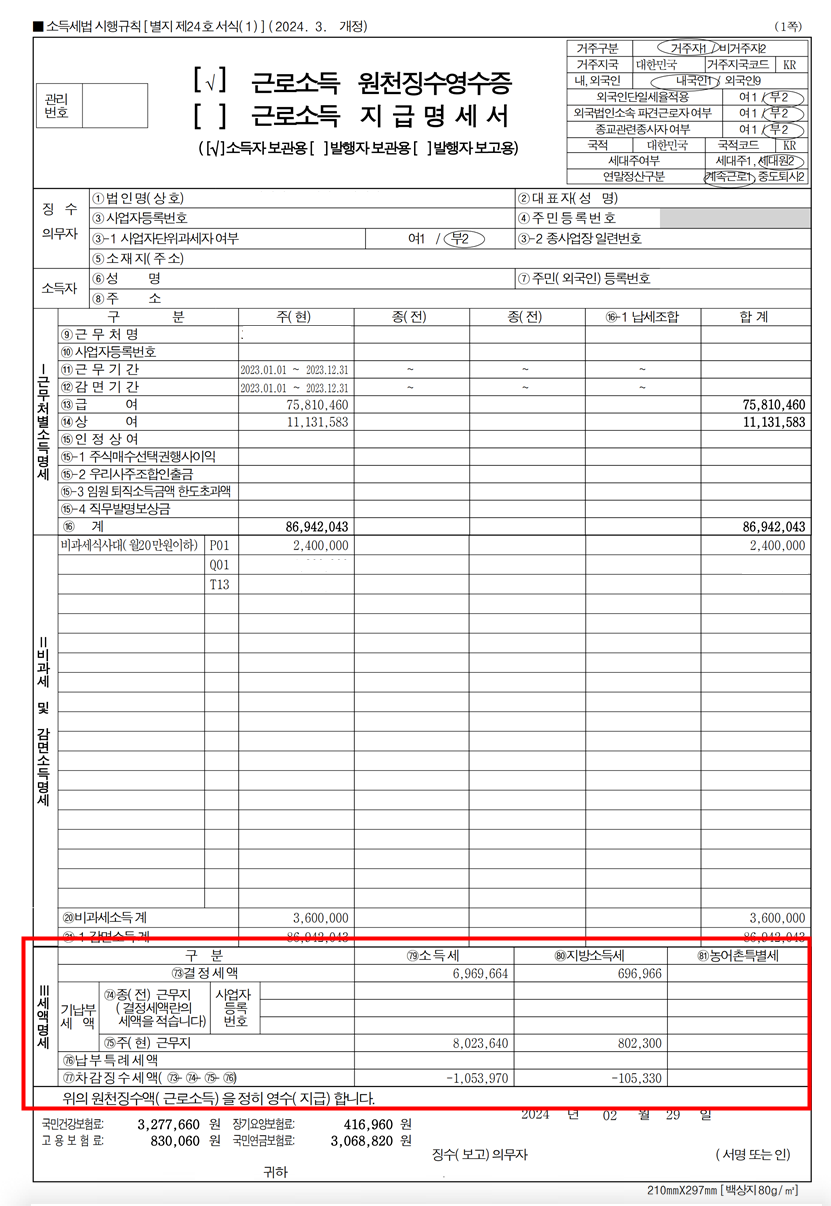

1.Let's check each items in your year-end tax settlement receipts

①Your annual income

The amount in the orange box represents your total salary for last year. It is the sum of your gross salary for each month. However, it also includes almost all the benefits provided by the company, so some employees might be a bit surprised because the amount is higher than expected.

Anyway, This figure reflects your annual salary, and the year-end tax settlement is process calculating taxes based on this total. (in this example : 86,942,043)

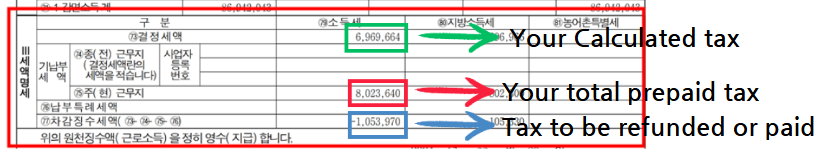

②Taxes calculated

The green box represents the calculated taxes from your year-end tax settlement.

In Korean tax law, there are numerous deductions available. Employees can apply each deduction that is applicable to their individual situation. The final tax amount, after considering all applicable deductions, is shown in the green box. (in this example : 6,969,664)

③Taxes prepaid

The red box represents the total taxes you paid each month when you received your salary.

This is crucial because, based on this amount, it will be determined whether you need to pay additional taxes or receive a tax refund. (In this example: 8,023,640 KRW)

④Taxes to be refunded or paid

The blue box represents the tax amount you will either need to pay or receive as a refund.

It is calculated by subtracting the prepaid taxes from the calculated taxes. If the amount is (-)negative, you will receive a refund. However, if it is (+) positive, you will need to pay additional taxes. (In this example: -1,053,970 KRW *which menas it will be refunded)

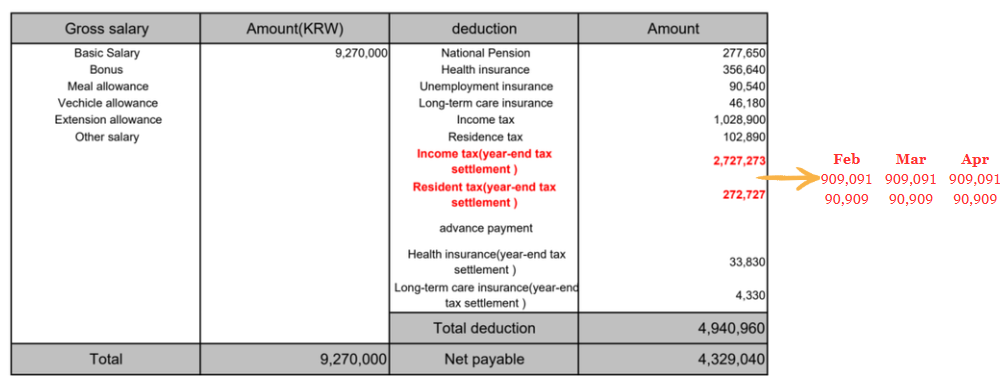

2.Company should pay the refund amounts to employees

The company should pay the refund amount to employees in addition to each employee's salary as you can see on the payslip.

Than, How can the company obtain the money?

Typically, the year-end tax settlemnt amount is deducted from the withholding tax amounts that the company will pay in the future. Consequently, companies usually don't need to pay withholding taxes after the year-end tax settlement.

3.If you have amounts to pay, you can pay it installment

While receiving a tax refund through the year-end tax settlement feels good, it can be frustrating to find yourself owing more taxes, usually due to insufficient deduction items or prepaid taxes.

For example, if your normal salary is 9,270,000 KRW and the tax payable by year-end settlement is 3,000,000 KRW, your February salary would be much less than normal month.

In such cases, you have the option to either deduct the entire amount from your February salary or spread the payment over three months (e.g., Feb 1,000,000 / Mar 1,000,000 / Apr 1,000,000). To arrange for installment payments, you should request this from your company.

4.I've paid additional tax this year how can I get tax refund next year?

①Find deduction that you can meet the condition and prepare in advance

For example, if you sign up for certain financial products at the bank, you may be eligible for tax credits. Additionally, if your salary is high enough to benefit from the foreign employee flat tax rate, you might want to consider applying it. Donations can also be deducted in the year-end tax settlement

②Increase tax withholing percentage (120%)

You can adjust the percentage of your withholding tax each month. For example, if your salary is 5,000,000 KRW, the standard tax amount you will pay each month is 335,470 KRW. '

However, you can choose to increase or decrease this amount.

If you feel that you don’t have enough deductions and find it burdensome to pay a lump sum after the year-end tax settlement, you can choose to pay more taxes each month by setting your withholding tax rate to 120%. and viceversa also possible.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 202