1.Local tax employee portion

There is a local tax called "Local Tax Employee Portion", which not all companies are required to pay. Companies that pay an average monthly salary of over 150,000,000 KRW are obligated to pay this tax.

To determine if a company is required to pay this tax, the average salary of the past 12 months, including the payment month, must be calculated each month.

For example,

| Apr 2022 | 150,000,000 |

| May 2022 | 130,000,000 |

| Jun 2022 | 170,000,000 |

| Jul 2022 | 180,000,000 |

| Aug 2022 | 130,000,000 |

| Sep 2022 | 140,000,000 |

| Oct 2022 | 130,000,000 |

| Nov 2022 | 160,000,000 |

| Dec 2022 | 150,000,000 |

| Jan 2023 | 140,000,000 |

| Feb 2023 | 160,000,000 |

| Mar 2023 | 165,000,000 160,000,000 |

In this situation, if the salary for March is 165,000,000 KRW, then the average salary for the past 12 months exceeds 150,000,000 KRW, and the company should calculate and pay the Local Tax Employee Portion.

To check the threshold, the total salary for the past 12 months (from April of the previous year to March of the current year) should be divided by 12.

For example:

1)Check the threshold

Total salary 4~3 = 1,805,000,000 , 1,805,000,000/12 = 150,416,667

However, if the salary for March is 160,000,000 KRW, then the average salary for the past 12 months does not exceed 150,000,000 KRW, and the company does not have to pay the tax.

Total salary 4~3 = 1,800,000,000 , 1,800,000,000/12 = 150,000,000

2.How much should pay?

The tax rate for the Local Tax Employee Portion is 0.5%. If the total salary for the month is 165,000,000 KRW, the tax payable amount would be calculated as follows:

165,000,000 KRW x 0.5% = 825,000 KRW

3.Support for SME(Small and Medium enterprises)

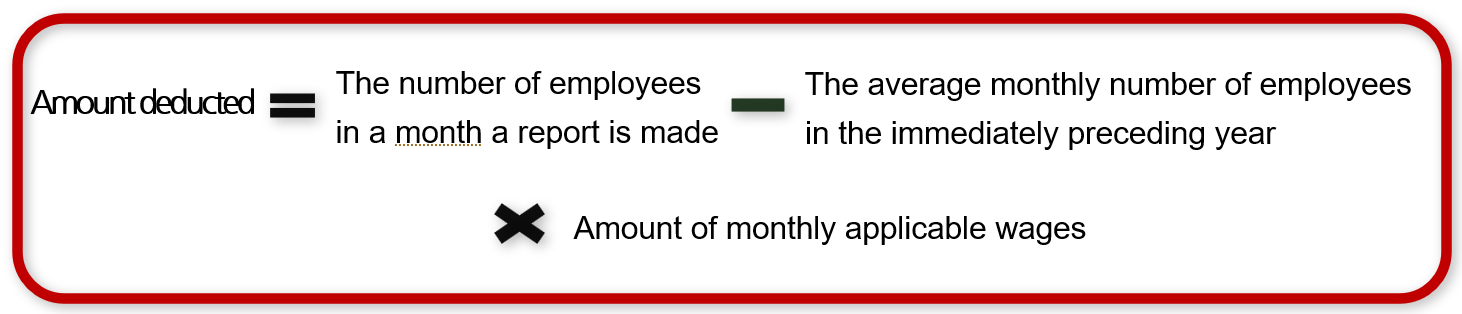

For Small and Medium Enterprises (SMEs) that have hired more employees, there is support available in the form of tax discounts.

*The monthly wages shall be calculated by dividing the total amount of employees’ wages for the applicable month

by the number of employees in the applicable month

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact us easily through direct message

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152

steven@g-tax.kr