If you're considering launching a business in Korea, the initial step you'll want to take is obtaining a business license in Korea. We can categorize business licenses into two types: individual business licenses and corporate business licenses.

There are significant differences to consider, particularly when setting up for the first time. Today, I'll provide an explanation of these aspects.

Process of setting up a buisness is more complicate when you make Corporate business.

Unlike individual business which don't require court registry, to make corporate business you should do the process that court registration process. the process require a couple of documents. and also should pay taxes for the process.

1)Individual business set up requirment document

①Business Name

You need to determine the name of your company. This name will be registered for your business, and it will also appear on your tax invoices.

*It's essential to ensure there are no other businesses with the same name in your industry, as this could lead to potential issues. You can verify name availability within your industry through below website.

KIPRIS 특허정보 검색서비스

www.kipris.or.kr.

②Location and Rent Contract

Having a valid rent contract is an essential document for establishing a business in Korea. The Korea tax office requires a rent contract as part of the business registration process. It's also possible to use your own residence as a place of business, though certain industries may not permit this. If you plan to use a property that you don't own, you'll need to obtain permission from the property owner or lessor.

*If you're facing challenges finding a suitable business location, considering a shared office space can be a viable option.

③Permission documents

Certain types of businesses in Korea necessitate permission documents to operate legally. For example, if you plan to run a restaurant, you'll need a certificate from the district office. Similarly, if you intend to sell goods online, you may require specific documents related to online marketing business certification.

However, not all businesses require permission documents, so it's crucial to determine the nature of your business and identify the necessary documents. You can conveniently check the specific requirements for your business on the Hometax website.

국세청 홈택스

www.hometax.go.kr

2)Corporate business set up requirment document

①Name of the business

②Rent contract

③Permission documents for the industry

The first three points (①, ②, and ③) are applicable to both individual and corporate businesses. However, corporate businesses have additional process related to court registration.

*One crucial aspect to consider is that your rent contract should be under your corporate name.

④Court registary

If you intend to obtain a corporate business license, the initial step involves acquiring the court registry. This process necessitates several documents.

| ④-1 Shareholder list / invester list It's the document about who invest to your corporate and how much they invest. it's related to capiatal amounts which is you are setting. so the capital amounts should be same as the shareholder list's total amoutns. ④-2 The article of assoication It's documents about what's business your corprate are going to do, and the basic rules of your corporate. these documents also contain the salary and retirement benefit of executives. ④-3 Minutes of the board of directors ④-4 corporate seal ④-5 certificate of seal impression ④-6 Receipt of registration and licens tax payment |

As these procedures can be intricate, many individuals opt to enlist professional assistance in navigating these steps. It's essential to be aware that corporate setup also comes with tax and fee obligations, which vary based on the corporate's capital.

Thank you for read my article! I hope it helps.

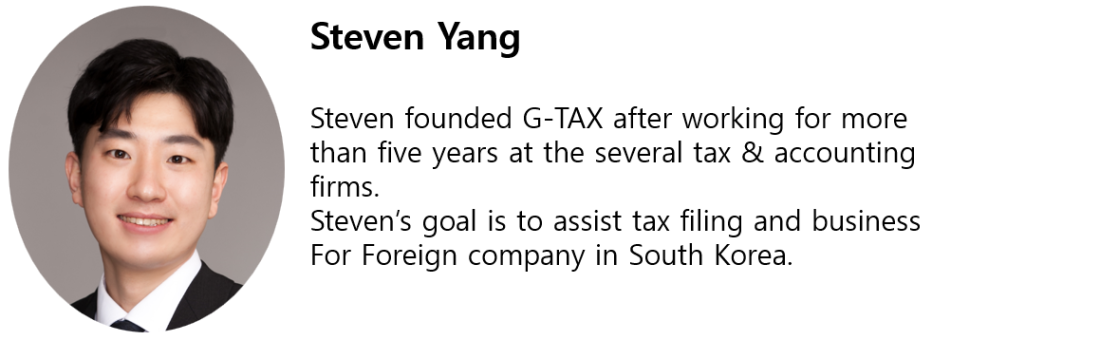

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us