/ retirement /business /other income/interest/dividend/royalty

-Withholded tax(소득세 등)

It's taxes amounts you deducted before you pay income to someone. and it also amounts you should pay to tax office.

Techinically, it's just delivering the incomer's taxes.

Tax rates are different depending on the type of income. as you can check in the below picture,

Tax rates vary widely which types of income you pay. so before you pay income to someone, it's important to talk with your tax accountanct.

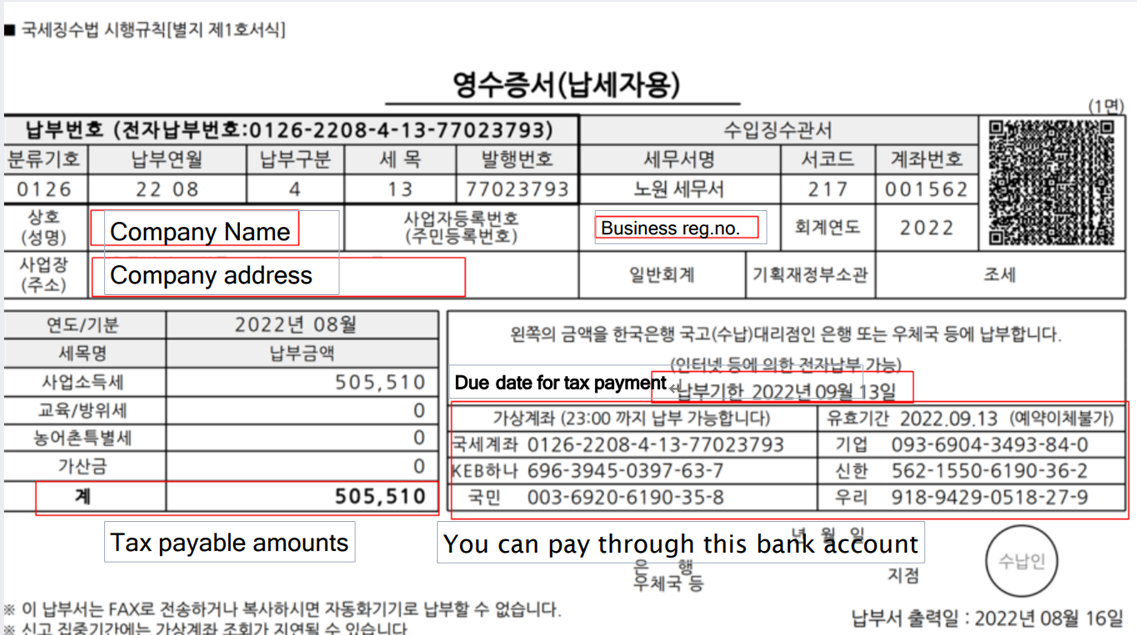

2.Tax filing receipt

This is the receipt you get after filing withholding tax return electronically through Hometax (https://www.hometax.go.kr/)

what you should check is total amounts of payment and total amounts of taxes withholded. this figure should be equal to the figures of withholding tax return.

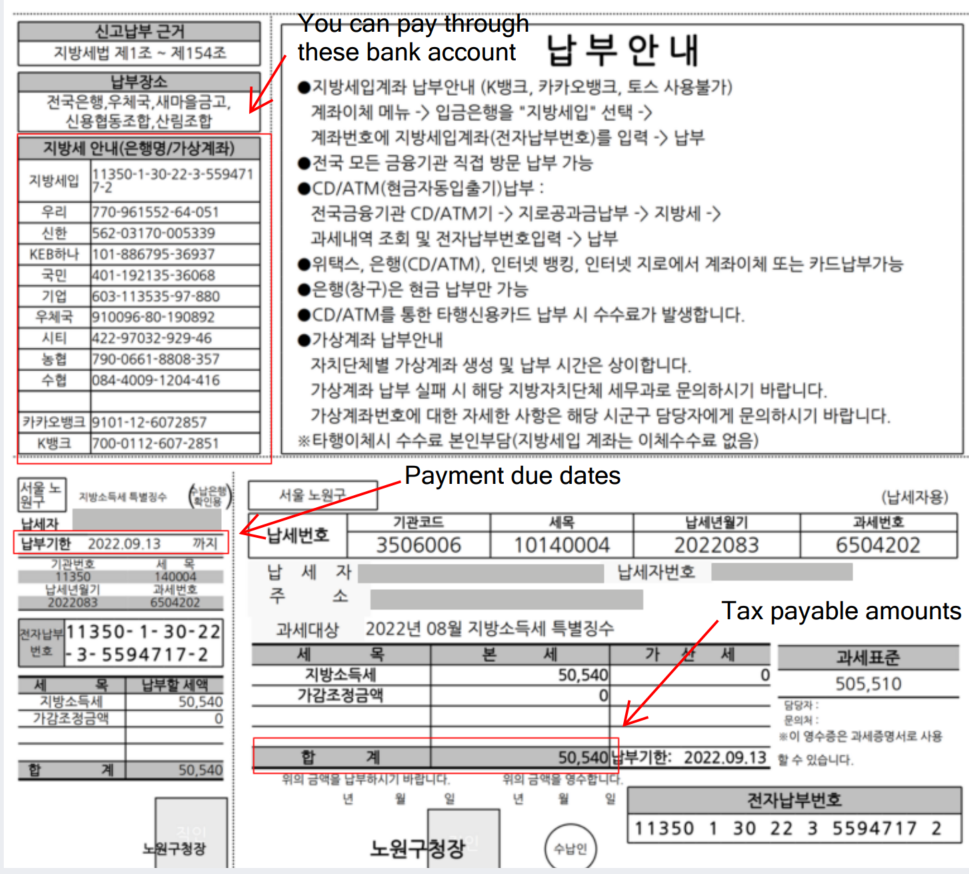

3.Tax payment slip

You also can get this payment slip through Hometax!(typically from your tax accountant/) you can pay the tax payable amounts(left below in the picture) by wiring to the bank account number(right below in the picture).

What you should care is 'due date for tax payment'. after the due dates, this tax payment slip is invalid. you should get a new one to pay taxes. and you also have to pay extra taxes as penality for fail to pay within due dates.

And there are local tax. it's usually added to national tax, and it's 10% of national tax amounts.

so, basically you will get 2types of tax paymenst slip. one is national and the other is local tax.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

Helping Foreign corpration and individual business's tax & Financial goals

Steven Yang / Certified Tax Accountant

(+82) 0 10.9599.7152

steven@g-tax.kr

G-tax

Providing service

Linked in www.linkedin.com/in/steven-yang-49416421b

Facebook Steven Yang | Facebook

Instgram : @gtax_steven

Homepage : www.g-tax.kr /